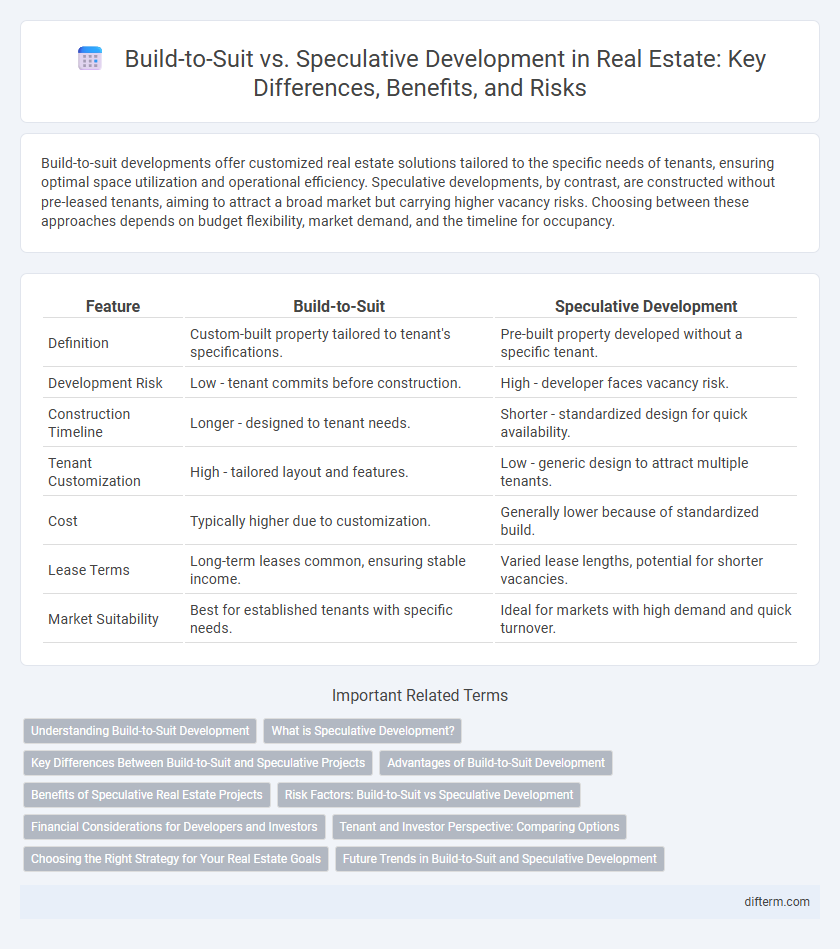

Build-to-suit developments offer customized real estate solutions tailored to the specific needs of tenants, ensuring optimal space utilization and operational efficiency. Speculative developments, by contrast, are constructed without pre-leased tenants, aiming to attract a broad market but carrying higher vacancy risks. Choosing between these approaches depends on budget flexibility, market demand, and the timeline for occupancy.

Table of Comparison

| Feature | Build-to-Suit | Speculative Development |

|---|---|---|

| Definition | Custom-built property tailored to tenant's specifications. | Pre-built property developed without a specific tenant. |

| Development Risk | Low - tenant commits before construction. | High - developer faces vacancy risk. |

| Construction Timeline | Longer - designed to tenant needs. | Shorter - standardized design for quick availability. |

| Tenant Customization | High - tailored layout and features. | Low - generic design to attract multiple tenants. |

| Cost | Typically higher due to customization. | Generally lower because of standardized build. |

| Lease Terms | Long-term leases common, ensuring stable income. | Varied lease lengths, potential for shorter vacancies. |

| Market Suitability | Best for established tenants with specific needs. | Ideal for markets with high demand and quick turnover. |

Understanding Build-to-Suit Development

Build-to-suit development involves constructing properties tailored specifically to the needs and specifications of a single tenant, ensuring customized design, layout, and features that align with their operational requirements. This approach minimizes vacancy risk and upfront investment for tenants, as the developer assumes the construction risk with a pre-leased agreement in place. The tailored nature of build-to-suit projects often results in higher tenant satisfaction and long-term lease commitments compared to speculative developments.

What is Speculative Development?

Speculative development refers to the construction of real estate projects without pre-leased tenants or confirmed buyers, aiming to attract occupants post-completion. This approach involves higher financial risk but allows developers to respond quickly to market demand and trends. Speculative developments are common in commercial and industrial real estate markets where flexibility and speed-to-market are critical for competitive advantage.

Key Differences Between Build-to-Suit and Speculative Projects

Build-to-suit projects are tailored specifically to a tenant's requirements, ensuring customized design, location, and amenities that align with the tenant's operational needs. Speculative developments involve constructing properties without pre-commitments from tenants, relying on market demand to lease the space post-completion, often leading to faster availability but higher market risk. Key differences include the level of customization, financial risk distribution, and project timelines, with build-to-suit offering tenant-specific solutions and speculative buildings providing flexibility for multiple potential users.

Advantages of Build-to-Suit Development

Build-to-suit development offers customized design and construction tailored specifically to the tenant's operational needs, ensuring optimal space utilization and efficiency. This approach reduces time and financial risks associated with speculative vacancies and market fluctuations, providing stability through long-term lease agreements. Furthermore, build-to-suit projects often result in higher tenant satisfaction and retention due to personalized amenities and infrastructure.

Benefits of Speculative Real Estate Projects

Speculative real estate projects enable developers to quickly respond to market demand without waiting for tenant commitments, accelerating project completion and potential revenue generation. These developments attract a broader range of tenants by offering versatile spaces that can be customized upon lease, increasing occupancy rates. Higher flexibility and reduced lead times in speculative construction often result in competitive advantages in dynamic real estate markets.

Risk Factors: Build-to-Suit vs Speculative Development

Build-to-suit developments minimize vacancy risk by securing tenant commitments before construction, ensuring tailored specifications and stable cash flow. Speculative developments carry higher market risk due to construction without pre-leasing, exposing developers to potential vacancies and fluctuating demand. Financial uncertainty and longer absorption periods are significant risk factors influencing profitability in speculative projects compared to the more secure, tenant-driven build-to-suit model.

Financial Considerations for Developers and Investors

Build-to-suit projects offer developers and investors reduced financial risk through pre-leased agreements ensuring steady cash flow and limited vacancy periods, while speculative developments carry higher uncertainty with potential for greater returns if market demand is strong. Financing build-to-suit developments often benefits from lower interest rates and longer loan terms due to predictable tenant commitments, contrasting with speculative projects that may face higher capital costs and stricter lending conditions. Evaluating cash-on-cash returns, internal rate of return (IRR), and market absorption rates is critical for investors deciding between these approaches in fluctuating real estate markets.

Tenant and Investor Perspective: Comparing Options

Build-to-suit developments offer tenants customized spaces tailored to specific operational needs, enhancing efficiency and long-term satisfaction, while investors benefit from reduced vacancy risks and pre-secured leases. Speculative developments provide investors with flexibility to adapt to market demand and potentially higher returns through leasing to multiple tenants, but pose greater vacancy risks and less customization for occupants. Tenants favor build-to-suit for personalized fit and stability, whereas speculative developments appeal to those seeking quicker occupancy and flexible lease terms.

Choosing the Right Strategy for Your Real Estate Goals

Build-to-suit development offers customized properties tailored to specific tenant needs, ensuring efficient use of space and long-term satisfaction, while speculative development involves constructing properties without pre-committed tenants, targeting faster market entry and potential higher returns. Choosing the right strategy depends on factors such as market demand, budget flexibility, risk tolerance, and project timeline, with build-to-suit favored for stable, long-term occupancy and speculative development suited for markets with strong absorption rates. Evaluating local real estate trends and tenant profiles is crucial to align development approach with your investment objectives and operational needs.

Future Trends in Build-to-Suit and Speculative Development

Future trends in build-to-suit development emphasize increasing customization driven by technological advancements such as AI-driven design and sustainable building materials, catering specifically to tenant requirements and enhancing operational efficiency. Speculative development is shifting towards adaptive reuse and flexible space configurations to mitigate market risks while capitalizing on emerging demand in mixed-use and urban infill projects. Data analytics and market forecasting tools are becoming integral in both strategies to optimize location selection, reduce vacancy periods, and improve investment returns in a dynamic real estate environment.

Build-to-Suit vs Speculative Development Infographic

difterm.com

difterm.com