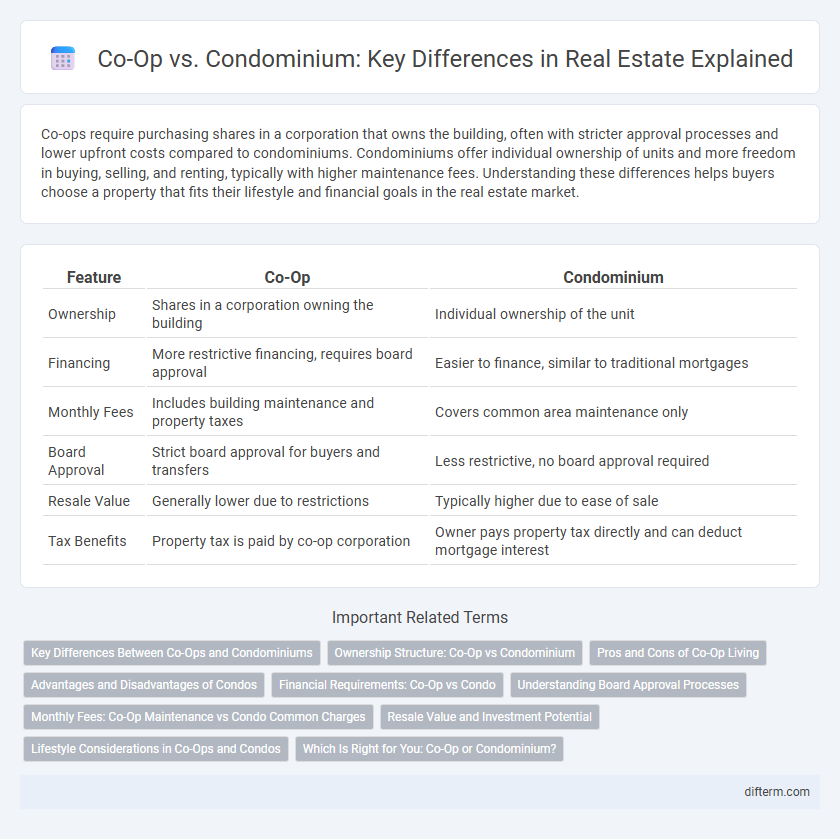

Co-ops require purchasing shares in a corporation that owns the building, often with stricter approval processes and lower upfront costs compared to condominiums. Condominiums offer individual ownership of units and more freedom in buying, selling, and renting, typically with higher maintenance fees. Understanding these differences helps buyers choose a property that fits their lifestyle and financial goals in the real estate market.

Table of Comparison

| Feature | Co-Op | Condominium |

|---|---|---|

| Ownership | Shares in a corporation owning the building | Individual ownership of the unit |

| Financing | More restrictive financing, requires board approval | Easier to finance, similar to traditional mortgages |

| Monthly Fees | Includes building maintenance and property taxes | Covers common area maintenance only |

| Board Approval | Strict board approval for buyers and transfers | Less restrictive, no board approval required |

| Resale Value | Generally lower due to restrictions | Typically higher due to ease of sale |

| Tax Benefits | Property tax is paid by co-op corporation | Owner pays property tax directly and can deduct mortgage interest |

Key Differences Between Co-Ops and Condominiums

Co-ops involve purchasing shares in a corporation that owns the building, granting residents proprietary leases, while condominiums provide individual ownership of specific units and shared ownership of common areas. Financing for co-ops often requires board approval and may include restrictions on subletting, whereas condominiums typically allow easier resale and more flexible financing options. Co-op residents usually pay monthly maintenance fees covering building expenses, while condo owners pay homeowners association (HOA) fees that fund upkeep and amenities.

Ownership Structure: Co-Op vs Condominium

Co-op ownership involves purchasing shares in a corporation that owns the building, granting shareholders proprietary leases, whereas condominium ownership means acquiring a deed to a specific unit with individual ownership rights. In a co-op, residents collectively control the entire property and decision-making typically requires board approval, while condominium owners have more autonomy with direct ownership of their units and shared responsibility for common areas. Understanding these ownership structures is crucial for buyers to assess financing options, restrictions, and legal responsibilities associated with co-ops versus condominiums.

Pros and Cons of Co-Op Living

Co-Op living offers lower purchase prices and typically requires a smaller down payment compared to condominiums, making it an affordable entry into homeownership in competitive urban markets like New York City. However, Co-Ops impose strict board approval processes and resident restrictions, including subletting limitations, which can reduce flexibility for owners. Maintenance fees in Co-Ops often include underlying mortgage payments for the building, leading to potentially higher monthly costs despite initial affordability.

Advantages and Disadvantages of Condos

Condominiums offer individual ownership of units with the flexibility to sell or rent without board approval, making them attractive for investors and homeowners seeking autonomy. Shared amenities like gyms, pools, and enhanced security add value but come with homeowner association (HOA) fees that can fluctuate and impact monthly expenses. However, condo owners may face restrictions from HOA rules and less control over building management compared to co-op shareholders.

Financial Requirements: Co-Op vs Condo

Co-Op ownership typically demands higher financial scrutiny, including larger down payments often ranging from 20% to 25% and strict debt-to-income ratio requirements set by the co-op board. Condominium purchases usually require lower down payments, sometimes as low as 10%, and lenders primarily evaluate individual creditworthiness rather than board approval. Monthly maintenance fees for co-ops often encompass underlying mortgage and property taxes, affecting overall affordability compared to condo association fees that cover common area upkeep.

Understanding Board Approval Processes

Board approval processes in co-ops involve a detailed review of financial documents, personal interviews, and a thorough background check to ensure candidates meet the cooperative's strict financial and community standards. Condominium boards typically focus on verifying adherence to association rules and evaluating prospective owners' ability to pay monthly fees, with fewer personal financial disclosures required. Understanding these distinct approval protocols is crucial for buyers navigating co-op and condominium purchases.

Monthly Fees: Co-Op Maintenance vs Condo Common Charges

Co-op monthly maintenance fees typically cover building expenses, property taxes, and underlying mortgage payments, often resulting in higher costs compared to condominium common charges. Condo common charges primarily cover shared amenities, building upkeep, and insurance, usually excluding property taxes, which are paid separately by individual owners. Understanding these fee differences is essential for buyers evaluating total monthly ownership expenses in Co-op versus condominium properties.

Resale Value and Investment Potential

Co-op apartments generally have lower resale values and slower appreciation compared to condominiums due to stricter board approvals and limited financing options. Condominiums offer higher investment potential with greater market liquidity and more flexible ownership rights, attracting a broader range of buyers. Investors often prefer condos for their ability to generate stronger returns and easier market exit strategies.

Lifestyle Considerations in Co-Ops and Condos

Co-op living often fosters a close-knit community with shared decision-making, appealing to residents who value social interaction and collective responsibility. Condominiums provide more autonomy and flexibility, attracting those who prioritize privacy and the ability to customize their units. Lifestyle choices in co-ops versus condos hinge on preferences for communal involvement versus individual independence, impacting daily living experiences and long-term satisfaction.

Which Is Right for You: Co-Op or Condominium?

Choosing between a co-op and a condominium depends on your financial flexibility, lifestyle preferences, and willingness to engage with a cooperative board. Co-ops often require substantial down payments and board approval, offering lower monthly fees but more restrictions on renovations and subletting. Condominiums provide greater ownership freedom and ease of resale, making them ideal for buyers seeking flexibility and fewer governance hurdles in prime real estate markets.

Co-Op vs Condominium Infographic

difterm.com

difterm.com