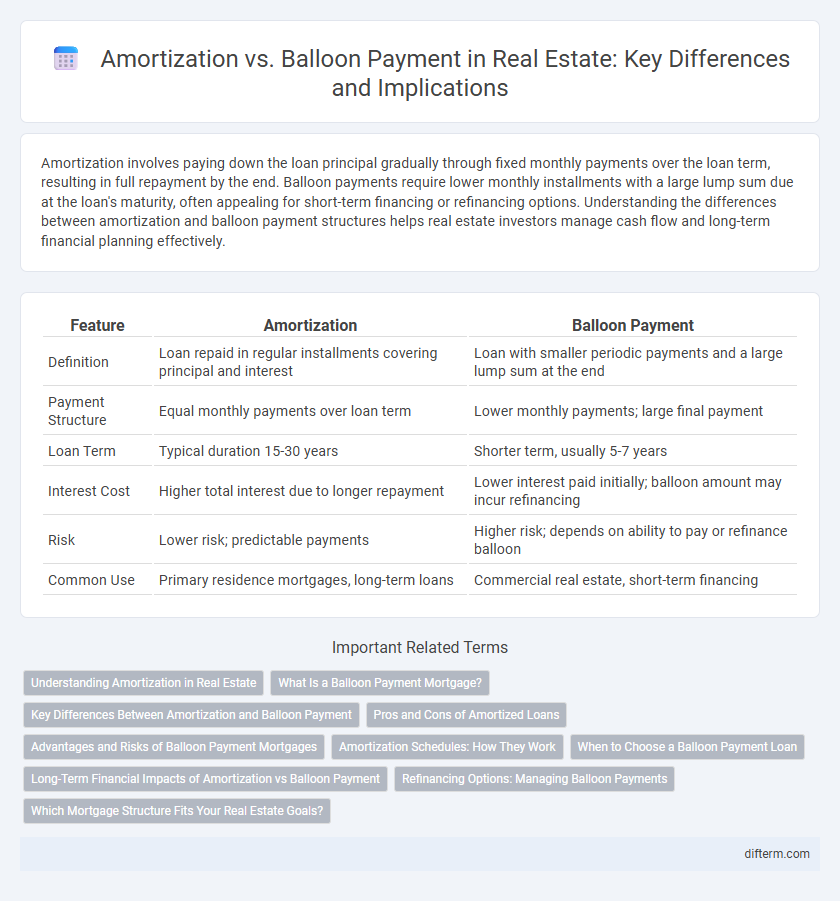

Amortization involves paying down the loan principal gradually through fixed monthly payments over the loan term, resulting in full repayment by the end. Balloon payments require lower monthly installments with a large lump sum due at the loan's maturity, often appealing for short-term financing or refinancing options. Understanding the differences between amortization and balloon payment structures helps real estate investors manage cash flow and long-term financial planning effectively.

Table of Comparison

| Feature | Amortization | Balloon Payment |

|---|---|---|

| Definition | Loan repaid in regular installments covering principal and interest | Loan with smaller periodic payments and a large lump sum at the end |

| Payment Structure | Equal monthly payments over loan term | Lower monthly payments; large final payment |

| Loan Term | Typical duration 15-30 years | Shorter term, usually 5-7 years |

| Interest Cost | Higher total interest due to longer repayment | Lower interest paid initially; balloon amount may incur refinancing |

| Risk | Lower risk; predictable payments | Higher risk; depends on ability to pay or refinance balloon |

| Common Use | Primary residence mortgages, long-term loans | Commercial real estate, short-term financing |

Understanding Amortization in Real Estate

Amortization in real estate refers to the gradual repayment of a mortgage loan through regular, fixed payments that cover both principal and interest over a specified term, typically 15 or 30 years. This structured payment plan ensures the loan balance decreases steadily until it is fully paid off by the end of the amortization schedule. Unlike balloon payments, amortization provides predictable monthly expenses and avoids a large lump-sum payment at loan maturity.

What Is a Balloon Payment Mortgage?

A balloon payment mortgage requires borrowers to make smaller monthly payments for a set period, followed by a large lump-sum payment at the end of the loan term. Unlike traditional amortization, where payments gradually pay off the principal and interest, balloon loans defer a significant portion of the principal until maturity. This structure often benefits borrowers seeking lower initial payments but requires careful planning to manage the substantial final payment.

Key Differences Between Amortization and Balloon Payment

Amortization involves spreading loan payments evenly over the loan term, covering both principal and interest, resulting in full loan repayment by the end of the period. Balloon payment loans require smaller periodic payments with one large final payment, or "balloon," due at the end of the loan term, often used in commercial real estate financing. The key difference lies in payment structure: amortized loans provide consistent payment amounts, whereas balloon loans feature lower initial payments but a substantial lump sum owed at maturity.

Pros and Cons of Amortized Loans

Amortized loans provide consistent monthly payments that cover both principal and interest, allowing borrowers to build equity steadily while reducing the loan balance over time. This structure offers predictability and long-term financial planning advantages, but typically results in higher monthly payments compared to balloon loans. The disadvantage lies in less flexibility; borrowers may pay more in interest over the loan term and face challenges if cash flow varies unexpectedly.

Advantages and Risks of Balloon Payment Mortgages

Balloon payment mortgages offer lower initial monthly payments compared to fully amortized loans, making homeownership more accessible for buyers seeking short-term affordability. The primary risk involves a large lump-sum payment due at the end of the loan term, which can cause financial strain or require refinancing under potentially unfavorable market conditions. Borrowers benefit from reduced payments early on but must carefully assess market trends and their ability to refinance or pay off the balloon amount to avoid default.

Amortization Schedules: How They Work

Amortization schedules outline the process of gradually paying off a mortgage loan through regular fixed payments that cover both principal and interest over time, reducing the loan balance until fully paid. Each payment in the schedule includes a specific portion allocated to interest and principal, with the principal portion increasing as the loan matures. This structure contrasts with balloon payments, where a large lump sum remains due at the end of the term instead of being fully amortized.

When to Choose a Balloon Payment Loan

Balloon payment loans are ideal for borrowers expecting a significant increase in income or a financial windfall before the balloon payment is due, such as planned business growth or asset sale. These loans suit short-term property investments where refinancing options or property resale can cover the large final payment. Choosing a balloon payment loan can maximize cash flow during the loan term, especially in markets with rising property values or low interest rates.

Long-Term Financial Impacts of Amortization vs Balloon Payment

Amortization spreads loan repayments evenly over the loan term, reducing total interest costs and providing predictable monthly payments that improve long-term financial stability. Balloon payments require smaller monthly installments but culminate in a large lump-sum payment, potentially causing cash flow challenges and refinancing risks at loan maturity. Choosing amortization supports consistent equity buildup, while balloon payments may offer initial affordability but introduce uncertainty in managing future financial obligations.

Refinancing Options: Managing Balloon Payments

Refinancing options for managing balloon payments often involve converting the large lump sum due at the end of the loan term into a new mortgage with a longer amortization schedule, reducing monthly payments and mitigating financial strain. Homeowners facing balloon payments can negotiate with lenders to refinance into fixed-rate or adjustable-rate mortgages, optimizing cash flow and avoiding default risks. Understanding the differences between amortization schedules and balloon payment structures is crucial for strategic refinancing decisions in real estate financial planning.

Which Mortgage Structure Fits Your Real Estate Goals?

Choosing between amortization and balloon payment mortgage structures depends on your long-term real estate goals and financial strategy. Amortization offers predictable monthly payments that gradually reduce the loan principal, ideal for buyers seeking stability and full loan payoff over time. Balloon payments require smaller initial payments with a large lump sum due at the end, suiting investors expecting to refinance or sell the property before the balloon matures.

Amortization vs Balloon Payment Infographic

difterm.com

difterm.com