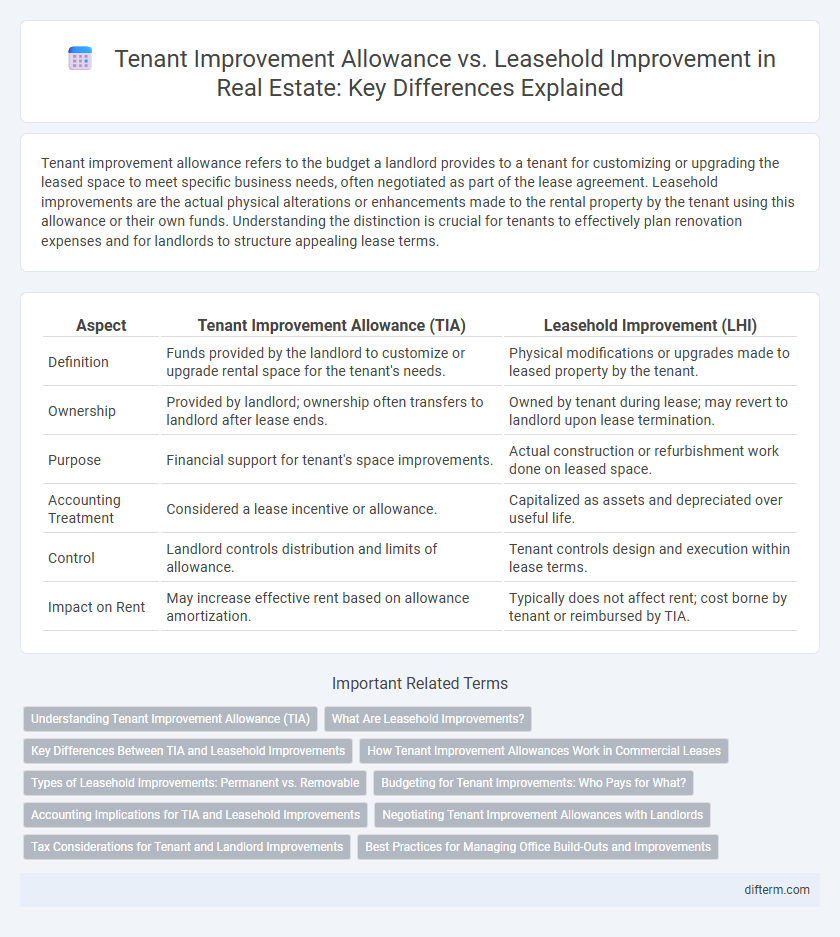

Tenant improvement allowance refers to the budget a landlord provides to a tenant for customizing or upgrading the leased space to meet specific business needs, often negotiated as part of the lease agreement. Leasehold improvements are the actual physical alterations or enhancements made to the rental property by the tenant using this allowance or their own funds. Understanding the distinction is crucial for tenants to effectively plan renovation expenses and for landlords to structure appealing lease terms.

Table of Comparison

| Aspect | Tenant Improvement Allowance (TIA) | Leasehold Improvement (LHI) |

|---|---|---|

| Definition | Funds provided by the landlord to customize or upgrade rental space for the tenant's needs. | Physical modifications or upgrades made to leased property by the tenant. |

| Ownership | Provided by landlord; ownership often transfers to landlord after lease ends. | Owned by tenant during lease; may revert to landlord upon lease termination. |

| Purpose | Financial support for tenant's space improvements. | Actual construction or refurbishment work done on leased space. |

| Accounting Treatment | Considered a lease incentive or allowance. | Capitalized as assets and depreciated over useful life. |

| Control | Landlord controls distribution and limits of allowance. | Tenant controls design and execution within lease terms. |

| Impact on Rent | May increase effective rent based on allowance amortization. | Typically does not affect rent; cost borne by tenant or reimbursed by TIA. |

Understanding Tenant Improvement Allowance (TIA)

Tenant Improvement Allowance (TIA) is a financial grant provided by landlords to tenants for customizing leased commercial spaces to meet specific business needs, typically included as a negotiation term in lease agreements. This allowance covers costs related to constructing or modifying interiors, such as installing partitions, lighting, or flooring, helping tenants offset upfront expenses. Understanding the scope and limitations of the TIA is crucial for tenants to accurately budget improvements and avoid unexpected out-of-pocket costs.

What Are Leasehold Improvements?

Leasehold improvements refer to modifications made by a tenant to customize a leased commercial property according to their business needs, often including interior design changes, partitions, lighting, and HVAC upgrades. These enhancements become a permanent part of the leased space but typically revert to the landlord at lease termination. Understanding leasehold improvements is crucial in commercial real estate as they impact lease negotiation, property value, and tenant responsibilities.

Key Differences Between TIA and Leasehold Improvements

Tenant Improvement Allowance (TIA) is a financial contribution provided by landlords to tenants for customizing leased spaces to meet specific business needs, whereas leasehold improvements refer to the actual physical alterations made to the property by the tenant. TIAs are typically negotiated in lease agreements as a budget or credit amount, while leasehold improvements represent the completed construction or renovation work funded by the TIA or tenant. Understanding the distinction is critical for lease negotiations, accounting treatment, and determining responsibility for maintenance and depreciation.

How Tenant Improvement Allowances Work in Commercial Leases

Tenant Improvement Allowances (TIAs) in commercial leases provide tenants with a negotiated sum from landlords to customize or upgrade leased spaces, tailored to the tenant's specific business needs. These allowances cover construction, design, and material costs, often requiring detailed proposals and landlord approvals before disbursement. Leasehold improvements funded by TIAs become permanent fixtures that enhance property value but typically remain with the landlord upon lease termination.

Types of Leasehold Improvements: Permanent vs. Removable

Tenant improvement allowance (TIA) provides funding for customizing leased spaces, typically covering both permanent and removable leasehold improvements. Permanent leasehold improvements include structural changes like wall installations or electrical upgrades, enhancing long-term functionality and value. Removable improvements involve non-structural modifications such as furniture or partitions, which tenants can remove upon lease termination without affecting the property's core infrastructure.

Budgeting for Tenant Improvements: Who Pays for What?

Tenant improvement allowance (TIA) is a budget that landlords provide to tenants to customize leased spaces, covering expenses like painting, flooring, or partitioning. Leasehold improvements refer to modifications made by tenants to adapt the property to their specific needs, often funded through the TIA but may exceed it, resulting in out-of-pocket costs for tenants. Understanding the scope of the TIA and negotiating clear terms in the lease agreement is essential for allocating financial responsibility between landlord and tenant effectively.

Accounting Implications for TIA and Leasehold Improvements

Tenant Improvement Allowance (TIA) is accounted for as a reduction of lease expense or a lease incentive liability, often amortized over the lease term, whereas leasehold improvements are capitalized as assets and depreciated over their useful life or the lease term, whichever is shorter. The accounting treatment impacts the financial statements significantly, with TIA affecting the income statement and leasehold improvements influencing the balance sheet through asset recognition and depreciation expense. Proper differentiation ensures compliance with accounting standards such as ASC 842 or IFRS 16, optimizing lease accounting and financial reporting accuracy.

Negotiating Tenant Improvement Allowances with Landlords

Negotiating tenant improvement allowances involves securing a budget from landlords to customize commercial spaces according to business needs, often factored into the lease terms. Leasehold improvements refer to the actual alterations made by tenants, which can include partitions, lighting, and flooring, enhancing functionality and aesthetics. Understanding market standards and leveraging comparable property data empowers tenants to negotiate favorable allowances, minimizing out-of-pocket expenses and aligning improvements with long-term lease commitments.

Tax Considerations for Tenant and Landlord Improvements

Tenant Improvement Allowance (TIA) provides tenants with funds from landlords to customize leased commercial spaces, with the allowance often treated as rental income subject to taxation for landlords and capitalized improvements for tenants. Leasehold improvements made by tenants typically qualify for depreciation deductions over a specific recovery period under IRS guidelines, reducing taxable income. Landlords must distinguish between TIAs and their own capital improvements, as TIAs increase rental income while landlord improvements are capitalized separately for tax depreciation purposes.

Best Practices for Managing Office Build-Outs and Improvements

Tenant improvement allowance (TIA) is a budget provided by landlords to tenants for customizing office spaces, while leasehold improvements are the physical modifications made by tenants using those funds. Best practices for managing office build-outs include detailed budgeting of TIAs, clear communication with contractors, and ensuring improvements comply with lease terms and building codes. Maintaining thorough documentation and timely inspections can prevent disputes and maximize the value of leasehold improvements.

tenant improvement allowance vs leasehold improvement Infographic

difterm.com

difterm.com