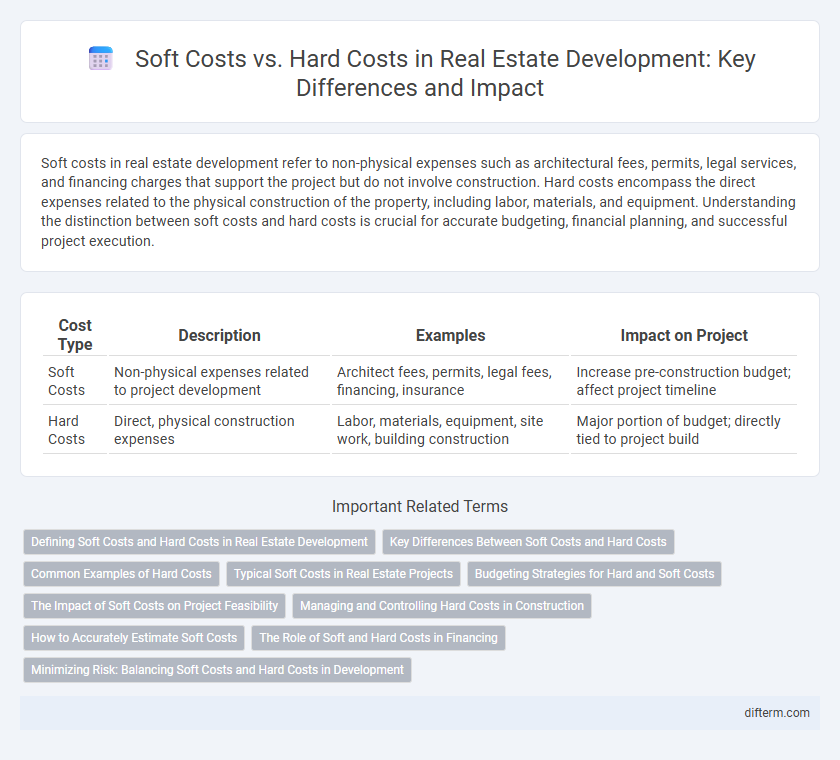

Soft costs in real estate development refer to non-physical expenses such as architectural fees, permits, legal services, and financing charges that support the project but do not involve construction. Hard costs encompass the direct expenses related to the physical construction of the property, including labor, materials, and equipment. Understanding the distinction between soft costs and hard costs is crucial for accurate budgeting, financial planning, and successful project execution.

Table of Comparison

| Cost Type | Description | Examples | Impact on Project |

|---|---|---|---|

| Soft Costs | Non-physical expenses related to project development | Architect fees, permits, legal fees, financing, insurance | Increase pre-construction budget; affect project timeline |

| Hard Costs | Direct, physical construction expenses | Labor, materials, equipment, site work, building construction | Major portion of budget; directly tied to project build |

Defining Soft Costs and Hard Costs in Real Estate Development

Soft costs in real estate development encompass non-physical expenses such as architectural fees, permits, legal services, and financing charges, critical for project planning and regulatory compliance. Hard costs refer to the tangible construction expenses, including materials, labor, equipment, and site work required to physically build the property. Distinguishing between soft and hard costs is essential for accurate budgeting, financial analysis, and resource allocation during the development process.

Key Differences Between Soft Costs and Hard Costs

Hard costs in real estate development refer to the tangible, physical expenses such as construction materials, labor, and site work, while soft costs encompass intangible expenses like architectural fees, permits, legal services, and financing charges. Hard costs typically represent a larger portion of the budget and are directly associated with the building process, whereas soft costs relate to pre-construction and project management activities. Understanding the distinction is crucial for accurate budgeting and financial planning in development projects.

Common Examples of Hard Costs

Common examples of hard costs in real estate development include expenses related to labor, materials, and equipment necessary for construction. These encompass foundation work, framing, roofing, plumbing, electrical systems, and interior finishes. Hard costs are tangible expenses directly associated with the physical building process and site improvements.

Typical Soft Costs in Real Estate Projects

Typical soft costs in real estate development projects include architectural and engineering fees, permits and inspection expenses, legal services, and financing fees such as loan interest and commitment charges. These non-physical expenses contribute significantly to the overall project budget, often accounting for 20-30% of total development costs. Understanding soft costs is critical for accurate budget forecasting and successful project management.

Budgeting Strategies for Hard and Soft Costs

Effective budgeting strategies for real estate development require distinct approaches to soft costs and hard costs. Hard costs encompass tangible construction expenses like materials, labor, and equipment, necessitating precise estimation and contingency allocation to control overruns. Soft costs involve intangible expenses such as architectural fees, permits, and financing, requiring detailed tracking and phased budgeting to ensure project feasibility and timely cash flow management.

The Impact of Soft Costs on Project Feasibility

Soft costs, including architectural fees, permits, insurance, and financing expenses, significantly influence a real estate project's overall feasibility by increasing the total budget beyond just construction expenses. These non-tangible expenses often account for 20-30% of the total development cost and can affect cash flow projections and investor returns. Understanding and accurately estimating soft costs is essential to avoid budget overruns and ensure the financial viability of real estate development projects.

Managing and Controlling Hard Costs in Construction

Managing and controlling hard costs in construction requires detailed budgeting of materials, labor, and equipment expenses to prevent cost overruns. Implementing real-time cost tracking systems and regular site audits helps identify discrepancies and optimize resource allocation. Effective hard cost management enhances project profitability and ensures timely completion within the established financial framework.

How to Accurately Estimate Soft Costs

Accurately estimating soft costs in real estate development requires detailed analysis of pre-construction expenses such as architectural fees, permits, legal services, and financing charges, typically accounting for 20-30% of total project costs. Utilizing historical data from similar projects and consulting with experienced professionals enhances precision in forecasting these intangible expenditures. Implementing a contingency buffer of 10-15% ensures coverage for unforeseen soft cost fluctuations during the development process.

The Role of Soft and Hard Costs in Financing

Soft costs in real estate development encompass expenses such as architectural fees, permits, legal services, and financing charges, which are crucial for project planning and regulatory compliance. Hard costs refer to the direct construction expenses, including materials, labor, and equipment necessary to build the physical structure. Accurate identification and allocation of soft and hard costs are essential for developers and lenders to structure project financing, manage budgets, and assess investment feasibility.

Minimizing Risk: Balancing Soft Costs and Hard Costs in Development

Minimizing risk in real estate development requires a strategic balance between soft costs, such as architectural design, permits, and legal fees, and hard costs like construction labor and materials. Overestimating soft costs can safeguard against unexpected expenses related to planning and approvals, while careful control of hard costs ensures budget adherence during physical construction. Accurate forecasting and continuous monitoring of both cost types help developers mitigate financial risks and improve project viability.

Soft Costs vs Hard Costs (development) Infographic

difterm.com

difterm.com