Principal residence properties offer homeowners tax benefits such as exclusion of capital gains upon sale, making them more financially advantageous for primary living spaces. Investment properties, however, generate rental income and provide depreciation deductions but are subject to capital gains tax when sold. Understanding these distinctions is crucial for optimizing real estate strategies based on usage and financial goals.

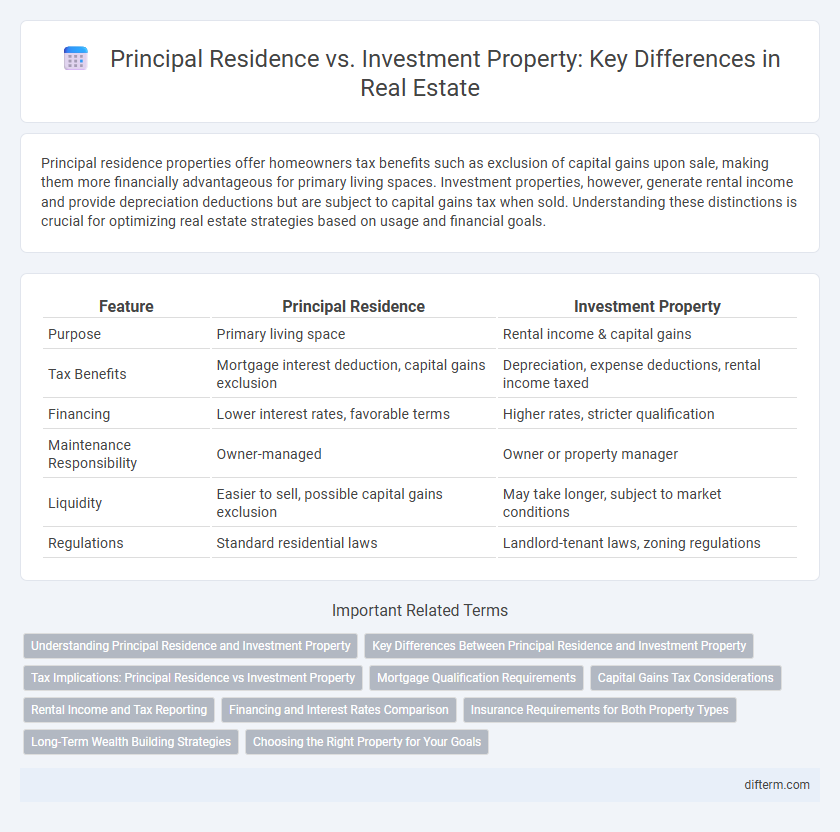

Table of Comparison

| Feature | Principal Residence | Investment Property |

|---|---|---|

| Purpose | Primary living space | Rental income & capital gains |

| Tax Benefits | Mortgage interest deduction, capital gains exclusion | Depreciation, expense deductions, rental income taxed |

| Financing | Lower interest rates, favorable terms | Higher rates, stricter qualification |

| Maintenance Responsibility | Owner-managed | Owner or property manager |

| Liquidity | Easier to sell, possible capital gains exclusion | May take longer, subject to market conditions |

| Regulations | Standard residential laws | Landlord-tenant laws, zoning regulations |

Understanding Principal Residence and Investment Property

A principal residence is the primary home where an individual or family lives most of the year, often qualifying for tax benefits like capital gains exclusions. An investment property is purchased specifically to generate rental income or for future resale profit, subject to different tax treatments including potential depreciation deductions. Clear differentiation between these property types impacts mortgage requirements, tax liabilities, and eligibility for government incentives in real estate transactions.

Key Differences Between Principal Residence and Investment Property

Key differences between a principal residence and an investment property lie in usage, tax treatment, and financial implications. A principal residence is primarily used as the homeowner's main living space, qualifying for tax exemptions on capital gains in many regions, whereas investment properties are rented out to generate income and are subject to different tax rules, including depreciation and rental income reporting. Financing for investment properties typically involves higher interest rates and stricter approval criteria compared to mortgages for principal residences.

Tax Implications: Principal Residence vs Investment Property

Principal residences benefit from capital gains tax exemptions, allowing homeowners to exclude profit from the sale when filing taxes. Investment properties are subject to capital gains tax, and rental income must be reported as taxable income, impacting overall tax liability. Depreciation deductions on investment properties can offset rental income, but principal residences do not qualify for this benefit.

Mortgage Qualification Requirements

Mortgage qualification requirements differ significantly between principal residences and investment properties, with lenders imposing stricter criteria on the latter due to higher perceived risk. Borrowers must demonstrate lower debt-to-income ratios, larger down payments usually ranging from 15% to 25%, and stronger credit scores when financing investment properties. Principal residences typically qualify for lower interest rates and more flexible lending terms, reflecting the reduced lender risk associated with owner-occupied homes.

Capital Gains Tax Considerations

Principal residences in real estate benefit from capital gains tax exemptions, meaning profits from the sale are typically tax-free if the property was solely used as a primary home. Investment properties, however, are subject to capital gains tax on profits from sales, with rates depending on the holding period and tax jurisdiction. Understanding the distinction between these property types is crucial for optimizing tax liabilities and investment strategies.

Rental Income and Tax Reporting

Rental income from a principal residence is typically not reported as taxable income since the owner occupies the property, whereas investment properties generate rental income that must be reported and is subject to taxation. Expenses related to investment properties, such as mortgage interest, property management fees, and maintenance costs, can often be deducted to reduce taxable rental income. Accurate record-keeping and differentiation between principal residence and investment property status are essential for compliant tax reporting and maximizing allowable deductions.

Financing and Interest Rates Comparison

Financing principal residences usually involves lower interest rates and more favorable loan terms due to lower risk profiles recognized by lenders. Investment properties often require higher down payments and carry higher interest rates as lenders compensate for increased default risk and reduced tax benefits. Borrowers should compare mortgage options carefully, considering that financing costs directly impact overall investment returns and affordability.

Insurance Requirements for Both Property Types

Principal residences require homeowner's insurance covering dwelling, personal property, liability, and additional living expenses, tailored to protect occupants and their belongings. Investment properties demand landlord insurance, which includes property damage, liability protection, and loss of rental income coverage, reflecting the unique risks of rental operations. Insurance premiums and coverage limits vary significantly depending on occupancy type, property location, and risk exposure, making precise policy customization essential.

Long-Term Wealth Building Strategies

Principal residences offer tax advantages like mortgage interest deductions and potential capital gains exclusion, making them essential for wealth preservation. Investment properties generate rental income and appreciate over time, serving as powerful tools for passive income and diversification. Combining both strategies can optimize long-term wealth building through tax efficiency and portfolio growth.

Choosing the Right Property for Your Goals

Selecting between a principal residence and an investment property hinges on your financial objectives and lifestyle priorities. Principal residences offer tax benefits like mortgage interest deductions and capital gains exclusions, enhancing long-term personal wealth accumulation. Investment properties generate rental income and potential appreciation but require active management and understanding of market dynamics to maximize returns.

Principal Residence vs Investment Property Infographic

difterm.com

difterm.com