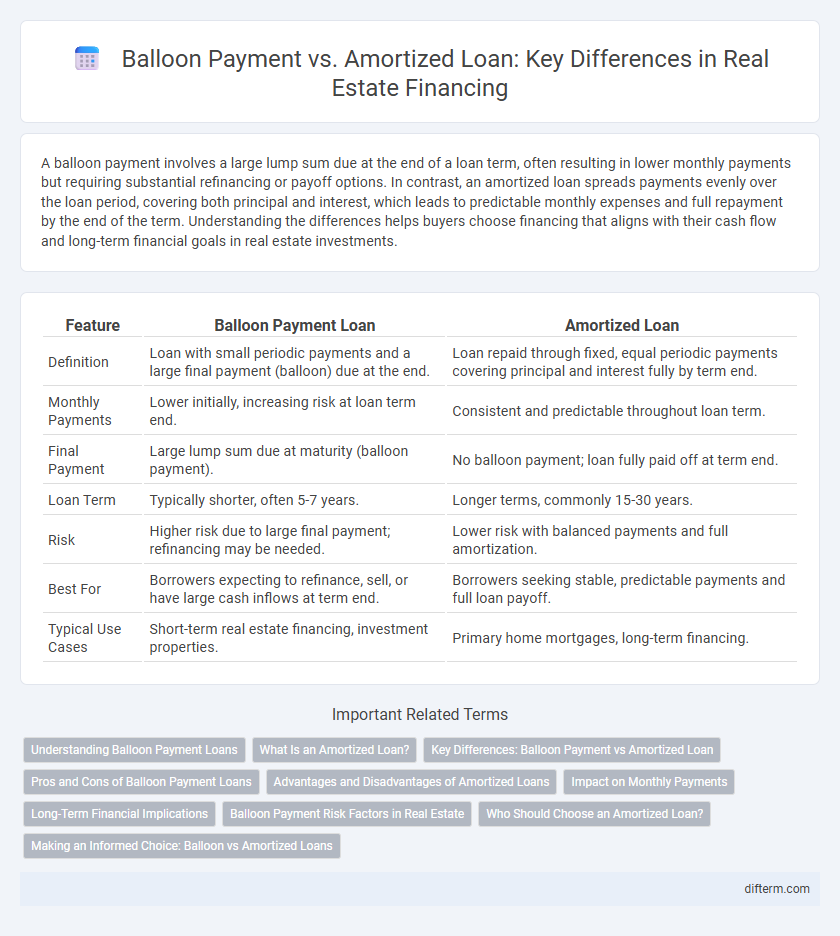

A balloon payment involves a large lump sum due at the end of a loan term, often resulting in lower monthly payments but requiring substantial refinancing or payoff options. In contrast, an amortized loan spreads payments evenly over the loan period, covering both principal and interest, which leads to predictable monthly expenses and full repayment by the end of the term. Understanding the differences helps buyers choose financing that aligns with their cash flow and long-term financial goals in real estate investments.

Table of Comparison

| Feature | Balloon Payment Loan | Amortized Loan |

|---|---|---|

| Definition | Loan with small periodic payments and a large final payment (balloon) due at the end. | Loan repaid through fixed, equal periodic payments covering principal and interest fully by term end. |

| Monthly Payments | Lower initially, increasing risk at loan term end. | Consistent and predictable throughout loan term. |

| Final Payment | Large lump sum due at maturity (balloon payment). | No balloon payment; loan fully paid off at term end. |

| Loan Term | Typically shorter, often 5-7 years. | Longer terms, commonly 15-30 years. |

| Risk | Higher risk due to large final payment; refinancing may be needed. | Lower risk with balanced payments and full amortization. |

| Best For | Borrowers expecting to refinance, sell, or have large cash inflows at term end. | Borrowers seeking stable, predictable payments and full loan payoff. |

| Typical Use Cases | Short-term real estate financing, investment properties. | Primary home mortgages, long-term financing. |

Understanding Balloon Payment Loans

Balloon payment loans require a large, lump-sum payment at the end of the loan term, typically after smaller, interest-only or low principal payments during the loan period. These loans offer lower initial monthly payments compared to amortized loans, which spread principal and interest evenly over the entire term. Understanding the risks associated with balloon payments, such as refinancing challenges or the need for a substantial final payment, is crucial for real estate investors and homeowners managing cash flow.

What Is an Amortized Loan?

An amortized loan requires borrowers to make regular, fixed payments over the loan term, covering both principal and interest, which gradually reduces the loan balance. This structure provides predictable monthly payments and ensures the loan is fully paid off by the end of the term. Common in real estate financing, amortized loans help homeowners manage budgets with consistent costs and clear payoff timelines.

Key Differences: Balloon Payment vs Amortized Loan

Balloon payment loans require smaller monthly payments with a large lump sum due at the end, while amortized loans spread payments evenly over the loan term, covering both principal and interest. Balloon loans often carry higher risk due to the substantial final payment, making them suitable for borrowers expecting increased future income or refinancing options. Amortized loans provide predictable budgeting and gradual equity buildup, which benefits long-term homeowners seeking financial stability.

Pros and Cons of Balloon Payment Loans

Balloon payment loans offer lower initial monthly payments compared to fully amortized loans, making them attractive for buyers who expect an increase in income or plan to refinance before the balloon payment is due. However, the significant lump-sum payment at the end poses a high financial risk if the borrower cannot refinance or sell the property, potentially leading to default. Borrowers benefit from lower short-term costs but face uncertainty and higher long-term financial exposure with balloon loans compared to amortized loans.

Advantages and Disadvantages of Amortized Loans

Amortized loans provide predictable monthly payments that cover both principal and interest, facilitating easier budgeting for homeowners and investors. These loans build equity steadily over the loan term, reducing the principal balance with each payment, which can lead to long-term financial stability. However, amortized loans typically have higher monthly payments compared to balloon loans, potentially limiting cash flow flexibility during the loan period.

Impact on Monthly Payments

Balloon payment loans feature lower initial monthly payments since borrowers pay only interest or a small portion of the principal before a large lump sum is due at the end of the term. In contrast, amortized loans require consistent monthly payments that cover both principal and interest, gradually reducing the loan balance over time. This difference significantly impacts budgeting, with balloon loans offering short-term relief but potential long-term financial strain due to the large final payment.

Long-Term Financial Implications

Balloon payment loans require a large lump sum payment at the end of the term, often resulting in higher risk and potential refinancing challenges that can impact long-term financial stability. Amortized loans provide consistent monthly payments, gradually reducing both principal and interest, which supports predictable budgeting and equity growth over time. Choosing between these loan types affects overall interest costs, cash flow management, and the ability to build sustainable wealth in real estate investment.

Balloon Payment Risk Factors in Real Estate

Balloon payment loans in real estate carry significant risk due to the large lump sum due at the loan's end, often causing borrower cash flow challenges. If property values decline or market conditions worsen, refinancing the balloon payment can become difficult, leading to potential default or foreclosure. Understanding the volatility in interest rates and market liquidity is crucial, as these factors directly impact the borrower's ability to meet balloon payment obligations.

Who Should Choose an Amortized Loan?

Borrowers seeking predictable monthly payments and gradual equity buildup should choose an amortized loan, as it spreads principal and interest evenly over the loan term. Homebuyers planning long-term ownership benefit from amortized loans by avoiding large lump-sum payments at the end of the mortgage. This loan type suits individuals prioritizing financial stability and steady debt reduction without unexpected payment spikes.

Making an Informed Choice: Balloon vs Amortized Loans

Choosing between balloon payments and amortized loans depends on cash flow management and long-term financial goals in real estate investment. Balloon loans offer lower initial monthly payments with a large lump sum due at the end, ideal for investors expecting increased future income or refinancing options. Amortized loans provide consistent monthly payments that fully pay off the principal and interest over the loan term, offering financial predictability and stability.

Balloon Payment vs Amortized Loan Infographic

difterm.com

difterm.com