Flipping properties involves purchasing homes at a lower price, renovating them quickly, and selling for a profit, offering fast returns but higher risk and market dependency. Buy-and-hold investing focuses on acquiring rental properties to generate steady, long-term income and property appreciation. Choosing between flipping and buy-and-hold strategies depends on your investment goals, risk tolerance, and market conditions.

Table of Comparison

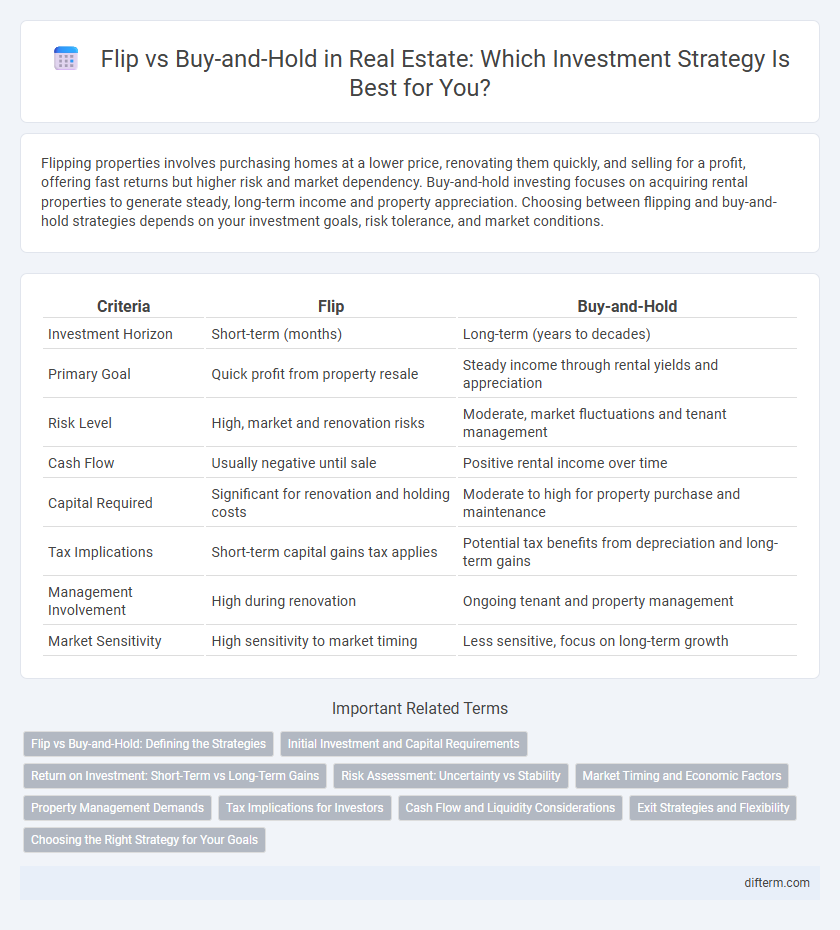

| Criteria | Flip | Buy-and-Hold |

|---|---|---|

| Investment Horizon | Short-term (months) | Long-term (years to decades) |

| Primary Goal | Quick profit from property resale | Steady income through rental yields and appreciation |

| Risk Level | High, market and renovation risks | Moderate, market fluctuations and tenant management |

| Cash Flow | Usually negative until sale | Positive rental income over time |

| Capital Required | Significant for renovation and holding costs | Moderate to high for property purchase and maintenance |

| Tax Implications | Short-term capital gains tax applies | Potential tax benefits from depreciation and long-term gains |

| Management Involvement | High during renovation | Ongoing tenant and property management |

| Market Sensitivity | High sensitivity to market timing | Less sensitive, focus on long-term growth |

Flip vs Buy-and-Hold: Defining the Strategies

Flipping involves purchasing properties with the intent to renovate and sell quickly for a profit, capitalizing on short-term market trends and value appreciation. Buy-and-hold investors acquire real estate to generate steady rental income and benefit from long-term property value growth. Each strategy presents distinct risk profiles, cash flow dynamics, and market sensitivities, influencing investment choices based on financial goals and time horizons.

Initial Investment and Capital Requirements

Flipping properties typically requires a higher initial investment due to renovation costs, quick turnaround expenses, and the need for sufficient capital to cover holding costs during the resale period. In contrast, buy-and-hold strategies demand significant upfront capital mainly for property acquisition and potential tenant improvements, but spread out ongoing maintenance and financing costs over time. Understanding these capital requirements is crucial for investors to align their financial capacity with investment goals and risk tolerance.

Return on Investment: Short-Term vs Long-Term Gains

Flipping properties delivers rapid return on investment by capitalizing on market trends and renovation improvements, often realizing profits within months. Buy-and-hold strategies generate long-term gains through property appreciation and rental income, offering steady cash flow and tax advantages over years or decades. Evaluating market conditions and financial goals is critical to choosing between immediate profits or sustained wealth accumulation in real estate investment.

Risk Assessment: Uncertainty vs Stability

Flipping properties involves higher risk due to market volatility and renovation uncertainties, often leading to unpredictable returns. Buy-and-hold strategies prioritize stability through long-term market appreciation and consistent rental income, reducing exposure to short-term fluctuations. Assessing risk tolerance and market conditions is crucial for choosing between the fast-paced, high-risk flip approach and the steady, lower-risk buy-and-hold investment model.

Market Timing and Economic Factors

Flipping properties demands precise market timing to capitalize on short-term price fluctuations and high demand, thriving in seller's markets with rising property values. Buy-and-hold strategies benefit from long-term economic stability, steady rental income, and appreciation, making them resilient during market downturns and periods of economic uncertainty. Understanding interest rates, employment trends, and local real estate cycles is critical when choosing between flipping and buy-and-hold investments.

Property Management Demands

Flipping properties requires intense short-term property management tasks such as rapid renovations, contractor coordination, and market timing to maximize resale value. Buy-and-hold strategies demand long-term property management expertise, including tenant screening, maintenance scheduling, rent collection, and legal compliance to ensure consistent cash flow. Understanding these distinct property management demands is crucial for investors to align their resources and risk tolerance with their investment strategy.

Tax Implications for Investors

Short-term capital gains taxes apply to flipped properties sold within a year, resulting in higher tax rates similar to ordinary income. Buy-and-hold investors benefit from long-term capital gains rates, which are typically lower and include opportunities for depreciation deductions that reduce taxable income. Understanding these tax implications is crucial for real estate investors when choosing between flipping properties or holding them as rental investments.

Cash Flow and Liquidity Considerations

Flipping properties generates quick cash but often lacks steady cash flow, requiring substantial liquidity to cover renovation and holding costs. Buy-and-hold strategies provide consistent monthly rental income, enhancing long-term cash flow stability and improving investor liquidity through gradual property appreciation. Evaluating capital availability and desired income timelines is crucial when choosing between flipping and buy-and-hold real estate investments.

Exit Strategies and Flexibility

Flipping properties offers rapid exit strategies, enabling investors to realize quick profits through renovations and swift resale, ideal for those seeking shorter investment horizons. Buy-and-hold strategies prioritize long-term wealth accumulation via rental income and property appreciation, providing flexibility to adapt to market changes with options like refinancing or eventual sale. Each strategy demands distinct risk tolerance and capital commitment, influencing an investor's ability to pivot based on financial goals and market dynamics.

Choosing the Right Strategy for Your Goals

Choosing the right real estate investment strategy depends on your financial goals and risk tolerance. Flipping properties offers quick returns through renovation and resale, ideal for those seeking rapid capital gains. Buy-and-hold investments build long-term wealth via rental income and property appreciation, suitable for investors aiming for steady cash flow and portfolio growth.

flip vs buy-and-hold Infographic

difterm.com

difterm.com