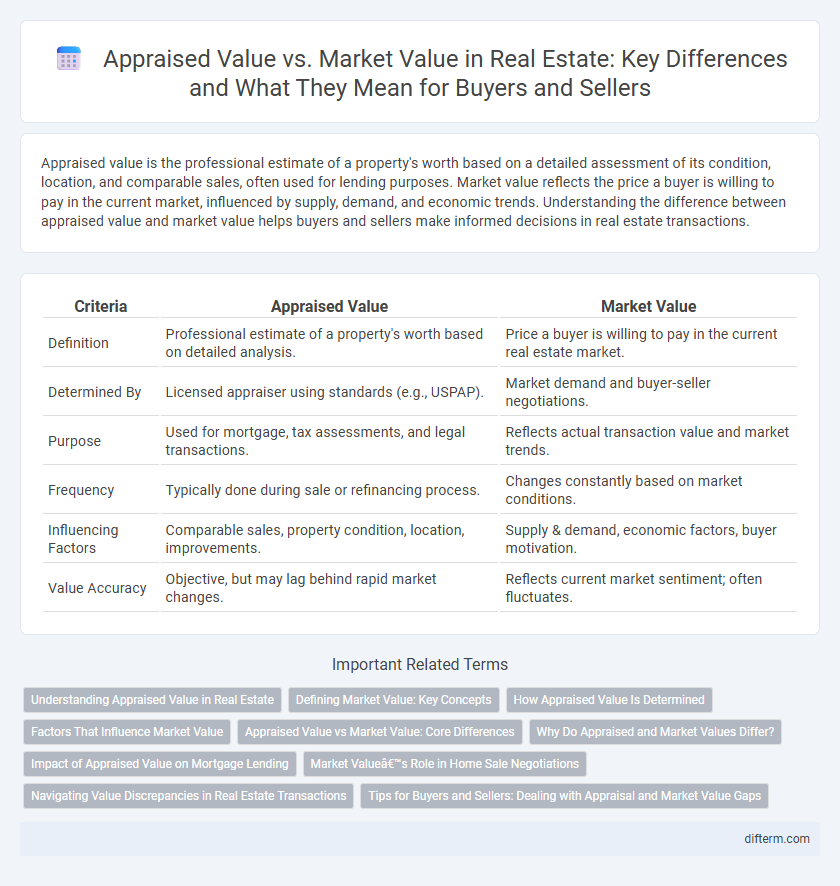

Appraised value is the professional estimate of a property's worth based on a detailed assessment of its condition, location, and comparable sales, often used for lending purposes. Market value reflects the price a buyer is willing to pay in the current market, influenced by supply, demand, and economic trends. Understanding the difference between appraised value and market value helps buyers and sellers make informed decisions in real estate transactions.

Table of Comparison

| Criteria | Appraised Value | Market Value |

|---|---|---|

| Definition | Professional estimate of a property's worth based on detailed analysis. | Price a buyer is willing to pay in the current real estate market. |

| Determined By | Licensed appraiser using standards (e.g., USPAP). | Market demand and buyer-seller negotiations. |

| Purpose | Used for mortgage, tax assessments, and legal transactions. | Reflects actual transaction value and market trends. |

| Frequency | Typically done during sale or refinancing process. | Changes constantly based on market conditions. |

| Influencing Factors | Comparable sales, property condition, location, improvements. | Supply & demand, economic factors, buyer motivation. |

| Value Accuracy | Objective, but may lag behind rapid market changes. | Reflects current market sentiment; often fluctuates. |

Understanding Appraised Value in Real Estate

Appraised value in real estate represents a professional estimate of a property's worth based on detailed analysis of comparable sales, property condition, and market trends. This value is determined by a licensed appraiser and is crucial for securing mortgage financing, ensuring lenders assess accurate risk. While market value fluctuates with demand and buyer perception, the appraised value provides a standardized, objective figure essential for transaction legitimacy and financial decisions.

Defining Market Value: Key Concepts

Market value represents the estimated amount a property would sell for on the open market under typical conditions, reflecting supply, demand, and buyer motivations. It considers factors such as location, property condition, recent comparable sales, and current real estate trends. Unlike appraised value, market value fluctuates based on market dynamics and buyer perception, offering a realistic snapshot of a property's worth at a given time.

How Appraised Value Is Determined

Appraised value is determined through a detailed analysis by a licensed appraiser who assesses the property's condition, location, and comparable sales in the area. The appraiser considers factors such as recent home sales, property size, features, and local market trends to estimate a fair value. This objective valuation is often used by lenders to ensure the property's worth justifies the loan amount.

Factors That Influence Market Value

Market value in real estate is influenced by factors such as location desirability, current supply and demand, and economic conditions including interest rates and employment levels. Property condition, recent comparable sales, and buyer perception also significantly impact market value fluctuations. Unlike appraised value, which is typically based on standardized assessments, market value reflects real-time buyer sentiment and competitive market dynamics.

Appraised Value vs Market Value: Core Differences

Appraised value is the professional estimate of a property's worth based on a systematic assessment of physical characteristics, location, and recent comparable sales, primarily used for lending purposes. Market value reflects the price a buyer is willing to pay in an open market influenced by supply, demand, and economic conditions, often fluctuating due to market trends. Understanding the core differences between appraised value and market value is essential for accurate pricing, investment decisions, and successful real estate transactions.

Why Do Appraised and Market Values Differ?

Appraised value differs from market value primarily because appraisals rely on standardized methods involving property inspections, comparable sales, and professional judgment to estimate worth, whereas market value reflects the actual price a willing buyer pays in a competitive market influenced by supply, demand, and buyer sentiment. Factors such as economic conditions, negotiation dynamics, and unique property features can cause market value to fluctuate independently from appraised value. Understanding these differences is crucial for buyers, sellers, and lenders navigating real estate transactions and financing decisions.

Impact of Appraised Value on Mortgage Lending

Appraised value serves as a critical benchmark for lenders to determine the loan amount they are willing to offer, directly impacting mortgage approval and terms. A lower appraised value compared to the market value may result in reduced loan-to-value ratios, necessitating higher down payments or loan denial. Accurate appraisal ensures risk mitigation for lenders while influencing borrower eligibility and interest rates in mortgage lending.

Market Value’s Role in Home Sale Negotiations

Market value plays a crucial role in home sale negotiations as it reflects the price a buyer is willing to pay under current market conditions, providing a realistic benchmark beyond the appraised value. Unlike appraised value, which is an expert's estimate based on property features and comparable sales, market value captures real-time demand and buyer sentiment. Understanding market value empowers sellers and buyers to negotiate effectively, ensuring a fair transaction aligned with current market trends and buyer interest.

Navigating Value Discrepancies in Real Estate Transactions

Appraised value represents an expert's unbiased estimate based on property condition, location, and comparables, often required by lenders to mitigate financing risks. Market value reflects the price a willing buyer would pay and a willing seller would accept in the current market, influenced by demand, trends, and negotiations. Understanding the distinction and identifying discrepancies between these values is crucial for buyers, sellers, and agents to ensure fair pricing and successful real estate transactions.

Tips for Buyers and Sellers: Dealing with Appraisal and Market Value Gaps

Buyers and sellers should conduct thorough market research to understand current property trends and price ranges, minimizing appraisal and market value gaps. Engaging a licensed appraiser and real estate agent can provide accurate valuations and negotiation leverage, ensuring fair transactions. Being prepared to adjust offers or listing prices based on appraisal outcomes prevents delays and fosters smoother deal closures.

Appraised Value vs Market Value Infographic

difterm.com

difterm.com