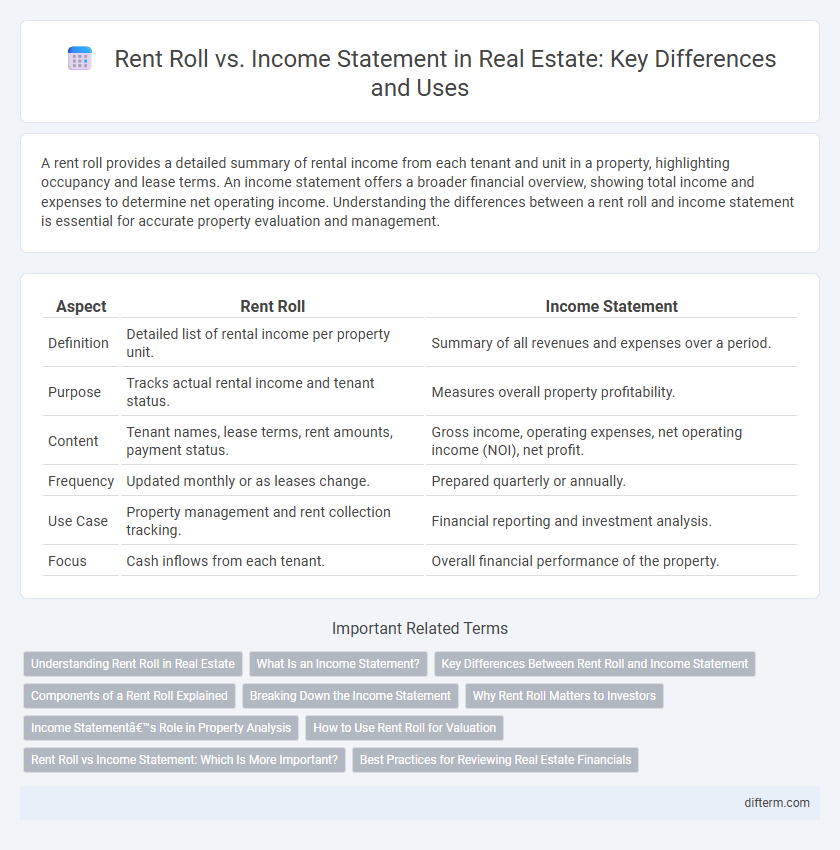

A rent roll provides a detailed summary of rental income from each tenant and unit in a property, highlighting occupancy and lease terms. An income statement offers a broader financial overview, showing total income and expenses to determine net operating income. Understanding the differences between a rent roll and income statement is essential for accurate property evaluation and management.

Table of Comparison

| Aspect | Rent Roll | Income Statement |

|---|---|---|

| Definition | Detailed list of rental income per property unit. | Summary of all revenues and expenses over a period. |

| Purpose | Tracks actual rental income and tenant status. | Measures overall property profitability. |

| Content | Tenant names, lease terms, rent amounts, payment status. | Gross income, operating expenses, net operating income (NOI), net profit. |

| Frequency | Updated monthly or as leases change. | Prepared quarterly or annually. |

| Use Case | Property management and rent collection tracking. | Financial reporting and investment analysis. |

| Focus | Cash inflows from each tenant. | Overall financial performance of the property. |

Understanding Rent Roll in Real Estate

A rent roll is a detailed report listing all rental income generated from a real estate property, including tenant names, lease terms, rental rates, and payment status. It serves as a crucial document for property owners, investors, and managers to track current cash flow and occupancy rates, providing real-time insight into the financial performance of rental properties. Unlike an income statement, which summarizes overall financial activity over a period, the rent roll offers granular data essential for evaluating tenant stability and forecasting future income.

What Is an Income Statement?

An income statement in real estate details the revenue and expenses generated by a property over a specific period, reflecting its profitability. It includes rental income, operating expenses, property management fees, and net operating income, providing a comprehensive financial overview. Unlike a rent roll, which lists tenant rent details, the income statement aggregates financial performance data to assess the property's economic viability.

Key Differences Between Rent Roll and Income Statement

A rent roll provides a detailed list of rental income sources from each tenant, including lease terms, rent amounts, and occupancy status, while an income statement summarizes overall property financial performance with revenues, expenses, and net operating income. The rent roll offers granular, tenant-level data crucial for assessing rental income stability and lease expirations, whereas the income statement delivers a high-level view of profitability and operational efficiency for a given period. Understanding these key differences helps real estate investors evaluate both individual lease performance and the property's overall financial health.

Components of a Rent Roll Explained

A rent roll details each tenant's lease information, including rent amount, lease start and end dates, unit number, and payment status, providing a granular view of rental income. It also tracks additional charges such as parking fees, utilities, and common area maintenance fees, which contribute to the property's overall revenue. This document is essential for investors to assess cash flow accuracy and occupancy rates, distinct from an income statement that summarizes total income and expenses.

Breaking Down the Income Statement

The income statement in real estate breaks down property revenues and expenses to reveal net operating income, essential for evaluating investment performance. Rent roll details tenant leases, including rent amounts and lease durations, providing a granular view of rental income that feeds into the income statement's total revenue. Understanding the interplay between the rent roll and income statement helps investors assess cash flow accuracy and property profitability.

Why Rent Roll Matters to Investors

Rent roll provides investors with a detailed snapshot of tenant occupancy, lease terms, and rental income projections, offering a real-time view of property cash flow and risk exposure. This granular data helps investors assess the stability and growth potential of their investment by highlighting tenant diversity, lease expirations, and rent escalations. In contrast to an income statement's historical financial summary, a rent roll enables proactive decision-making for portfolio management and investment valuation.

Income Statement’s Role in Property Analysis

The Income Statement provides a comprehensive overview of a property's financial performance by detailing revenues, expenses, and net operating income over a specific period, enabling investors to assess profitability and operational efficiency. Unlike the Rent Roll, which lists tenant rents and lease terms, the Income Statement incorporates property management costs, maintenance expenses, and other overheads essential for accurate cash flow analysis. This financial document plays a critical role in property analysis by offering insight into the sustainability of income streams and guiding investment decisions based on real operational results.

How to Use Rent Roll for Valuation

A rent roll provides detailed information on a property's current leases, including tenant names, lease terms, rental rates, and payment status, which helps in accurately projecting future income streams. Analyzing the rent roll allows investors to assess the stability and quality of income, tenant diversification, and potential risks such as vacancies or non-payment, directly impacting property valuation. Unlike the income statement, which reflects historical financial performance, the rent roll offers a forward-looking view essential for estimating market value and investment potential.

Rent Roll vs Income Statement: Which Is More Important?

Rent Roll provides a detailed overview of rental income, tenant information, and lease terms, making it essential for analyzing cash flow and occupancy rates. Income Statement offers a broader financial picture including operating expenses, net operating income (NOI), and profitability metrics. While both are critical, the Income Statement is generally more important for assessing overall financial health, but Rent Roll is invaluable for evaluating rental income stability and tenant performance.

Best Practices for Reviewing Real Estate Financials

Rent rolls provide detailed tenant-level data including lease terms, rent amounts, and occupancy status, essential for verifying cash flow consistency. Income statements summarize overall property revenue and expenses, offering insight into profitability and operational efficiency. Best practices for reviewing real estate financials involve cross-referencing rent roll data with income statements to identify discrepancies, validate rental income, and assess lease sustainability.

Rent Roll vs Income Statement Infographic

difterm.com

difterm.com