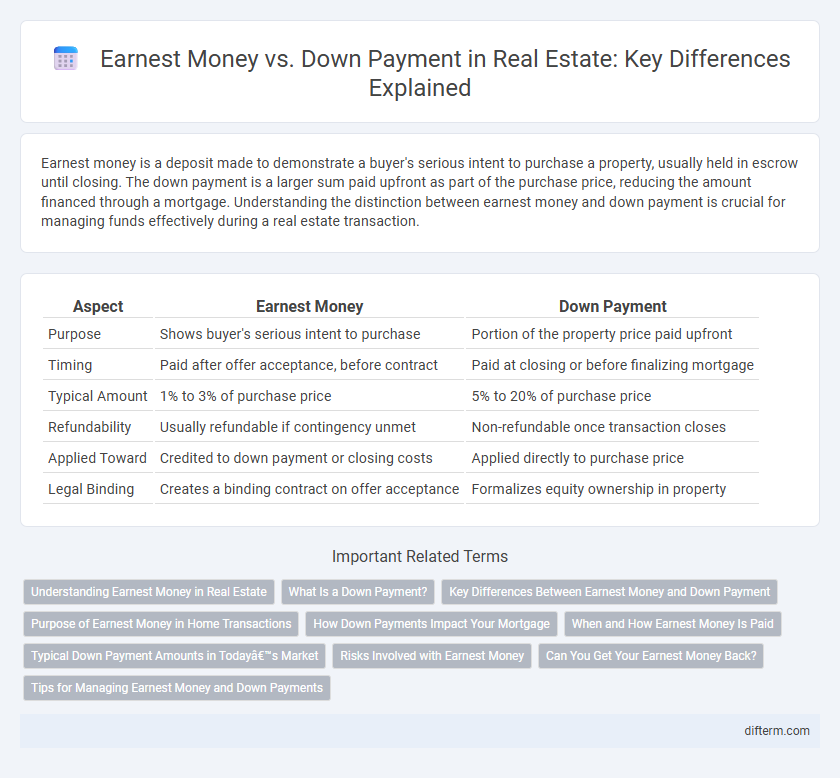

Earnest money is a deposit made to demonstrate a buyer's serious intent to purchase a property, usually held in escrow until closing. The down payment is a larger sum paid upfront as part of the purchase price, reducing the amount financed through a mortgage. Understanding the distinction between earnest money and down payment is crucial for managing funds effectively during a real estate transaction.

Table of Comparison

| Aspect | Earnest Money | Down Payment |

|---|---|---|

| Purpose | Shows buyer's serious intent to purchase | Portion of the property price paid upfront |

| Timing | Paid after offer acceptance, before contract | Paid at closing or before finalizing mortgage |

| Typical Amount | 1% to 3% of purchase price | 5% to 20% of purchase price |

| Refundability | Usually refundable if contingency unmet | Non-refundable once transaction closes |

| Applied Toward | Credited to down payment or closing costs | Applied directly to purchase price |

| Legal Binding | Creates a binding contract on offer acceptance | Formalizes equity ownership in property |

Understanding Earnest Money in Real Estate

Earnest money in real estate serves as a buyer's good faith deposit to demonstrate serious intent when making an offer on a property, typically amounting to 1-3% of the purchase price. This deposit is held in escrow and is credited toward the down payment or closing costs once the transaction proceeds. Unlike the down payment, which is a substantial portion of the home's price paid at closing, earnest money protects the seller against deal abandonment during the due diligence period.

What Is a Down Payment?

A down payment is a percentage of the home's purchase price paid upfront by the buyer, typically ranging from 3% to 20%, which reduces the loan amount required from the lender. It serves as a financial commitment to the purchase, often influencing mortgage approval and interest rates. Unlike earnest money, the down payment is applied directly to the home's total cost at closing.

Key Differences Between Earnest Money and Down Payment

Earnest money is a deposit made to demonstrate a buyer's serious intent to purchase a property, typically held in escrow until closing, whereas the down payment is the portion of the home's purchase price paid upfront at closing, reducing the mortgage principal. The earnest money amount is usually a smaller percentage of the purchase price, often 1-3%, while down payments generally range from 3% to 20% depending on the loan type and lender requirements. Earnest money may be forfeited if the buyer backs out without cause, while the down payment forms part of the buyer's equity in the property after the transaction completes.

Purpose of Earnest Money in Home Transactions

Earnest money serves as a buyer's good faith deposit in home transactions, demonstrating serious intent to purchase the property. This deposit is typically held in escrow and applied toward the down payment or closing costs if the sale proceeds, providing the seller with security against potential buyer default. Unlike the down payment, which is a portion of the home's purchase price paid at closing, earnest money is submitted early in the negotiation process to solidify the buyer's commitment.

How Down Payments Impact Your Mortgage

Down payments directly influence your mortgage by reducing the loan amount and potentially lowering your interest rate, which can save you thousands over the loan term. A higher down payment often means avoiding private mortgage insurance (PMI), decreasing monthly payments and overall costs. Lenders view larger down payments as a sign of financial stability, improving your chances of mortgage approval and better terms.

When and How Earnest Money Is Paid

Earnest money is typically paid shortly after an offer is accepted, serving as a deposit to demonstrate the buyer's serious intent to purchase a property. This payment is held in escrow and applied toward the down payment or closing costs once the sale is finalized. Unlike the down payment, earnest money is usually a smaller percentage of the purchase price and is refundable only under specific contract contingencies.

Typical Down Payment Amounts in Today’s Market

Typical down payment amounts in today's real estate market usually range from 5% to 20% of the home's purchase price, depending on the loan type and buyer qualifications. Conventional loans often require around 20% to avoid private mortgage insurance (PMI), while FHA loans may allow down payments as low as 3.5%. Understanding these amounts is essential for budgeting, as earnest money deposits, which are typically 1% to 3%, are applied toward the final down payment upon closing.

Risks Involved with Earnest Money

Earnest money is a deposit made to demonstrate serious intent to buy a property, but it carries risks such as loss if the buyer fails to meet contract contingencies or breaches the agreement. Unlike a down payment, which is applied toward the purchase price at closing, earnest money can be forfeited if the transaction falls through due to buyer error or changes in decision. Understanding the contractual terms and negotiation contingencies is crucial to minimizing potential financial loss associated with earnest money.

Can You Get Your Earnest Money Back?

Earnest money is a deposit made to demonstrate a buyer's serious intent in a real estate transaction, typically refundable if contingencies like inspections or financing aren't met. However, if the buyer withdraws without a valid contingency, the seller may keep the earnest money as compensation. Down payments are a separate, larger portion paid toward the purchase price, usually non-refundable once the contract progresses beyond contingencies.

Tips for Managing Earnest Money and Down Payments

Carefully track earnest money deposits by using an escrow account to ensure funds are securely held and accounted for during the home buying process. Communicate clearly with your real estate agent and lender to confirm deadlines and requirements for the down payment to avoid delays in closing. Budget ahead for both earnest money and down payment amounts, typically 1-3% for earnest money and 5-20% for down payment, to maintain financial stability throughout the transaction.

Earnest Money vs Down Payment Infographic

difterm.com

difterm.com