Equity sharing and joint ventures offer distinct approaches to real estate investment involving pets. Equity sharing allows multiple parties to co-own a property, sharing expenses and returns based on their ownership percentage, often benefiting pet owners seeking flexible financial arrangements. Joint ventures involve collaboration between parties pooling resources for a specific project, providing structured partnerships ideal for larger scale pet-friendly real estate developments.

Table of Comparison

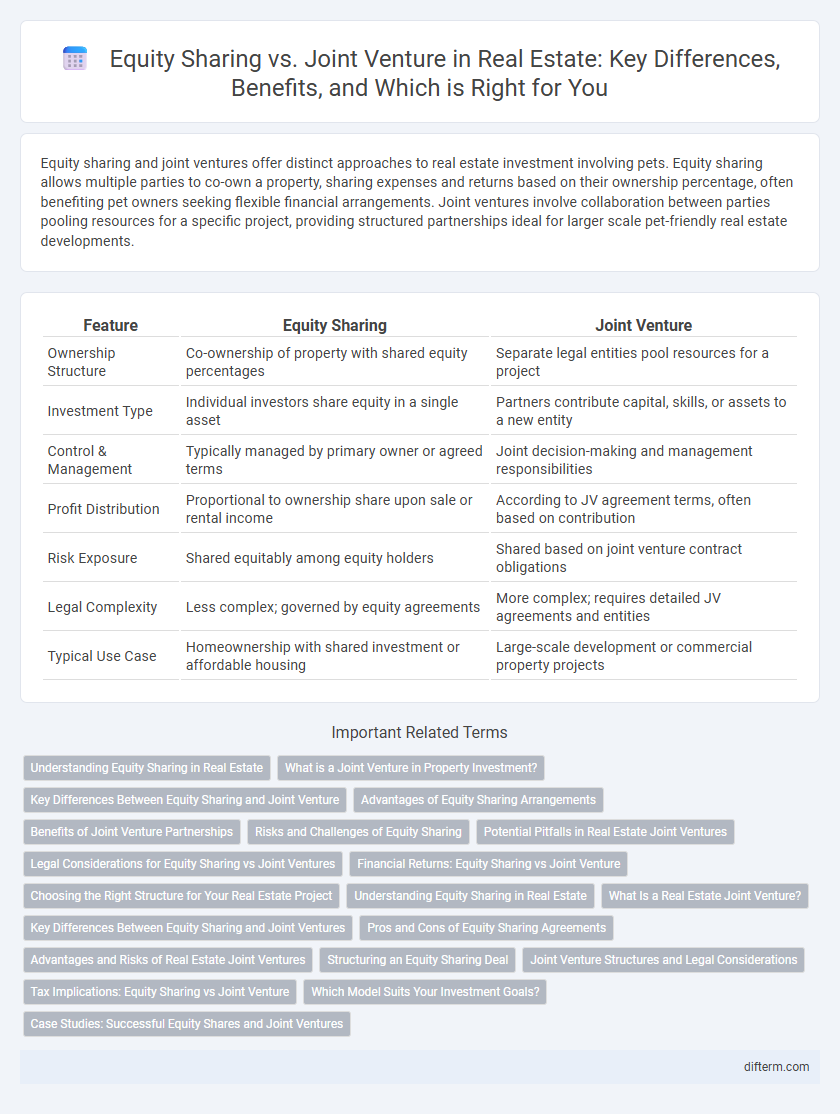

| Feature | Equity Sharing | Joint Venture |

|---|---|---|

| Ownership Structure | Co-ownership of property with shared equity percentages | Separate legal entities pool resources for a project |

| Investment Type | Individual investors share equity in a single asset | Partners contribute capital, skills, or assets to a new entity |

| Control & Management | Typically managed by primary owner or agreed terms | Joint decision-making and management responsibilities |

| Profit Distribution | Proportional to ownership share upon sale or rental income | According to JV agreement terms, often based on contribution |

| Risk Exposure | Shared equitably among equity holders | Shared based on joint venture contract obligations |

| Legal Complexity | Less complex; governed by equity agreements | More complex; requires detailed JV agreements and entities |

| Typical Use Case | Homeownership with shared investment or affordable housing | Large-scale development or commercial property projects |

Understanding Equity Sharing in Real Estate

Equity sharing in real estate involves multiple parties jointly investing in a property, where each participant owns a percentage of the equity based on their contribution. This model allows investors to share both the risks and rewards of property appreciation, rental income, and maintenance costs without the complexities of forming a separate legal entity as in a joint venture. Understanding equity sharing provides clarity on ownership percentages, profit distribution, and exit strategies, making it an attractive option for partners seeking flexible and collaborative investment opportunities.

What is a Joint Venture in Property Investment?

A joint venture in property investment is a strategic partnership where two or more parties combine resources, capital, and expertise to acquire, develop, or manage real estate assets. Each participant shares ownership, risks, profits, and decision-making responsibilities according to their agreed-upon equity stakes. This structure allows investors to leverage complementary strengths and access larger, more complex projects than they could individually.

Key Differences Between Equity Sharing and Joint Venture

Equity sharing involves two or more parties who co-own a property by contributing capital and sharing the equity based on their investment proportions, often used for residential real estate purchases. Joint ventures in real estate are strategic partnerships where parties combine resources and expertise to develop or manage a property, sharing profits and risks according to a contractual agreement. The key differences lie in ownership structure, with equity sharing focused on co-ownership of a single asset, while joint ventures typically involve project-based collaboration with separate legal entities and shared operational control.

Advantages of Equity Sharing Arrangements

Equity sharing arrangements in real estate provide investors with the advantage of shared financial risk and access to property ownership without requiring full capital investment. These arrangements allow co-investors to benefit from property appreciation and rental income proportionally, enhancing return potential while maintaining liquidity. Equity sharing also offers flexible exit strategies and tax benefits linked to property ownership, making it a strategic choice for diversifying real estate portfolios.

Benefits of Joint Venture Partnerships

Joint venture partnerships in real estate offer significant benefits such as shared financial risk, access to combined resources, and enhanced expertise, which can lead to more lucrative investment opportunities. These partnerships enable investors to pool capital and leverage each partner's strengths, facilitating larger developments and diversified portfolios. The collaborative structure also allows for streamlined decision-making and improved project management, increasing the potential for higher returns.

Risks and Challenges of Equity Sharing

Equity sharing in real estate involves co-ownership where one party typically provides financing while the other manages the property, exposing both to risks like market volatility and disagreements over property management decisions. Challenges include potential conflicts over profit distribution, lack of clear exit strategies, and complications in refinancing or selling the property due to shared equity stakes. Unlike joint ventures, equity sharing carries heightened risks related to unequal control and differing financial goals, which can lead to legal disputes and financial losses.

Potential Pitfalls in Real Estate Joint Ventures

Potential pitfalls in real estate joint ventures include misaligned goals between partners, which can lead to disputes and project delays. Financial risks often arise from unclear contribution structures and profit-sharing agreements, potentially causing cash flow issues. Additionally, lack of transparent communication and inadequate legal frameworks increase the likelihood of conflicts and failed investments.

Legal Considerations for Equity Sharing vs Joint Ventures

Equity sharing agreements in real estate often involve clear legal frameworks that define ownership percentages and responsibilities, minimizing disputes through detailed contracts. Joint ventures require comprehensive legal documentation to outline each party's contributions, profit distribution, liability, and decision-making processes, ensuring compliance with local regulations. Both structures demand thorough due diligence and tailored legal counsel to address potential risks such as tax implications, exit strategies, and dispute resolution mechanisms.

Financial Returns: Equity Sharing vs Joint Venture

Equity sharing allows investors to share property ownership and financial returns proportionally, often resulting in steady passive income and potential appreciation gains. Joint ventures combine resources and expertise, aiming for higher financial returns through collaborative project development and risk-sharing. While equity sharing offers diversified income streams from rental yields and property value increases, joint ventures typically target larger profits from property development and asset management success.

Choosing the Right Structure for Your Real Estate Project

Equity sharing and joint ventures both offer strategic pathways for pooling resources in real estate projects, but equity sharing focuses on shared ownership and profit division based on individual contributions, while joint ventures emphasize collaboration with defined roles and risks. Selecting the right structure depends on factors like investment size, control preferences, tax implications, and project duration, with equity sharing beneficial for individual investors seeking passive income and joint ventures suited for partners wanting active involvement. Clear agreements outlining profit distribution, responsibilities, and exit strategies are essential in both models to optimize financial returns and minimize conflicts.

Equity Sharing vs Joint Venture Infographic

difterm.com

difterm.com