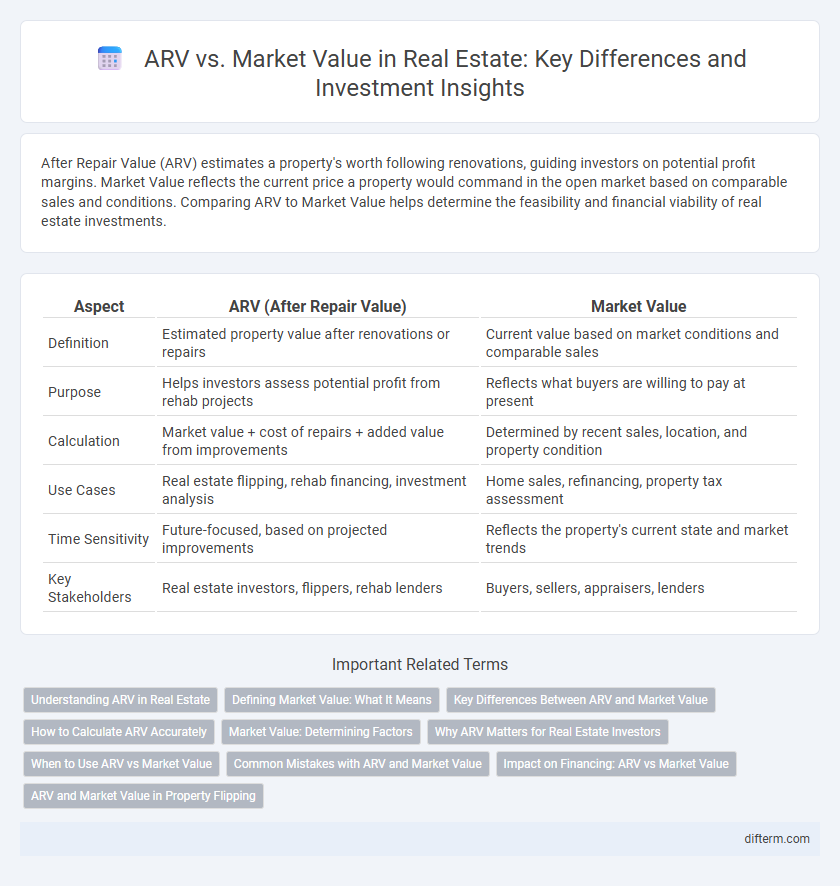

After Repair Value (ARV) estimates a property's worth following renovations, guiding investors on potential profit margins. Market Value reflects the current price a property would command in the open market based on comparable sales and conditions. Comparing ARV to Market Value helps determine the feasibility and financial viability of real estate investments.

Table of Comparison

| Aspect | ARV (After Repair Value) | Market Value |

|---|---|---|

| Definition | Estimated property value after renovations or repairs | Current value based on market conditions and comparable sales |

| Purpose | Helps investors assess potential profit from rehab projects | Reflects what buyers are willing to pay at present |

| Calculation | Market value + cost of repairs + added value from improvements | Determined by recent sales, location, and property condition |

| Use Cases | Real estate flipping, rehab financing, investment analysis | Home sales, refinancing, property tax assessment |

| Time Sensitivity | Future-focused, based on projected improvements | Reflects the property's current state and market trends |

| Key Stakeholders | Real estate investors, flippers, rehab lenders | Buyers, sellers, appraisers, lenders |

Understanding ARV in Real Estate

After Repair Value (ARV) is a crucial metric in real estate investing that estimates a property's potential market value after completing renovations and improvements. ARV helps investors determine the profitability of a flip by comparing it against acquisition and repair costs to ensure a desirable return on investment. Accurate ARV assessment requires analyzing comparable properties, current market trends, and renovation budgets to project realistic post-repair pricing.

Defining Market Value: What It Means

Market value represents the estimated amount a property would fetch in a competitive and open market under fair conditions, reflecting current buyer demand and seller expectations. It is determined by analyzing comparable sales, location, property condition, and prevailing economic trends. Understanding market value is essential for setting realistic prices, securing financing, and making informed investment decisions in real estate.

Key Differences Between ARV and Market Value

After Repair Value (ARV) estimates a property's future worth post-renovation, reflecting potential investment returns, while Market Value represents the current price a buyer is willing to pay based on comparable sales and current market conditions. ARV is crucial for real estate investors planning flips or rehab projects, as it drives decisions on purchase price and renovation budgets. Market Value fluctuates with demand, location, and economic factors, influencing traditional sales and refinancing opportunities.

How to Calculate ARV Accurately

To calculate After Repair Value (ARV) accurately, analyze comparable properties (comps) recently sold in the same neighborhood with similar size, condition, and features. Adjust the prices of these comps based on upgrades, renovations, and market trends to reflect potential improvements. Use local market data, including price per square foot and days on market, to ensure your ARV estimate reflects current real estate dynamics.

Market Value: Determining Factors

Market value in real estate is primarily influenced by location, property condition, and current market trends. Comparable sales, or "comps," provide critical data points that help assess what buyers are willing to pay for similar properties nearby. Economic indicators such as interest rates and local employment rates also play a significant role in shaping market value dynamics.

Why ARV Matters for Real Estate Investors

After Repair Value (ARV) is crucial for real estate investors because it estimates the future market value of a property post-renovation, guiding accurate investment decisions and profit projections. Understanding ARV helps investors assess whether the renovation costs justify the potential resale price, reducing financial risks. This metric is essential for securing financing, determining offer prices, and strategizing profitable property flips or rental investments.

When to Use ARV vs Market Value

ARV (After Repair Value) is essential when evaluating potential profits on fixer-upper properties or renovation projects, guiding investment decisions and financing options. Market value is more relevant for properties in stable condition, reflecting current sale prices based on comparable sales and local market trends. Investors rely on ARV to estimate future worth post-renovation, while buyers and sellers use market value to determine fair transaction prices in the existing market.

Common Mistakes with ARV and Market Value

Confusing After Repair Value (ARV) with Market Value leads many investors to overpay for properties or underestimate renovation costs, impacting profitability. A common mistake is relying solely on ARV without accounting for current market fluctuations or neighborhood trends, which can distort property valuations. Misinterpreting ARV as the property's actual worth rather than a projected post-renovation estimate often results in poor investment decisions and financial losses.

Impact on Financing: ARV vs Market Value

After Repair Value (ARV) significantly influences financing decisions by providing lenders with an estimate of the property's future value post-renovation, guiding loan-to-value ratios and loan approvals. Market Value reflects the current worth of the property based on comparable sales, affecting immediate appraisal and refinancing options. Understanding the distinction ensures accurate risk assessment and optimal financing terms for real estate investors and lenders.

ARV and Market Value in Property Flipping

ARV (After Repair Value) is the estimated market value of a property after all renovations and repairs are completed, playing a crucial role in property flipping by helping investors determine potential profit margins and decide offer prices. Market value, on the other hand, represents the current price a property is expected to sell for in its existing condition based on recent comparable sales and market trends. Accurate assessment of ARV against market value ensures informed investment decisions, minimizes risks, and maximizes return on investment in real estate flipping projects.

ARV vs Market Value Infographic

difterm.com

difterm.com