Soft inquiries for real estate credit checks do not impact your credit score and are typically used for pre-approval or initial screening processes by landlords and property managers. Hard inquiries occur when a lender or landlord requests a full credit report to make final decisions on rental applications or mortgage approvals, which can slightly lower your credit score. Understanding the difference between soft and hard inquiries helps renters and buyers manage their credit health during the real estate application process.

Table of Comparison

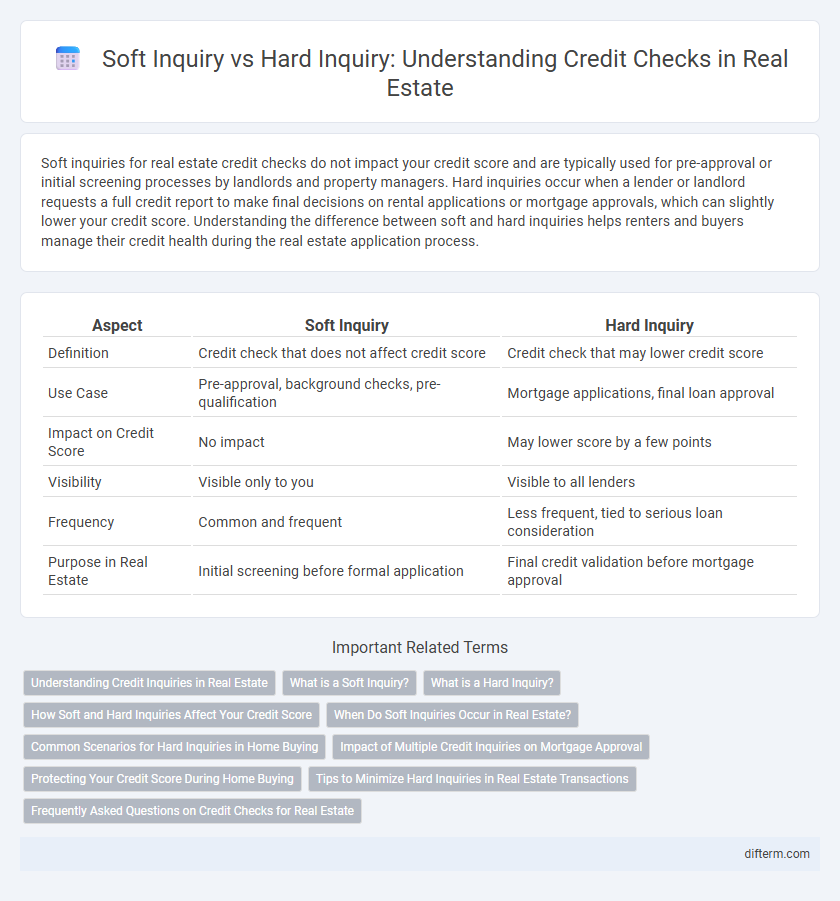

| Aspect | Soft Inquiry | Hard Inquiry |

|---|---|---|

| Definition | Credit check that does not affect credit score | Credit check that may lower credit score |

| Use Case | Pre-approval, background checks, pre-qualification | Mortgage applications, final loan approval |

| Impact on Credit Score | No impact | May lower score by a few points |

| Visibility | Visible only to you | Visible to all lenders |

| Frequency | Common and frequent | Less frequent, tied to serious loan consideration |

| Purpose in Real Estate | Initial screening before formal application | Final credit validation before mortgage approval |

Understanding Credit Inquiries in Real Estate

Soft inquiries in real estate credit checks allow lenders to review a borrower's credit report without affecting their credit score, commonly used for pre-qualification purposes. Hard inquiries occur when a borrower officially applies for a mortgage, resulting in a credit check that can temporarily lower the credit score and impact loan approval. Understanding the distinction between soft and hard inquiries is essential for managing credit health during the home buying process.

What is a Soft Inquiry?

A soft inquiry in real estate credit checks occurs when a lender or real estate agent reviews your credit report without affecting your credit score. This type of inquiry is typically used for pre-approval or background research and does not indicate a formal loan application. Understanding soft inquiries helps buyers assess their credit status without risking negative impacts on their mortgage eligibility.

What is a Hard Inquiry?

A hard inquiry occurs when a lender or real estate professional checks your credit report to evaluate your creditworthiness during a mortgage application or home loan process. This type of credit check can slightly lower your credit score and remains visible to other lenders for up to two years. Hard inquiries provide a detailed snapshot of your financial behavior, which is crucial in real estate transactions for assessing loan approval risk.

How Soft and Hard Inquiries Affect Your Credit Score

Soft inquiries occur when lenders check your credit for informational purposes without impacting your credit score, such as during pre-approval processes for real estate loans. Hard inquiries happen when you formally apply for credit, like a mortgage, and can lower your credit score by a few points for up to 12 months. Understanding the difference between soft and hard inquiries is crucial for homebuyers aiming to maintain a strong credit profile and secure better financing terms.

When Do Soft Inquiries Occur in Real Estate?

Soft inquiries in real estate occur when a potential buyer or renter's credit report is checked without impacting their credit score, often during pre-qualification or when landlords assess tenant applications. Lenders may use soft inquiries to gauge creditworthiness before a formal loan application, minimizing risk while avoiding negative effects on the applicant's credit. These inquiries provide essential insights into financial health without the commitment or consequences associated with hard credit checks.

Common Scenarios for Hard Inquiries in Home Buying

Hard inquiries occur during mortgage pre-approval, home loan applications, and refinancing, signaling lenders to evaluate the borrower's creditworthiness thoroughly. These credit checks impact credit scores temporarily, reflecting the risk associated with lending for significant real estate investments. Understanding when hard inquiries happen helps buyers manage their credit health while pursuing homeownership.

Impact of Multiple Credit Inquiries on Mortgage Approval

Multiple soft inquiries for credit checks during the mortgage approval process do not negatively affect credit scores, allowing potential homebuyers to shop for the best loan rates without penalty. In contrast, multiple hard inquiries within a short period, typically 14-45 days, are treated as a single inquiry to minimize impact, but numerous hard inquiries outside this window can lower credit scores and reduce mortgage approval chances. Lenders closely monitor hard inquiries as indicators of financial risk, influencing interest rates and loan terms offered to applicants.

Protecting Your Credit Score During Home Buying

Soft inquiries occur when lenders review your credit report without impacting your credit score, commonly used for pre-approval checks in real estate transactions. Hard inquiries take place when a mortgage lender formally requests your credit report, which can slightly lower your credit score and remain on your report for up to two years. Limiting the number of hard inquiries and timing them to occur within a focused period can help protect your credit score during the home buying process.

Tips to Minimize Hard Inquiries in Real Estate Transactions

Minimizing hard inquiries in real estate transactions involves strategic timing, such as consolidating mortgage applications within a short window of 14 to 45 days to reduce multiple hits on your credit report. Opt for pre-qualification instead of pre-approval when casually exploring property options, as pre-qualification typically triggers only a soft inquiry. Maintaining open communication with lenders about your preferred credit check method can further limit unnecessary hard inquiries that might impact your credit score.

Frequently Asked Questions on Credit Checks for Real Estate

Soft inquiries for real estate credit checks typically occur during preliminary mortgage pre-approvals or rental applications and do not affect credit scores, providing a risk-free way for lenders and landlords to assess creditworthiness. Hard inquiries are triggered by formal loan applications or final mortgage approval processes, potentially lowering credit scores by a few points and signaling active credit seeking to credit bureaus. Understanding the distinction between soft and hard inquiries helps homebuyers and renters manage their credit profiles effectively during property transactions.

Soft Inquiry vs Hard Inquiry (credit check for real estate) Infographic

difterm.com

difterm.com