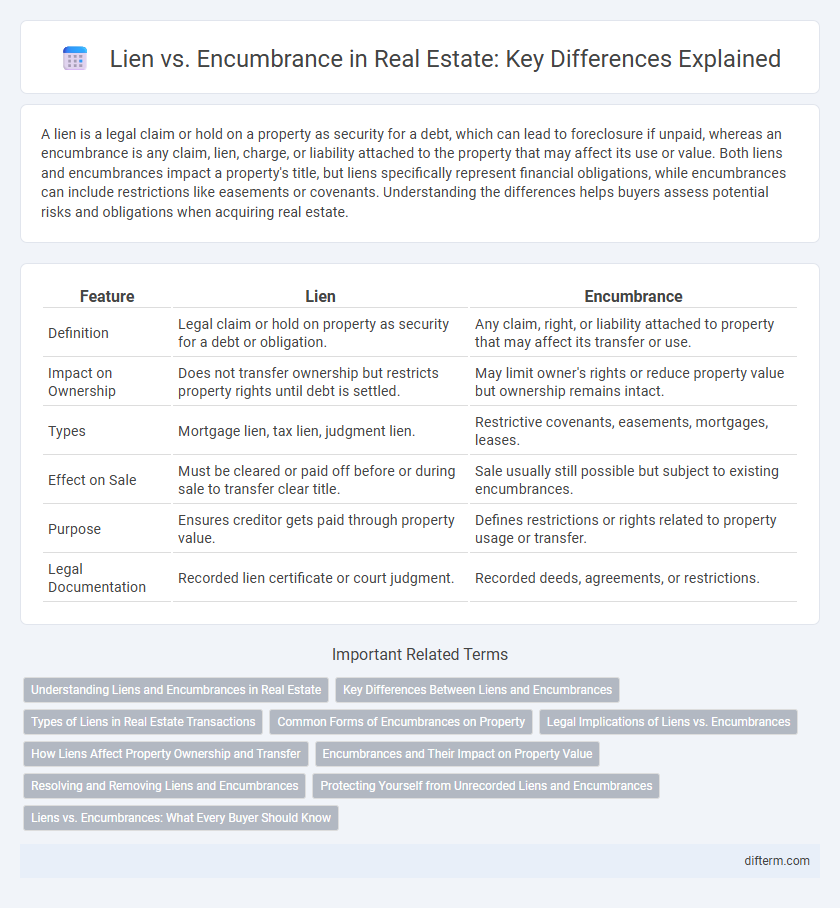

A lien is a legal claim or hold on a property as security for a debt, which can lead to foreclosure if unpaid, whereas an encumbrance is any claim, lien, charge, or liability attached to the property that may affect its use or value. Both liens and encumbrances impact a property's title, but liens specifically represent financial obligations, while encumbrances can include restrictions like easements or covenants. Understanding the differences helps buyers assess potential risks and obligations when acquiring real estate.

Table of Comparison

| Feature | Lien | Encumbrance |

|---|---|---|

| Definition | Legal claim or hold on property as security for a debt or obligation. | Any claim, right, or liability attached to property that may affect its transfer or use. |

| Impact on Ownership | Does not transfer ownership but restricts property rights until debt is settled. | May limit owner's rights or reduce property value but ownership remains intact. |

| Types | Mortgage lien, tax lien, judgment lien. | Restrictive covenants, easements, mortgages, leases. |

| Effect on Sale | Must be cleared or paid off before or during sale to transfer clear title. | Sale usually still possible but subject to existing encumbrances. |

| Purpose | Ensures creditor gets paid through property value. | Defines restrictions or rights related to property usage or transfer. |

| Legal Documentation | Recorded lien certificate or court judgment. | Recorded deeds, agreements, or restrictions. |

Understanding Liens and Encumbrances in Real Estate

Liens are legal claims or holds on a property by a creditor to secure a debt, typically arising from unpaid loans, taxes, or judgments, directly impacting the property's title and its ability to be sold or refinanced. Encumbrances encompass a broader category, including liens, easements, restrictions, and encroachments that can limit property use, affect value, or restrict ownership rights. Understanding these distinctions is crucial for real estate transactions to ensure clear title transfer and avoid future disputes or financial liabilities.

Key Differences Between Liens and Encumbrances

Liens represent a legal claim or hold on a property as security for a debt, allowing the lienholder to enforce payment through foreclosure if necessary. Encumbrances include any claim, lien, charge, or liability attached to the property that may diminish its value or restrict its use, such as easements, restrictions, or encroachments. The key difference lies in liens being specific financial claims enforceable against the property, whereas encumbrances encompass a broader category of limitations affecting ownership and marketability.

Types of Liens in Real Estate Transactions

Types of liens in real estate transactions include mortgage liens, mechanic's liens, and tax liens, each representing a claim against a property to secure a debt or obligation. Mortgage liens arise from loans taken to purchase the property, giving lenders the right to foreclose if payments are not met. Mechanic's liens protect contractors and suppliers, while tax liens are imposed by government authorities for unpaid property taxes, all affecting the title and ownership transfer process.

Common Forms of Encumbrances on Property

Common forms of encumbrances on property include liens, easements, and restrictive covenants, each affecting ownership rights and property value differently. Liens represent legal claims against a property for unpaid debts, often arising from mortgages, tax obligations, or contractor fees. Easements grant others limited access or use of the property without transferring ownership, while restrictive covenants impose specific limitations on property use established by a prior owner or governing authority.

Legal Implications of Liens vs. Encumbrances

Liens and encumbrances both affect property ownership, but liens specifically grant a creditor legal claim on the property until a debt is satisfied, potentially leading to foreclosure if unpaid. Encumbrances encompass a broader range of legal claims including easements, restrictions, or encroachments that limit property use without necessarily involving debt obligations. Understanding these distinctions is critical for real estate transactions, as liens often require resolution before transfer, whereas some encumbrances might remain post-sale, impacting future ownership rights.

How Liens Affect Property Ownership and Transfer

Liens impose a legal claim on a property, restricting the owner's ability to transfer clear title until the debt or obligation is satisfied. They often result from unpaid taxes, mortgages, or contractor fees, directly affecting the property's marketability and sale process. Encumbrances, including liens, easements, and restrictions, can limit property rights but vary in their impact on ownership transfer, with liens specifically requiring resolution before conveyance.

Encumbrances and Their Impact on Property Value

Encumbrances such as easements, mortgages, and restrictive covenants can significantly affect a property's market value by limiting its use or reducing its appeal to potential buyers. These legal claims or liabilities often restrict ownership rights and may require additional costs or negotiations during property transactions. Understanding the nature and extent of encumbrances is crucial for accurate property appraisal and risk assessment in real estate investments.

Resolving and Removing Liens and Encumbrances

Resolving liens and encumbrances involves identifying the debt or claim affecting the property's clear title and negotiating payment or settlement with the lienholder or encumbrance holder. Removing a lien often requires obtaining a lien release or satisfaction document once the obligation is fulfilled, whereas addressing encumbrances may include resolving easements, covenants, or restrictions through legal agreements or court action. Title companies and real estate attorneys play essential roles in ensuring all liens and encumbrances are resolved to secure a marketable and insurable property title.

Protecting Yourself from Unrecorded Liens and Encumbrances

Unrecorded liens and encumbrances pose significant risks in real estate transactions, as they can lead to unexpected financial obligations and clouded property titles. Conducting thorough title searches and obtaining title insurance are essential steps to uncover hidden claims and ensure clear ownership. Engaging a qualified real estate attorney or title professional helps in detecting and resolving these issues before finalizing the purchase.

Liens vs. Encumbrances: What Every Buyer Should Know

Liens are legal claims against a property that secure a debt, often resulting from unpaid loans or taxes, and must typically be cleared before the property can be sold. Encumbrances include liens but also cover other restrictions like easements and deed restrictions that affect property use or transferability. Understanding liens versus encumbrances ensures buyers can identify potential legal or financial obligations impacting property ownership and avoid costly surprises during the transaction.

lien vs encumbrance Infographic

difterm.com

difterm.com