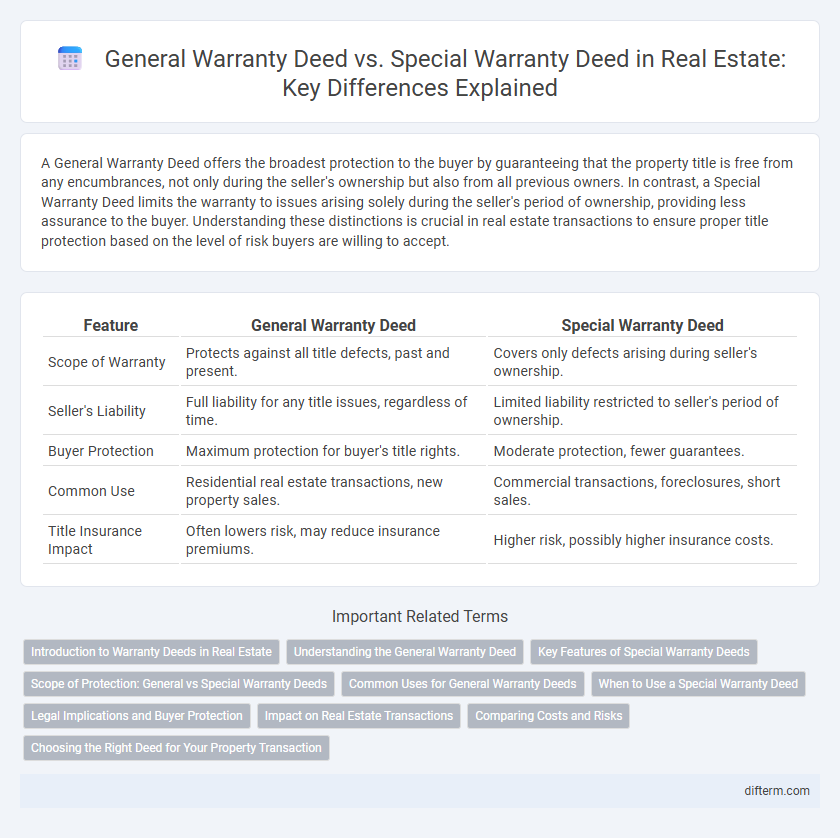

A General Warranty Deed offers the broadest protection to the buyer by guaranteeing that the property title is free from any encumbrances, not only during the seller's ownership but also from all previous owners. In contrast, a Special Warranty Deed limits the warranty to issues arising solely during the seller's period of ownership, providing less assurance to the buyer. Understanding these distinctions is crucial in real estate transactions to ensure proper title protection based on the level of risk buyers are willing to accept.

Table of Comparison

| Feature | General Warranty Deed | Special Warranty Deed |

|---|---|---|

| Scope of Warranty | Protects against all title defects, past and present. | Covers only defects arising during seller's ownership. |

| Seller's Liability | Full liability for any title issues, regardless of time. | Limited liability restricted to seller's period of ownership. |

| Buyer Protection | Maximum protection for buyer's title rights. | Moderate protection, fewer guarantees. |

| Common Use | Residential real estate transactions, new property sales. | Commercial transactions, foreclosures, short sales. |

| Title Insurance Impact | Often lowers risk, may reduce insurance premiums. | Higher risk, possibly higher insurance costs. |

Introduction to Warranty Deeds in Real Estate

Warranty deeds in real estate serve as crucial legal instruments that guarantee clear property ownership and protect buyers against title defects. A General Warranty Deed offers broad protection by assuring the buyer the grantor holds clear title throughout the property's history, covering all potential claims. In contrast, a Special Warranty Deed limits this assurance to only defects or claims that arose during the grantor's ownership, providing more limited protection.

Understanding the General Warranty Deed

A General Warranty Deed guarantees the buyer full ownership protection against any title defects, including those arising before and during the seller's ownership, ensuring the broadest level of legal recourse. It covenants that the property is free from encumbrances and the seller has the authority to transfer clear title. This deed offers the strongest assurances in real estate transactions compared to a Special Warranty Deed, which only covers issues during the seller's ownership period.

Key Features of Special Warranty Deeds

Special Warranty Deeds guarantee the seller has not caused any title defects or encumbrances during their period of ownership, but do not cover issues arising before that time. This deed limits the seller's liability to their period of ownership, offering less protection compared to a General Warranty Deed. It is commonly used in commercial real estate transactions where the seller wants to restrict responsibility for title defects to the time they held the property.

Scope of Protection: General vs Special Warranty Deeds

A General Warranty Deed provides comprehensive protection, guaranteeing the title is free from defects throughout the property's entire history, including previous owners. In contrast, a Special Warranty Deed limits the guarantee only to the period during which the seller owned the property, protecting against defects arising under the seller's ownership. Buyers seeking extensive title protection typically prefer General Warranty Deeds, while Special Warranty Deeds may be used in commercial transactions where sellers limit liability.

Common Uses for General Warranty Deeds

General warranty deeds are commonly used in residential real estate transactions to provide buyers with the highest level of protection, guaranteeing clear title from the property's origin to the current owner. These deeds are preferred in traditional home sales, refinancing, and purchases involving lenders due to their extensive coverage against title defects and liabilities. In contrast, special warranty deeds limit the warranty period, often utilized in commercial or foreclosure sales where sellers only guarantee title during their ownership.

When to Use a Special Warranty Deed

A Special Warranty Deed is used primarily in transactions where the grantor guarantees the title only against claims arising during their period of ownership, making it suitable for short-term owners or commercial property transfers. This deed limits the seller's liability, protecting them from claims that predate their ownership, which is common in corporate or bank sales. Buyers should consider Special Warranty Deeds in cases involving foreclosures, trustee sales, or parties with limited knowledge of the property's full title history.

Legal Implications and Buyer Protection

A General Warranty Deed offers the broadest legal protection to buyers by guaranteeing clear title against all claims, including those arising before the seller's ownership, thus providing comprehensive recourse for any title defects. In contrast, a Special Warranty Deed limits the seller's liability to only claims arising during their period of ownership, significantly reducing buyer protection against prior title disputes. Buyers seeking maximum legal security should favor General Warranty Deeds to ensure full indemnification and title defense.

Impact on Real Estate Transactions

A General Warranty Deed offers the highest level of protection in real estate transactions by guaranteeing the seller holds clear title and is responsible for any title defects, past or present. In contrast, a Special Warranty Deed limits this guarantee to only defects arising during the seller's ownership, potentially increasing risk for buyers. Understanding the differences affects buyer confidence, title insurance requirements, and overall transaction security in property deals.

Comparing Costs and Risks

A General Warranty Deed typically involves higher upfront costs due to comprehensive protections against title defects that occurred at any time, offering greater risk coverage for buyers. In contrast, a Special Warranty Deed usually has lower fees but limits the seller's liability to defects arising only during their ownership, increasing potential risks for purchasers. Evaluating these trade-offs in cost versus risk is crucial in real estate transactions to ensure adequate title security aligned with budget and risk tolerance.

Choosing the Right Deed for Your Property Transaction

Choosing the right deed for your property transaction hinges on the scope of seller guarantees and potential title issues. A General Warranty Deed offers the broadest protection by guaranteeing clear title against all claims, from the property's origins to transfer, making it ideal for buyers seeking maximum security. In contrast, a Special Warranty Deed limits the warranty to issues arising only during the seller's ownership, which may suit sellers who want to restrict liability while still providing some assurance to buyers.

General Warranty Deed vs Special Warranty Deed Infographic

difterm.com

difterm.com