Real Estate Investment Trusts (REITs) offer investors liquidity and diversification by allowing them to purchase shares in professionally managed property portfolios, typically traded on public exchanges. Real Estate Syndications involve pooling capital from multiple investors to directly acquire specific properties, providing more control and potential tax benefits but with less liquidity. Choosing between REITs and syndications depends on an investor's preference for liquidity, control, and risk tolerance in the real estate market.

Table of Comparison

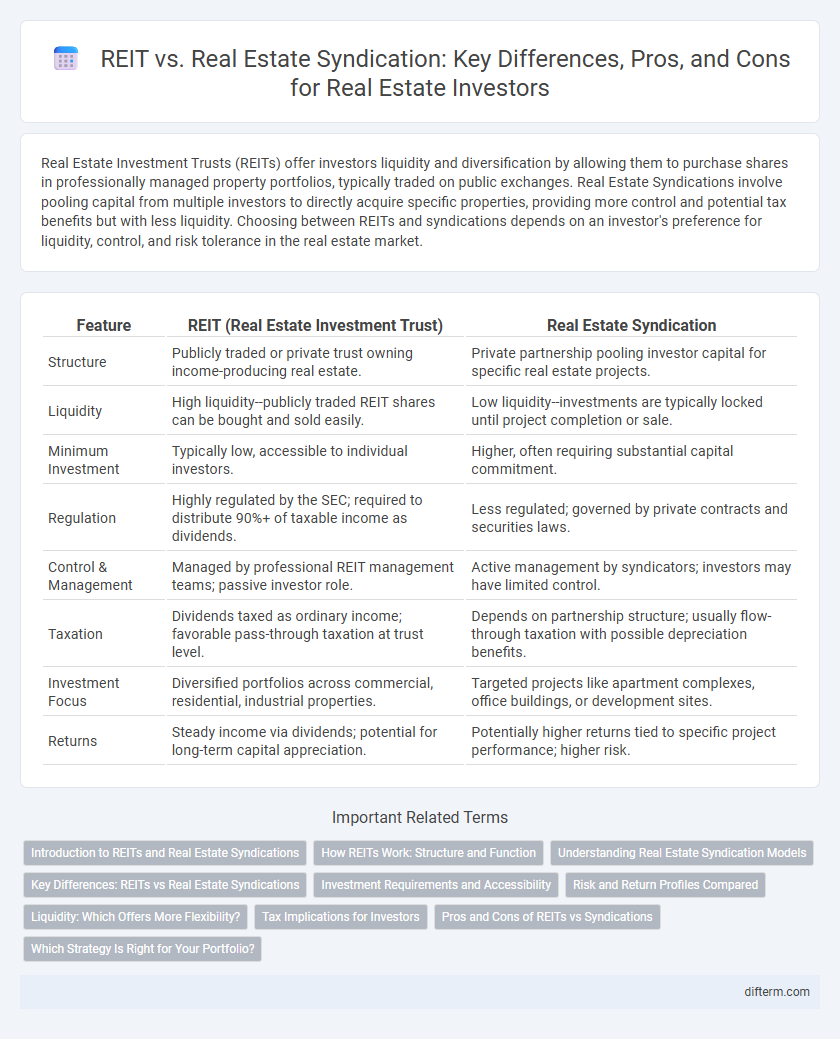

| Feature | REIT (Real Estate Investment Trust) | Real Estate Syndication |

|---|---|---|

| Structure | Publicly traded or private trust owning income-producing real estate. | Private partnership pooling investor capital for specific real estate projects. |

| Liquidity | High liquidity--publicly traded REIT shares can be bought and sold easily. | Low liquidity--investments are typically locked until project completion or sale. |

| Minimum Investment | Typically low, accessible to individual investors. | Higher, often requiring substantial capital commitment. |

| Regulation | Highly regulated by the SEC; required to distribute 90%+ of taxable income as dividends. | Less regulated; governed by private contracts and securities laws. |

| Control & Management | Managed by professional REIT management teams; passive investor role. | Active management by syndicators; investors may have limited control. |

| Taxation | Dividends taxed as ordinary income; favorable pass-through taxation at trust level. | Depends on partnership structure; usually flow-through taxation with possible depreciation benefits. |

| Investment Focus | Diversified portfolios across commercial, residential, industrial properties. | Targeted projects like apartment complexes, office buildings, or development sites. |

| Returns | Steady income via dividends; potential for long-term capital appreciation. | Potentially higher returns tied to specific project performance; higher risk. |

Introduction to REITs and Real Estate Syndications

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across various sectors, offering investors liquidity and dividend income through publicly traded shares. Real Estate Syndications are private investment partnerships where multiple investors pool capital to acquire, manage, and profit from large real estate projects, often requiring higher minimum investments and longer holding periods. Both investment vehicles provide access to real estate markets but differ in structure, regulatory oversight, and investor involvement.

How REITs Work: Structure and Function

REITs (Real Estate Investment Trusts) are companies that own, operate, or finance income-producing real estate across various sectors like residential, commercial, or industrial properties. They pool investor capital to acquire and manage property portfolios, distributing at least 90% of taxable income as dividends, providing liquidity and diversification. Structured as publicly traded or private entities, REITs offer investors streamlined access to real estate markets without direct property management responsibilities.

Understanding Real Estate Syndication Models

Real estate syndication models involve pooling capital from multiple investors to acquire and manage properties, offering access to larger deals with shared risk and returns. Unlike REITs, which are publicly traded and provide liquidity through stock exchanges, syndications are private investments with more direct control over property management and typically longer holding periods. Investors benefit from tax advantages and targeted asset selection, making syndications a strategic choice for those seeking personalized real estate exposure.

Key Differences: REITs vs Real Estate Syndications

REITs (Real Estate Investment Trusts) offer liquidity through publicly traded shares, making them accessible for individual investors seeking passive income from diversified real estate portfolios. Real estate syndications involve pooling capital from multiple investors to directly purchase and manage specific properties, typically requiring higher minimum investments and offering less liquidity but greater control. Key differences include REITs' regulated structure under SEC guidelines and daily tradability versus syndications' private placements with longer holding periods and potential for higher returns through active management.

Investment Requirements and Accessibility

Real Estate Investment Trusts (REITs) typically require lower minimum investments, often accessible to individual investors with amounts as low as $500, making them highly accessible through publicly traded shares. In contrast, real estate syndications usually demand higher minimum investments, ranging from $25,000 to $100,000, and are often limited to accredited investors, which restricts accessibility. The liquidity of REITs further enhances accessibility compared to the illiquid nature and longer investment horizons of syndications.

Risk and Return Profiles Compared

REITs offer investors liquidity and diversification with lower risk due to their regulatory oversight and publicly traded nature, typically providing moderate but steady returns. Real estate syndications involve higher risk as they are private investments with less liquidity, but they can deliver higher, potentially tax-advantaged returns through active property management and value-add strategies. Understanding the balance between REITs' stable dividend income and syndications' growth potential is critical for aligning investment goals with risk tolerance in real estate portfolios.

Liquidity: Which Offers More Flexibility?

Real Estate Investment Trusts (REITs) provide higher liquidity as they are publicly traded on stock exchanges, allowing investors to buy or sell shares quickly and with minimal transaction costs. Real estate syndications, however, involve private equity investments with longer lock-up periods and limited liquidity, often requiring years before exit options become available. Investors seeking flexibility and frequent trading opportunities typically favor REITs over syndications.

Tax Implications for Investors

Real Estate Investment Trusts (REITs) typically distribute dividends taxed as ordinary income, impacting investors' tax liabilities at higher rates compared to long-term capital gains. In contrast, real estate syndications allow investors to benefit from pass-through taxation, where income, deductions, and credits flow directly to individual tax returns, potentially lowering taxable income through depreciation and other deductions. Understanding these tax implications aids investors in optimizing after-tax returns when choosing between REITs and real estate syndications.

Pros and Cons of REITs vs Syndications

REITs offer liquidity, diversified real estate portfolios, and passive income with lower investment minimums, but they often come with less control and are subject to stock market volatility. Real estate syndications provide investors with greater control, potential for higher returns, and direct ownership in properties, yet they require higher capital, longer investment horizons, and involve more risk due to less liquidity. Choosing between REITs and syndications depends on the investor's risk tolerance, desired involvement, and investment timeframe.

Which Strategy Is Right for Your Portfolio?

REITs offer liquidity and passive income through publicly traded shares, making them ideal for investors seeking diversification without direct property management. Real estate syndications provide access to specific high-value commercial properties with potential for higher returns but require longer holding periods and active investor involvement. Analyzing your risk tolerance, investment horizon, and desire for control will help determine whether REITs or syndications align better with your portfolio goals.

REIT vs Real Estate Syndication Infographic

difterm.com

difterm.com