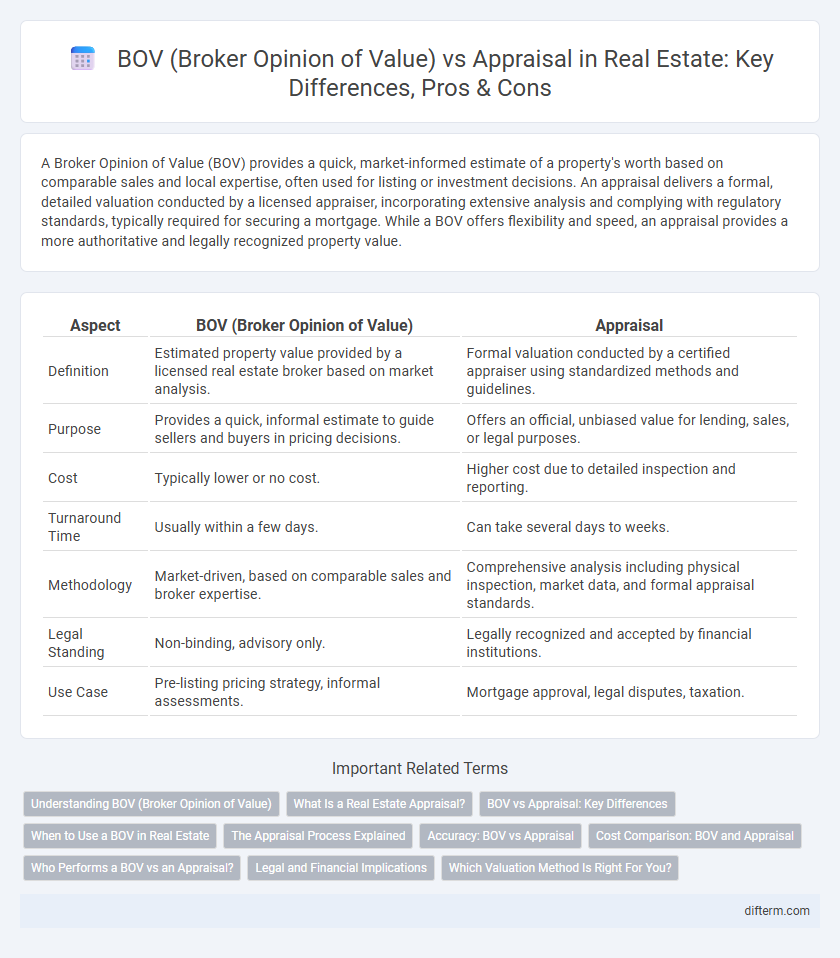

A Broker Opinion of Value (BOV) provides a quick, market-informed estimate of a property's worth based on comparable sales and local expertise, often used for listing or investment decisions. An appraisal delivers a formal, detailed valuation conducted by a licensed appraiser, incorporating extensive analysis and complying with regulatory standards, typically required for securing a mortgage. While a BOV offers flexibility and speed, an appraisal provides a more authoritative and legally recognized property value.

Table of Comparison

| Aspect | BOV (Broker Opinion of Value) | Appraisal |

|---|---|---|

| Definition | Estimated property value provided by a licensed real estate broker based on market analysis. | Formal valuation conducted by a certified appraiser using standardized methods and guidelines. |

| Purpose | Provides a quick, informal estimate to guide sellers and buyers in pricing decisions. | Offers an official, unbiased value for lending, sales, or legal purposes. |

| Cost | Typically lower or no cost. | Higher cost due to detailed inspection and reporting. |

| Turnaround Time | Usually within a few days. | Can take several days to weeks. |

| Methodology | Market-driven, based on comparable sales and broker expertise. | Comprehensive analysis including physical inspection, market data, and formal appraisal standards. |

| Legal Standing | Non-binding, advisory only. | Legally recognized and accepted by financial institutions. |

| Use Case | Pre-listing pricing strategy, informal assessments. | Mortgage approval, legal disputes, taxation. |

Understanding BOV (Broker Opinion of Value)

A Broker Opinion of Value (BOV) is an estimated property valuation provided by a real estate broker based on market knowledge, comparable sales, and current trends, offering a practical price range for sellers or buyers. Unlike formal appraisals, BOVs are less detailed and less costly, providing a quicker, market-focused insight rather than a certified valuation required by lenders. Understanding BOV helps clients make informed decisions by leveraging local market expertise and real-time data without the expense and time of a full appraisal.

What Is a Real Estate Appraisal?

A real estate appraisal is a professional, unbiased estimate of a property's market value conducted by a licensed appraiser using standardized methods and recent comparable sales data. Unlike a Broker Opinion of Value (BOV), which relies on a real estate agent's experience and market knowledge, an appraisal provides a legally recognized valuation often required for mortgage lending and legal purposes. Appraisals include detailed property inspections, market analysis, and adherence to state and national appraisal standards, ensuring accuracy and credibility in the final valuation report.

BOV vs Appraisal: Key Differences

BOV (Broker Opinion of Value) provides a market-based estimate of a property's worth leveraging recent comparable sales and local expertise, offering a quicker and often less costly alternative to appraisals. An appraisal delivers a comprehensive, lender-required valuation conducted by a licensed appraiser using standardized methodologies, including property inspection and detailed analysis of market trends. The primary difference lies in BOV's reliance on market insight without formal certification, while appraisals ensure regulatory compliance and are critical for mortgage financing.

When to Use a BOV in Real Estate

A Broker Opinion of Value (BOV) is most useful during preliminary stages of real estate transactions, such as property listing evaluations, market analysis, or when a quick estimate of a property's worth is needed without the expense of a formal appraisal. BOVs provide real estate professionals with a comparative market analysis based on recent sales, current listings, and local market trends, offering flexible and timely pricing guidance. In contrast, appraisals are required for mortgage lending, legal matters, or formal valuations where a certified, detailed report is necessary.

The Appraisal Process Explained

The appraisal process involves a licensed appraiser conducting an in-depth analysis of a property's condition, location, and comparable sales to determine its fair market value. Unlike a Broker Opinion of Value (BOV), which is an estimate based on the agent's expertise and market trends, an appraisal provides an objective, third-party valuation often required by lenders during mortgage approvals. Detailed inspections and verified data make appraisals the gold standard for accurate property valuation in real estate transactions.

Accuracy: BOV vs Appraisal

A Broker Opinion of Value (BOV) typically provides a market-based estimate derived from comparable sales, recent listings, and neighborhood trends, offering a practical valuation adjusted by local market expertise. An appraisal, conducted by a licensed appraiser, delivers a thoroughly researched and standardized assessment following strict guidelines designed to provide a legally defensible value. While appraisals are generally more accurate for financial and legal purposes due to their comprehensive methodologies, BOVs can offer timely, localized insights but may lack the precision and formality of a professional appraisal.

Cost Comparison: BOV and Appraisal

A Broker Opinion of Value (BOV) typically costs significantly less than a formal appraisal, ranging from a few hundred to around $500 depending on the market and property complexity. In contrast, professional appraisals often exceed $300 to $600, reflecting the detailed analysis and regulatory adherence required. Choosing between a BOV and an appraisal depends on budget constraints and the intended use of the valuation, with BOVs offering cost-effective, quick estimates while appraisals provide comprehensive, lender-approved assessments.

Who Performs a BOV vs an Appraisal?

A Broker Opinion of Value (BOV) is performed by a licensed real estate broker or agent who leverages market knowledge and recent sales data to estimate a property's value. In contrast, an appraisal is conducted by a certified appraiser trained to provide an unbiased, professional valuation based on detailed inspections and standardized appraisal methods. While brokers use BOVs to offer a quick, market-driven estimate, appraisers deliver legally recognized valuations often required for loans and official transactions.

Legal and Financial Implications

A Broker Opinion of Value (BOV) provides an estimated property value based on market analysis and broker expertise, but it lacks the legal authority and formal certification of a licensed appraiser's appraisal. In legal disputes, mortgage financing, or tax assessments, an appraisal by a certified appraiser holds greater weight and is often required by lenders and courts for its adherence to strict valuation standards and regulatory compliance. Relying solely on a BOV may expose sellers or buyers to financial risks, including inaccurate pricing and potential loan denials, due to its informal nature and absence of standardized methodology.

Which Valuation Method Is Right For You?

A Broker Opinion of Value (BOV) offers a fast, cost-effective estimate based on local market expertise, ideal for sellers needing a quick valuation or preparing marketing strategies. An appraisal provides an in-depth, formal valuation conducted by a licensed appraiser, essential for mortgage approval, refinancing, or legal purposes. Choosing the right method depends on your goals, time frame, and the level of valuation accuracy required for your real estate transaction.

BOV (broker opinion of value) vs appraisal Infographic

difterm.com

difterm.com