Flipping real estate involves purchasing properties, renovating them, and selling for a profit, appealing to investors seeking immediate returns with higher risk and capital investment. Wholesaling requires finding undervalued properties and assigning purchase contracts to other buyers, minimizing financial exposure and offering quicker cash flow opportunities. Understanding the differences between flipping and wholesaling helps investors choose strategies aligned with their resources and market conditions.

Table of Comparison

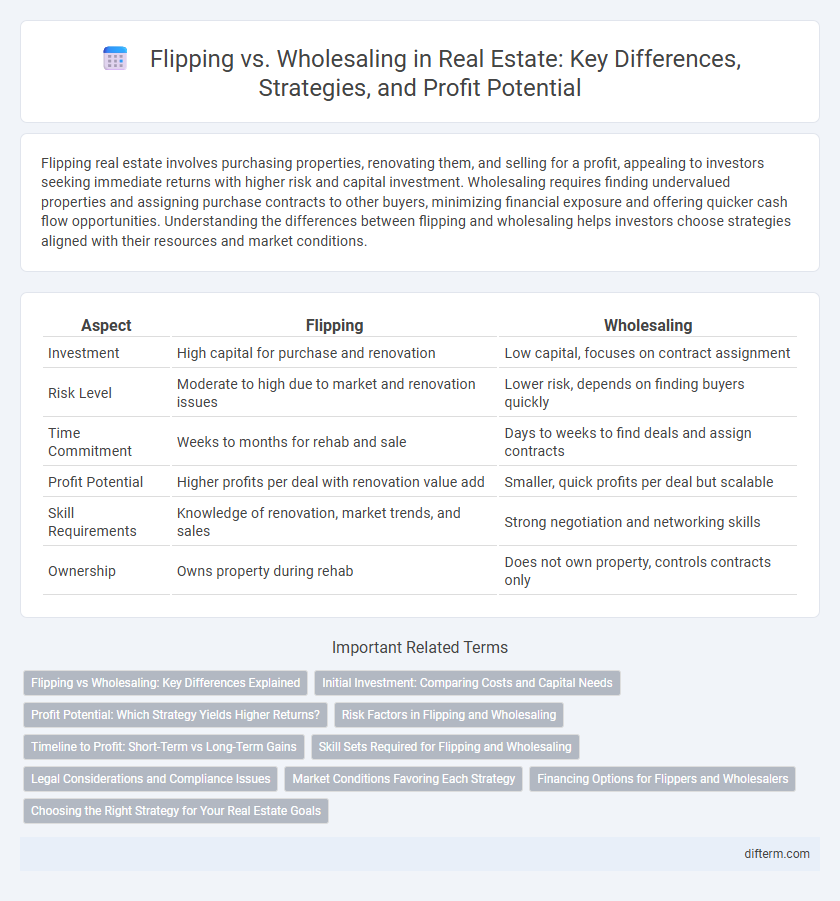

| Aspect | Flipping | Wholesaling |

|---|---|---|

| Investment | High capital for purchase and renovation | Low capital, focuses on contract assignment |

| Risk Level | Moderate to high due to market and renovation issues | Lower risk, depends on finding buyers quickly |

| Time Commitment | Weeks to months for rehab and sale | Days to weeks to find deals and assign contracts |

| Profit Potential | Higher profits per deal with renovation value add | Smaller, quick profits per deal but scalable |

| Skill Requirements | Knowledge of renovation, market trends, and sales | Strong negotiation and networking skills |

| Ownership | Owns property during rehab | Does not own property, controls contracts only |

Flipping vs Wholesaling: Key Differences Explained

Flipping involves purchasing properties, renovating them extensively, and selling at a higher price for profit, requiring significant capital and time investment. Wholesaling focuses on securing a contract for a property and selling that contract to another buyer, minimizing financial risk with quicker turnaround but lower profit margins. Understanding these distinctions is crucial for investors to align strategies with their financial capabilities and market goals.

Initial Investment: Comparing Costs and Capital Needs

Flipping real estate typically requires a higher initial investment, including purchase price, renovation costs, and holding expenses, often totaling tens of thousands or more depending on the market. Wholesaling demands significantly less capital upfront, as it primarily involves securing a property under contract and assigning that contract to another buyer, minimizing the need for funding renovations or long-term holding costs. Understanding the capital requirements is crucial for investors to align their financial capacity with their real estate investment strategy and risk tolerance.

Profit Potential: Which Strategy Yields Higher Returns?

Flipping properties typically yields higher returns due to value-add renovations that can significantly increase market price, often generating profits ranging from 10% to 30% per deal. Wholesaling offers quicker, lower-risk profits, usually between 3% and 7% per transaction, by assigning contracts to end buyers without holding the property. Real estate investors seeking substantial long-term profits often prefer flipping, while wholesalers prioritize rapid cash flow and lower capital requirements.

Risk Factors in Flipping and Wholesaling

Flipping properties involves significant market risk due to price fluctuations, rising renovation costs, and extended holding periods that can erode profit margins. Wholesaling carries lower financial risk since investors typically do not purchase properties outright, but it exposes them to legal risks and challenges in finding reliable end buyers quickly. Both strategies require due diligence, but flipping demands higher capital investment and greater exposure to market volatility compared to the faster, lower-capital approach of wholesaling.

Timeline to Profit: Short-Term vs Long-Term Gains

Flipping real estate typically involves renovating properties and selling them within a few months to achieve medium-term profits, often requiring significant upfront capital and market knowledge. Wholesaling offers a faster profit timeline, with deals often closing in weeks by assigning contracts without property ownership, making it ideal for investors seeking quick returns with lower financial risk. Both strategies demand understanding market conditions, but wholesaling delivers immediate cash flow, while flipping relies on property appreciation and improvement over a longer period.

Skill Sets Required for Flipping and Wholesaling

Flipping real estate demands skills in property renovation, market analysis, and financial management to maximize profit through strategic improvements and sales timing. Wholesaling requires proficiency in contract negotiation, lead generation, and networking to swiftly connect sellers with buyers while minimizing capital investment. Mastery of both strategies involves understanding local market dynamics and legal regulations to ensure compliant and profitable transactions.

Legal Considerations and Compliance Issues

Flipping and wholesaling properties involve distinct legal considerations, including contract enforceability and disclosure obligations that vary by state. Flippers must navigate stringent regulations on property condition disclosures and renovation permits, while wholesalers face legal scrutiny regarding licensing requirements and assignment contracts. Ensuring compliance with local real estate laws and federal regulations is essential to avoid litigation and maintain ethical business practices in both strategies.

Market Conditions Favoring Each Strategy

Flipping thrives in a seller's market where rising property values enable quick renovations and profitable resale within short timeframes. Wholesaling excels during buyer's markets or slower economies, allowing investors to assign contracts without holding properties long-term. Understanding local inventory levels, interest rates, and demand trends is essential to choosing the optimal real estate investment strategy.

Financing Options for Flippers and Wholesalers

Flippers typically rely on hard money loans, private lenders, or renovation loans like the FHA 203(k) to secure short-term financing, enabling quick property acquisition and rehab. Wholesalers usually require minimal capital and often finance deals through transactional funding or assign contracts without needing traditional loans. Understanding the distinct financing needs is crucial for investors to optimize cash flow and investment turnaround.

Choosing the Right Strategy for Your Real Estate Goals

Flipping offers higher profit potential through property renovations but requires significant capital and market knowledge, making it ideal for experienced investors seeking long-term gains. Wholesaling demands less upfront investment by securing contracts and assigning them to buyers, appealing to beginners aiming for quick, low-risk returns. Aligning your choice with financial resources, risk tolerance, and investment timeline ensures the best strategy to achieve targeted real estate goals.

flipping vs wholesaling Infographic

difterm.com

difterm.com