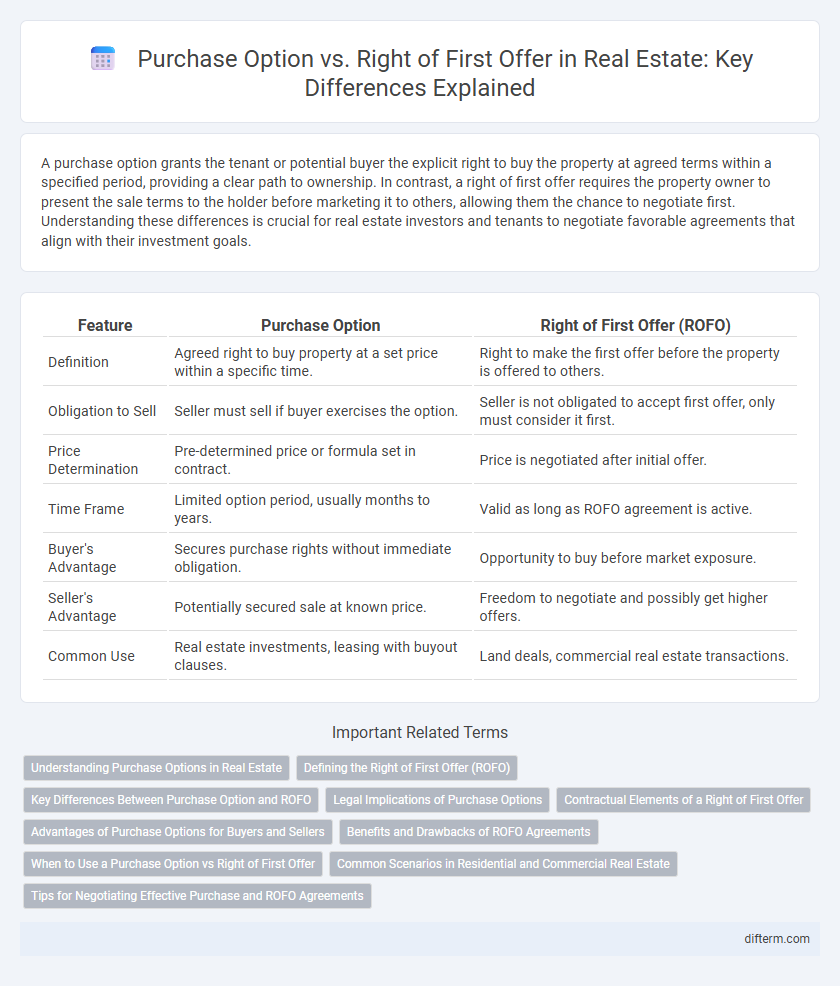

A purchase option grants the tenant or potential buyer the explicit right to buy the property at agreed terms within a specified period, providing a clear path to ownership. In contrast, a right of first offer requires the property owner to present the sale terms to the holder before marketing it to others, allowing them the chance to negotiate first. Understanding these differences is crucial for real estate investors and tenants to negotiate favorable agreements that align with their investment goals.

Table of Comparison

| Feature | Purchase Option | Right of First Offer (ROFO) |

|---|---|---|

| Definition | Agreed right to buy property at a set price within a specific time. | Right to make the first offer before the property is offered to others. |

| Obligation to Sell | Seller must sell if buyer exercises the option. | Seller is not obligated to accept first offer, only must consider it first. |

| Price Determination | Pre-determined price or formula set in contract. | Price is negotiated after initial offer. |

| Time Frame | Limited option period, usually months to years. | Valid as long as ROFO agreement is active. |

| Buyer's Advantage | Secures purchase rights without immediate obligation. | Opportunity to buy before market exposure. |

| Seller's Advantage | Potentially secured sale at known price. | Freedom to negotiate and possibly get higher offers. |

| Common Use | Real estate investments, leasing with buyout clauses. | Land deals, commercial real estate transactions. |

Understanding Purchase Options in Real Estate

Purchase options in real estate grant the holder the exclusive right to buy a property at predetermined terms within a specific timeframe, providing certainty and control over future acquisition. Unlike the Right of First Offer, which requires the owner to offer the property to the option holder before marketing it to others, a purchase option allows immediate exercise without negotiation. This instrument is particularly valuable for investors and developers seeking to secure property rights while mitigating risk and preserving flexibility in transaction timing.

Defining the Right of First Offer (ROFO)

The Right of First Offer (ROFO) grants a potential buyer the opportunity to negotiate the purchase of a property before the seller offers it to third parties, ensuring priority access without obligating the seller to accept the initial offer. This contractual agreement specifies the terms under which the seller must present the property to the ROFO holder, often including price and timeframe conditions. ROFO differs from other rights like the Right of First Refusal by requiring the holder to make an initial offer, which the seller can either accept or reject before marketing the property more broadly.

Key Differences Between Purchase Option and ROFO

A Purchase Option grants the holder an exclusive right to buy a property at a predetermined price within a specified period, providing certainty and control over the transaction. In contrast, a Right of First Offer (ROFO) requires the property owner to offer the property to the holder before marketing it to third parties, giving the holder the opportunity to negotiate first but without guaranteed purchase terms. Key differences include exclusivity, timing, and price determination, with Purchase Options offering fixed terms upfront and ROFOs dependent on owner initiation and negotiation outcomes.

Legal Implications of Purchase Options

A purchase option grants the holder a legally enforceable right to buy a property at a predetermined price within a specified period, creating binding obligations on both seller and buyer once exercised. It often requires clear contractual terms to avoid disputes over timing, price adjustments, and conditions precedent, directly impacting enforceability and potential litigation risks. Unlike a right of first offer, which merely grants negotiation priority without binding the seller to sell, purchase options carry more significant legal weight and implications for property owners and investors.

Contractual Elements of a Right of First Offer

The contractual elements of a Right of First Offer (ROFO) in real estate include a defined offer period during which the holder must decide to accept or decline the property offer before it is marketed to others. The ROFO agreement typically specifies the notice requirements, response timeframe, and the price or pricing mechanism for the initial offer. Unlike a purchase option, the ROFO does not guarantee the right to purchase but grants the holder priority to negotiate terms before the seller entertains third-party offers.

Advantages of Purchase Options for Buyers and Sellers

Purchase options offer buyers a secured opportunity to acquire property at predetermined terms, reducing uncertainty and enabling strategic financial planning. Sellers benefit from purchase options by generating upfront option fees and maintaining control over the sale timeline while attracting committed buyers. This arrangement minimizes market exposure risk and can lead to higher sale prices through competitive buyer interest.

Benefits and Drawbacks of ROFO Agreements

Right of First Offer (ROFO) agreements provide property buyers with the advantage of negotiating purchase terms before the seller markets the property to others, offering a strategic edge in competitive real estate markets. However, ROFO can create uncertainty for sellers by potentially delaying full market exposure and reducing competitive bidding opportunities. While buyers benefit from early negotiation rights, the lack of a fixed price in ROFO agreements may lead to prolonged negotiations or disagreements on valuation.

When to Use a Purchase Option vs Right of First Offer

Purchase options are ideal when buyers want a guaranteed future purchase price and timing, providing certainty in volatile real estate markets. Right of first offer suits sellers seeking market-driven pricing while offering buyers a chance to negotiate before listing publicly. Investors use purchase options for strategic property control, whereas right of first offer benefits parties aiming for flexibility and market responsiveness.

Common Scenarios in Residential and Commercial Real Estate

Purchase options in residential real estate are frequently used by buyers who want the exclusive right to buy a property within a specified period, often seen in new developments and lease-to-own agreements. Right of First Offer agreements commonly appear in commercial real estate, providing tenants or investors the chance to negotiate a sale before the property is offered to outside buyers, frequently in retail or office leases. Both mechanisms help manage transaction timing and risk, with purchase options granting more certainty on purchase terms, while rights of first offer allow sellers to gauge interest and secure better deals.

Tips for Negotiating Effective Purchase and ROFO Agreements

When negotiating Purchase Option and Right of First Offer (ROFO) agreements in real estate, clearly define terms such as exercise period, pricing mechanisms, and notification procedures to prevent future disputes. Prioritize securing flexibility in the agreement, including conditions for extension or transfer, while ensuring competitive pricing that reflects current market values. Engage legal counsel to tailor provisions that protect investment interests and align with strategic acquisition goals.

Purchase Option vs Right of First Offer Infographic

difterm.com

difterm.com