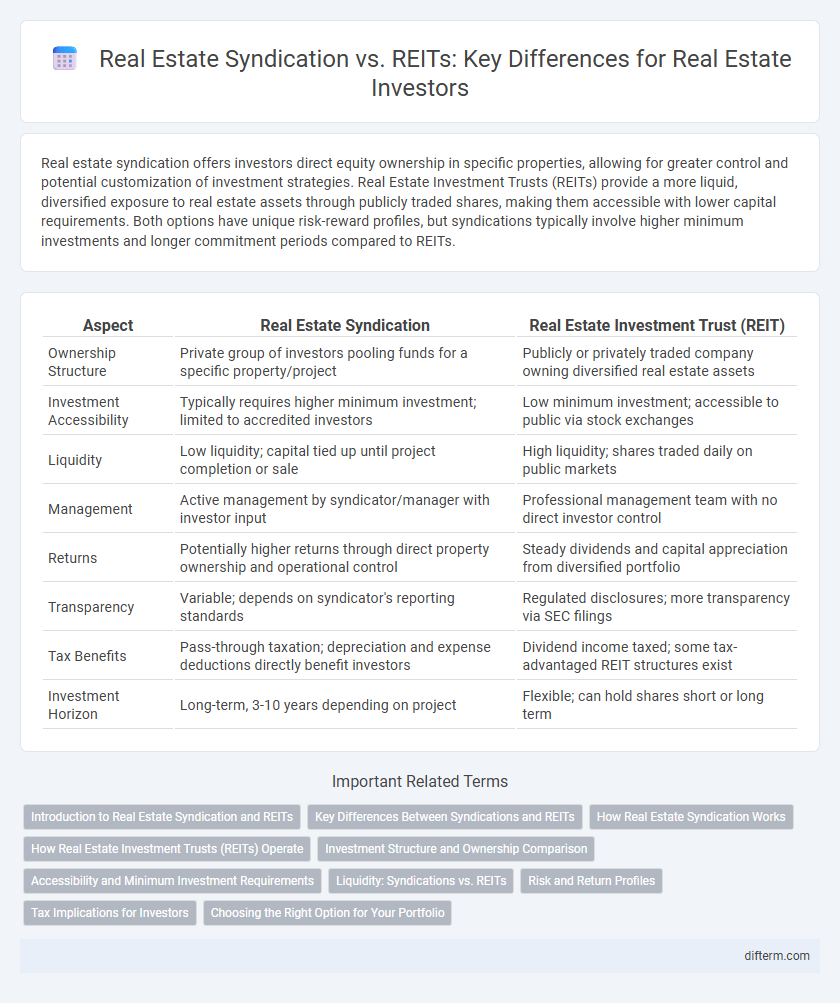

Real estate syndication offers investors direct equity ownership in specific properties, allowing for greater control and potential customization of investment strategies. Real Estate Investment Trusts (REITs) provide a more liquid, diversified exposure to real estate assets through publicly traded shares, making them accessible with lower capital requirements. Both options have unique risk-reward profiles, but syndications typically involve higher minimum investments and longer commitment periods compared to REITs.

Table of Comparison

| Aspect | Real Estate Syndication | Real Estate Investment Trust (REIT) |

|---|---|---|

| Ownership Structure | Private group of investors pooling funds for a specific property/project | Publicly or privately traded company owning diversified real estate assets |

| Investment Accessibility | Typically requires higher minimum investment; limited to accredited investors | Low minimum investment; accessible to public via stock exchanges |

| Liquidity | Low liquidity; capital tied up until project completion or sale | High liquidity; shares traded daily on public markets |

| Management | Active management by syndicator/manager with investor input | Professional management team with no direct investor control |

| Returns | Potentially higher returns through direct property ownership and operational control | Steady dividends and capital appreciation from diversified portfolio |

| Transparency | Variable; depends on syndicator's reporting standards | Regulated disclosures; more transparency via SEC filings |

| Tax Benefits | Pass-through taxation; depreciation and expense deductions directly benefit investors | Dividend income taxed; some tax-advantaged REIT structures exist |

| Investment Horizon | Long-term, 3-10 years depending on project | Flexible; can hold shares short or long term |

Introduction to Real Estate Syndication and REITs

Real estate syndication pools capital from multiple investors to acquire properties, offering direct ownership and potential for higher returns through active management. Real Estate Investment Trusts (REITs) are companies that own or finance income-producing real estate, allowing investors to buy shares and gain exposure to diversified property portfolios with liquidity similar to stocks. Both structures provide access to real estate markets but differ in management style, investor involvement, and regulatory requirements.

Key Differences Between Syndications and REITs

Real estate syndications involve pooling capital from a limited group of investors to acquire specific properties, offering direct ownership and potential tax benefits, while REITs are publicly or privately traded companies owning diversified portfolios of properties, providing liquidity and passive income through dividends. Syndications typically require active investor involvement and higher minimum investments, whereas REITs allow smaller investments with ease of entry and exit in secondary markets. The risk profiles differ as syndications often focus on single assets with targeted strategies, contrasting REITs' broader market exposure and regulatory requirements under SEC guidelines.

How Real Estate Syndication Works

Real estate syndication pools capital from multiple investors to collectively purchase and manage income-producing properties, typically structured with a general partner managing the project and limited partners providing funds. The general partner oversees property acquisition, financing, and operations, while limited partners receive passive income through distributions proportional to their investment. This model enables investors to access larger, diversified real estate assets without direct management responsibilities.

How Real Estate Investment Trusts (REITs) Operate

Real Estate Investment Trusts (REITs) operate by pooling capital from numerous investors to acquire, manage, and develop income-generating properties, distributing at least 90% of taxable income as dividends. These entities trade on major stock exchanges, offering liquidity and lower entry costs compared to direct real estate ownership. REITs focus on diversified portfolios, professional management, and regulatory compliance to maximize shareholder returns in commercial and residential real estate sectors.

Investment Structure and Ownership Comparison

Real estate syndication involves a group of investors pooling capital to directly own specific properties, providing more control and potential tax benefits through pass-through income. Real Estate Investment Trusts (REITs) offer a publicly traded, liquid investment structure where shareholders own shares of a diversified real estate portfolio without direct ownership of individual properties. Syndications require active management and higher minimum investments, whereas REITs provide passive income with lower entry barriers and regulatory oversight by the SEC.

Accessibility and Minimum Investment Requirements

Real Estate Syndication typically requires a higher minimum investment, often ranging from $25,000 to $100,000, making it less accessible to small investors but offering greater control and potential returns. In contrast, Real Estate Investment Trusts (REITs) allow investors to buy shares with very low minimums, sometimes as little as the price of a single stock share, providing easy accessibility and liquidity. REITs are publicly traded or private funds that pool capital to invest in diversified property portfolios, appealing to investors seeking passive income without direct property management.

Liquidity: Syndications vs. REITs

Real estate syndications typically offer lower liquidity as investors commit capital for a fixed holding period, often several years, before realizing returns. REITs provide higher liquidity by trading shares on public exchanges, allowing investors to buy or sell shares quickly and access cash within days. The liquidity advantage of REITs makes them more suitable for investors seeking flexibility and faster exit options compared to the long-term nature of syndication investments.

Risk and Return Profiles

Real estate syndication typically offers higher potential returns but comes with increased risk due to illiquidity and the reliance on specific property performance, often involving fewer investors and less regulatory oversight. In contrast, Real Estate Investment Trusts (REITs) provide more diversified portfolios and greater liquidity, as they are publicly traded and subject to strict regulatory requirements, resulting in generally lower but more stable returns. Investors seeking higher control and targeted investments may prefer syndications, while those prioritizing liquidity and steady income streams often choose REITs for risk mitigation.

Tax Implications for Investors

Real estate syndication allows investors to benefit from pass-through taxation, enabling income and losses to flow directly to individual tax returns, often resulting in significant tax deductions such as depreciation. In contrast, Real Estate Investment Trusts (REITs) typically distribute dividends taxed as ordinary income, which may result in higher tax liabilities for investors without direct asset depreciation benefits. Understanding these tax implications is crucial for investors seeking optimal after-tax returns in real estate investment strategies.

Choosing the Right Option for Your Portfolio

Real estate syndication offers direct ownership and potential for higher returns through active participation in property management, making it ideal for investors seeking control and customized investment strategies. Real Estate Investment Trusts (REITs) provide liquidity, diversification, and passive income via publicly traded shares, suitable for investors prioritizing accessibility and lower risk. Assessing your risk tolerance, investment horizon, and desired involvement is crucial when selecting between syndication and REITs to optimize portfolio growth and income stability.

Real Estate Syndication vs Real Estate Investment Trust (REIT) Infographic

difterm.com

difterm.com