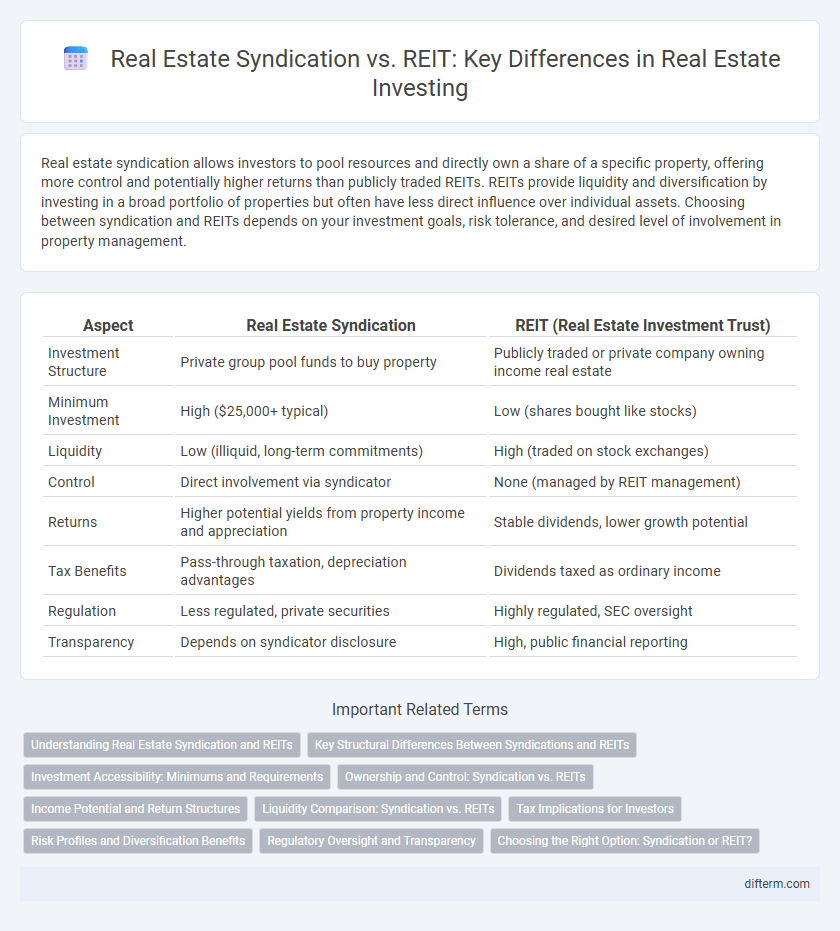

Real estate syndication allows investors to pool resources and directly own a share of a specific property, offering more control and potentially higher returns than publicly traded REITs. REITs provide liquidity and diversification by investing in a broad portfolio of properties but often have less direct influence over individual assets. Choosing between syndication and REITs depends on your investment goals, risk tolerance, and desired level of involvement in property management.

Table of Comparison

| Aspect | Real Estate Syndication | REIT (Real Estate Investment Trust) |

|---|---|---|

| Investment Structure | Private group pool funds to buy property | Publicly traded or private company owning income real estate |

| Minimum Investment | High ($25,000+ typical) | Low (shares bought like stocks) |

| Liquidity | Low (illiquid, long-term commitments) | High (traded on stock exchanges) |

| Control | Direct involvement via syndicator | None (managed by REIT management) |

| Returns | Higher potential yields from property income and appreciation | Stable dividends, lower growth potential |

| Tax Benefits | Pass-through taxation, depreciation advantages | Dividends taxed as ordinary income |

| Regulation | Less regulated, private securities | Highly regulated, SEC oversight |

| Transparency | Depends on syndicator disclosure | High, public financial reporting |

Understanding Real Estate Syndication and REITs

Real estate syndication involves pooling funds from multiple investors to acquire and manage properties, offering direct ownership and often higher control over investment decisions. REITs (Real Estate Investment Trusts) allow investors to buy shares in a diversified portfolio of income-producing real estate, providing liquidity and passive income without the need to directly manage assets. Understanding the differences in risk, return potential, management involvement, and liquidity is essential for making informed investment choices in real estate.

Key Structural Differences Between Syndications and REITs

Real estate syndications involve a small group of investors pooling capital directly to acquire specific properties, often requiring active management and offering limited liquidity. REITs (Real Estate Investment Trusts) are publicly or privately traded companies that own, manage, and operate diversified real estate portfolios, providing investors with high liquidity and regulatory oversight under the SEC. Syndications allow for targeted property selection and potential tax benefits through pass-through income, whereas REITs offer ease of access and diversification without direct property management responsibilities.

Investment Accessibility: Minimums and Requirements

Real estate syndication often requires higher minimum investments, typically starting around $25,000 to $50,000, restricting access to accredited or high-net-worth investors. In contrast, Real Estate Investment Trusts (REITs) offer more accessible entry points, with minimum purchases as low as the price of a single share, enabling broader investor participation. This accessibility difference significantly influences portfolio diversification and liquidity for individual investors.

Ownership and Control: Syndication vs. REITs

Real estate syndication offers investors direct ownership stakes and active control over property decisions, typically managed by a syndicator who coordinates acquisition and operations. In contrast, Real Estate Investment Trusts (REITs) provide shareholders with fractional ownership through publicly traded shares but limit investor control to voting on corporate matters without involvement in day-to-day management. Syndications appeal to investors seeking hands-on involvement, whereas REITs suit those preferring passive investment with liquidity in diversified real estate portfolios.

Income Potential and Return Structures

Real estate syndication offers investors higher income potential through direct ownership stakes and profit distributions based on property cash flow and appreciation. REITs provide more stable but generally lower returns, with dividends derived from a diversified portfolio of income-producing properties. Syndications typically have variable return structures linked to project performance, while REIT investors receive regular, predictable dividends often taxed at ordinary income rates.

Liquidity Comparison: Syndication vs. REITs

Real estate syndications typically offer limited liquidity, as investors must often hold their shares until the property is sold or the syndication is liquidated, which can take several years. In contrast, Real Estate Investment Trusts (REITs) trade on public stock exchanges, allowing investors to buy and sell shares daily, providing significantly higher liquidity. This makes REITs a more flexible investment option for those seeking quicker access to capital compared to the long-term commitment required in syndications.

Tax Implications for Investors

Real estate syndication allows investors to directly participate in property ownership, providing potential tax benefits such as depreciation deductions and pass-through income that can offset other income streams. In contrast, REITs typically distribute dividends taxed as ordinary income, which may result in higher tax liabilities for individual investors. Understanding the differing tax treatments of syndications versus REITs is crucial for optimizing after-tax returns in real estate investments.

Risk Profiles and Diversification Benefits

Real estate syndication offers investors direct ownership in specific properties, resulting in higher risk exposure but potential for greater control and returns, whereas REITs provide diversified portfolios across multiple properties, significantly reducing individual asset risk. Syndications often concentrate risk in fewer assets, making them susceptible to market fluctuations of specific properties, while REITs spread risk across various commercial, residential, and industrial real estate sectors. Investors seeking diversification benefits typically favor REITs for their liquidity and exposure to broad market segments compared to the more concentrated and illiquid nature of syndications.

Regulatory Oversight and Transparency

Real estate syndications typically operate under private offering exemptions with limited SEC oversight, requiring investors to perform due diligence due to less standardized reporting. In contrast, Real Estate Investment Trusts (REITs) are registered with the SEC and mandated to provide regular, detailed financial disclosures, ensuring higher transparency and regulatory compliance. This increased oversight in REITs offers investors greater protection and access to verified performance data compared to syndications.

Choosing the Right Option: Syndication or REIT?

Real estate syndication offers investors direct ownership and the potential for higher returns through active management, while REITs provide liquidity and diversification with ease of trading on public markets. Syndications often require higher minimum investments and longer commitment periods, contrasting with REITs' accessibility and stable dividend payments. Evaluating factors like risk tolerance, investment horizon, and desired involvement helps determine whether syndication or a REIT aligns best with an investor's financial goals.

real estate syndication vs REIT Infographic

difterm.com

difterm.com