Fee simple ownership grants the property owner complete control and indefinite ownership of the land and any structures on it, allowing for unrestricted sale, transfer, or inheritance. Leasehold interest provides the right to use and occupy the property for a specified period, after which ownership reverts to the freeholder. Understanding the differences between fee simple and leasehold is essential for real estate investors and homeowners to assess long-term value and rights.

Table of Comparison

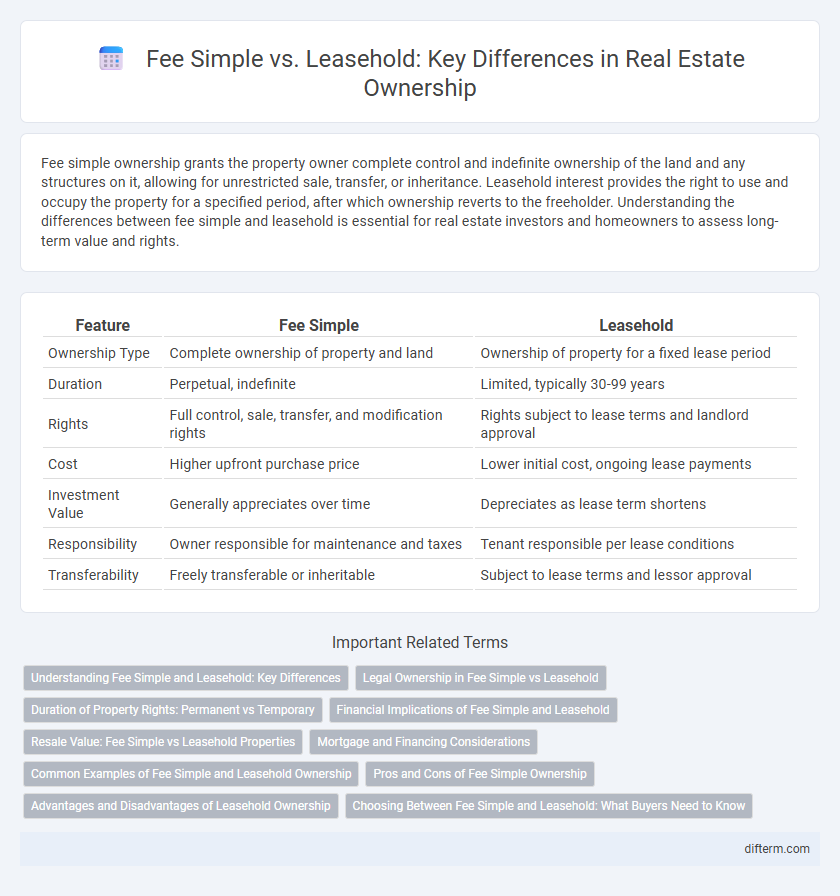

| Feature | Fee Simple | Leasehold |

|---|---|---|

| Ownership Type | Complete ownership of property and land | Ownership of property for a fixed lease period |

| Duration | Perpetual, indefinite | Limited, typically 30-99 years |

| Rights | Full control, sale, transfer, and modification rights | Rights subject to lease terms and landlord approval |

| Cost | Higher upfront purchase price | Lower initial cost, ongoing lease payments |

| Investment Value | Generally appreciates over time | Depreciates as lease term shortens |

| Responsibility | Owner responsible for maintenance and taxes | Tenant responsible per lease conditions |

| Transferability | Freely transferable or inheritable | Subject to lease terms and lessor approval |

Understanding Fee Simple and Leasehold: Key Differences

Fee simple ownership grants absolute ownership of a property and the land it stands on, allowing the owner full control, transfer rights, and indefinite possession. Leasehold arrangements provide possession and use of a property for a specified term under a lease agreement, with ownership reverting to the landlord after the lease expires. Understanding these differences is crucial for investors and homebuyers to assess long-term control, financial commitments, and property value implications in real estate transactions.

Legal Ownership in Fee Simple vs Leasehold

Fee simple ownership grants the property owner the highest legal interest, providing absolute and indefinite rights to use, sell, or transfer the property without restriction. Leasehold ownership offers a limited legal interest, where the tenant holds rights to use the property for a specified lease term, but the landlord retains ultimate ownership. Understanding the distinction in legal ownership rights is crucial for real estate transactions, as fee simple confers complete control, while leasehold imposes time-bound usage limitations.

Duration of Property Rights: Permanent vs Temporary

Fee simple property rights grant ownership that is indefinite and permanent, allowing the owner full control over the land and any improvements. Leasehold estates provide temporary property rights, typically lasting from a few years to several decades, after which ownership reverts to the landlord. Understanding the contrast between permanent fee simple ownership and time-limited leasehold agreements is crucial in real estate investment and property management decisions.

Financial Implications of Fee Simple and Leasehold

Fee simple ownership grants buyers full property rights with indefinite duration, leading to higher market value and long-term financial stability. Leasehold properties require periodic rent payments and may include ground rent or lease renewal fees, often resulting in lower initial costs but potential financial uncertainty over time. Investors should weigh upfront affordability against ongoing expenses and asset appreciation potential when choosing between fee simple and leasehold interests.

Resale Value: Fee Simple vs Leasehold Properties

Fee simple properties generally offer higher resale value due to full ownership rights and fewer restrictions compared to leasehold properties, which have a limited ownership term affecting long-term market appeal. Resale value of leasehold properties often depreciates as the lease term shortens, creating uncertainty for potential buyers. Investors prioritize fee simple estates for stability, appreciating asset potential, and greater market demand.

Mortgage and Financing Considerations

Fee simple ownership offers buyers full control and clear title, making mortgage approval easier due to lower lender risk and straightforward collateral. Leasehold properties often face stricter financing terms, higher interest rates, and shorter loan durations because lenders consider the limited lease term as a risk factor. Evaluating lease length, ground rent obligations, and lender acceptance is crucial when securing a mortgage for leasehold real estate.

Common Examples of Fee Simple and Leasehold Ownership

Common examples of fee simple ownership include single-family homes, condominiums, and commercial properties where the owner holds complete control over the land and structures indefinitely. Leasehold ownership is frequently seen in cooperative housing, certain urban residential properties, and land leased from government or private entities for a fixed term, typically ranging from 30 to 99 years. These distinctions impact property rights, transferability, and long-term value in real estate transactions.

Pros and Cons of Fee Simple Ownership

Fee simple ownership grants complete and indefinite property rights, providing maximum control, freedom to modify, and potential for unlimited appreciation value. Owners face higher upfront costs and ongoing responsibilities, including property taxes, maintenance, and zoning compliance. Unlike leasehold, fee simple offers greater security without expiration, reducing risks associated with lease renewal or landlord restrictions.

Advantages and Disadvantages of Leasehold Ownership

Leasehold ownership offers lower upfront costs compared to fee simple, making it more accessible for buyers looking to enter competitive real estate markets. However, leaseholders face limitations such as property use restrictions, potential ground rent increases, and the risk of lease expiration affecting long-term investment value. The lack of full ownership rights can reduce resale value and complicate financing options, requiring careful consideration of lease terms before purchase.

Choosing Between Fee Simple and Leasehold: What Buyers Need to Know

Buyers choosing between fee simple and leasehold properties should consider ownership duration and associated rights; fee simple grants full, indefinite ownership with greater control and asset value, while leasehold offers temporary rights for a specified term often with lower upfront costs. Evaluating factors like property location, lease length, ground rent, and potential restrictions is critical for long-term investment security and resale value. Understanding these distinctions helps buyers align property choice with financial goals and lifestyle preferences.

Fee Simple vs Leasehold Infographic

difterm.com

difterm.com