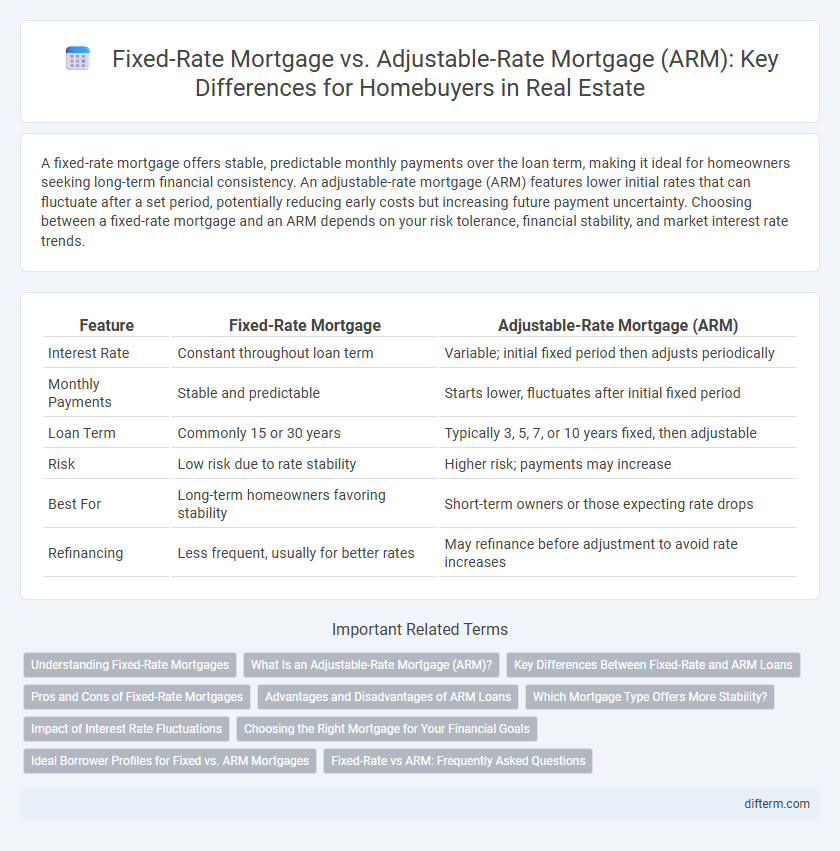

A fixed-rate mortgage offers stable, predictable monthly payments over the loan term, making it ideal for homeowners seeking long-term financial consistency. An adjustable-rate mortgage (ARM) features lower initial rates that can fluctuate after a set period, potentially reducing early costs but increasing future payment uncertainty. Choosing between a fixed-rate mortgage and an ARM depends on your risk tolerance, financial stability, and market interest rate trends.

Table of Comparison

| Feature | Fixed-Rate Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Constant throughout loan term | Variable; initial fixed period then adjusts periodically |

| Monthly Payments | Stable and predictable | Starts lower, fluctuates after initial fixed period |

| Loan Term | Commonly 15 or 30 years | Typically 3, 5, 7, or 10 years fixed, then adjustable |

| Risk | Low risk due to rate stability | Higher risk; payments may increase |

| Best For | Long-term homeowners favoring stability | Short-term owners or those expecting rate drops |

| Refinancing | Less frequent, usually for better rates | May refinance before adjustment to avoid rate increases |

Understanding Fixed-Rate Mortgages

Fixed-rate mortgages offer a consistent interest rate and monthly payment throughout the loan term, providing financial stability and ease of budgeting for homeowners. These loans typically range from 15 to 30 years, making them ideal for borrowers seeking long-term predictability in their mortgage costs. Understanding the benefits of fixed-rate mortgages includes recognizing their protection against interest rate fluctuations, which can lead to significant savings compared to adjustable-rate mortgages (ARMs) over time.

What Is an Adjustable-Rate Mortgage (ARM)?

An Adjustable-Rate Mortgage (ARM) features an interest rate that changes periodically based on a specific financial index, typically after an initial fixed-rate period. ARMs offer lower initial interest rates compared to fixed-rate mortgages, making them attractive for borrowers planning to sell or refinance before adjustments begin. Common ARM types include 5/1, 7/1, and 10/1, where the first number represents fixed years and the second indicates annual rate adjustments thereafter.

Key Differences Between Fixed-Rate and ARM Loans

Fixed-rate mortgages maintain a consistent interest rate and monthly payment throughout the loan term, providing stability and predictable budgeting for homeowners. Adjustable-rate mortgages (ARMs) start with a lower initial interest rate that adjusts periodically based on market indices, potentially causing payment fluctuations over time. Key differences include long-term cost predictability, risk tolerance, and how market interest rate changes impact monthly payments.

Pros and Cons of Fixed-Rate Mortgages

Fixed-rate mortgages offer the stability of consistent monthly payments and protection against interest rate increases, making budgeting easier for homeowners. These loans typically have higher initial interest rates compared to adjustable-rate mortgages (ARMs), which may result in higher costs over the loan term if market rates fall. Fixed-rate mortgages are ideal for buyers planning to stay long-term in their homes, while those seeking lower initial payments might consider ARMs despite their payment variability.

Advantages and Disadvantages of ARM Loans

Adjustable-rate mortgage (ARM) loans offer lower initial interest rates compared to fixed-rate mortgages, enabling homebuyers to benefit from reduced monthly payments during the initial fixed period, which typically ranges from 3 to 10 years. However, ARM loans carry the risk of interest rate fluctuations after the initial period, potentially leading to significantly higher monthly payments and increased financial uncertainty. Borrowers with ARM loans must consider the advantages of initial affordability against the disadvantages of rate adjustments linked to market conditions and index rates like the LIBOR or SOFR.

Which Mortgage Type Offers More Stability?

Fixed-rate mortgages provide more stability by locking in a consistent interest rate and monthly payment over the life of the loan, protecting homeowners from market fluctuations. In contrast, adjustable-rate mortgages (ARMs) have initial lower rates that can reset periodically, leading to unpredictable payment changes tied to benchmark indices like the LIBOR or SOFR. For borrowers seeking long-term financial predictability, fixed-rate mortgages are the preferred choice due to their fixed interest structure.

Impact of Interest Rate Fluctuations

Fixed-rate mortgages provide predictable monthly payments by locking in a constant interest rate, protecting homeowners from rising rates and helping with long-term budget planning. Adjustable-rate mortgages (ARMs) initially offer lower rates but expose borrowers to interest rate fluctuations, which can increase monthly payments and overall loan costs over time. Understanding these impacts on monthly affordability and total interest paid is crucial when choosing between fixed-rate and adjustable-rate mortgage options.

Choosing the Right Mortgage for Your Financial Goals

Fixed-rate mortgages offer stable monthly payments with interest rates locked for the loan term, making them ideal for long-term planning and budgeting certainty. Adjustable-rate mortgages (ARMs) provide lower initial rates that adjust periodically based on market indexes, benefiting homeowners who plan to sell or refinance before rate changes occur. Selecting the right mortgage depends on your financial goals, risk tolerance, and how long you intend to stay in the property, balancing predictable costs against potential savings from variable rates.

Ideal Borrower Profiles for Fixed vs. ARM Mortgages

Fixed-rate mortgages suit borrowers seeking predictable monthly payments and long-term financial stability, ideal for those planning to stay in a home for many years. Adjustable-rate mortgages (ARM) benefit borrowers expecting short-term residence or anticipating income growth, as initial lower rates often adjust after a fixed period. Understanding individual financial goals and risk tolerance helps determine the optimal mortgage type for home financing.

Fixed-Rate vs ARM: Frequently Asked Questions

Fixed-rate mortgages offer consistent monthly payments with interest rates locked for the entire loan term, making budgeting easier and providing stability amid market fluctuations. Adjustable-rate mortgages (ARMs) typically start with lower initial rates that adjust periodically based on market indices, which can result in unpredictable payment changes over time. Homebuyers should consider factors like loan duration, interest rate trends, and risk tolerance when choosing between fixed-rate and adjustable-rate mortgage options.

Fixed-rate mortgage vs Adjustable-rate mortgage (ARM) Infographic

difterm.com

difterm.com