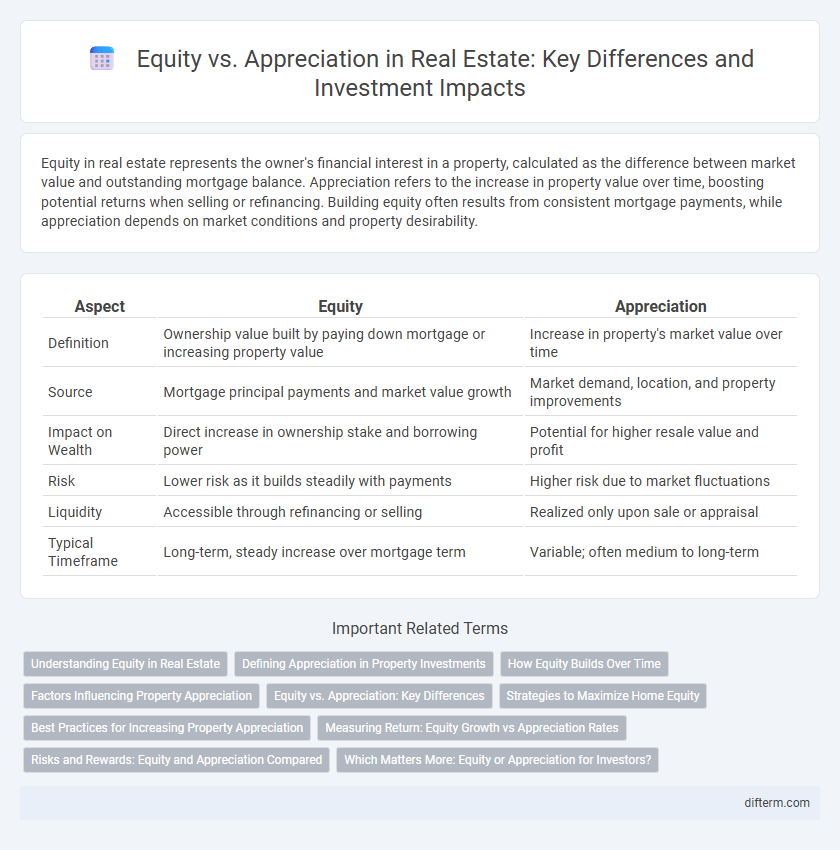

Equity in real estate represents the owner's financial interest in a property, calculated as the difference between market value and outstanding mortgage balance. Appreciation refers to the increase in property value over time, boosting potential returns when selling or refinancing. Building equity often results from consistent mortgage payments, while appreciation depends on market conditions and property desirability.

Table of Comparison

| Aspect | Equity | Appreciation |

|---|---|---|

| Definition | Ownership value built by paying down mortgage or increasing property value | Increase in property's market value over time |

| Source | Mortgage principal payments and market value growth | Market demand, location, and property improvements |

| Impact on Wealth | Direct increase in ownership stake and borrowing power | Potential for higher resale value and profit |

| Risk | Lower risk as it builds steadily with payments | Higher risk due to market fluctuations |

| Liquidity | Accessible through refinancing or selling | Realized only upon sale or appraisal |

| Typical Timeframe | Long-term, steady increase over mortgage term | Variable; often medium to long-term |

Understanding Equity in Real Estate

Equity in real estate represents the difference between the current market value of a property and the outstanding balance on any mortgages or liens. Building equity occurs through mortgage payments and property value appreciation, providing homeowners with a valuable financial asset. Understanding equity is crucial for leveraging homeownership benefits such as securing loans or investing in additional properties.

Defining Appreciation in Property Investments

Appreciation in property investments refers to the increase in the market value of real estate over time due to factors such as location improvements, market demand, and inflation. Unlike equity, which represents the owner's stake built through mortgage payments and property value, appreciation directly impacts the property's resale price and potential profit. Investors leverage appreciation to maximize returns by holding properties in high-growth areas with strong economic fundamentals.

How Equity Builds Over Time

Equity in real estate builds over time as homeowners pay down their mortgage principal, increasing their ownership stake in the property. Property appreciation further amplifies equity by raising the market value, creating additional wealth without extra investment. This combination of principal repayment and rising home values makes equity a powerful wealth-building tool in real estate.

Factors Influencing Property Appreciation

Property appreciation is primarily influenced by location quality, market demand, and economic growth within the region. Infrastructure developments, such as new transportation links and commercial projects, significantly boost property values over time. Government policies, interest rates, and neighborhood safety also play crucial roles in determining the rate of property appreciation.

Equity vs. Appreciation: Key Differences

Equity represents the portion of a property's value that the owner actually owns, calculated as the current market value minus any outstanding mortgage balance. Appreciation refers to the increase in a property's market value over time due to factors like location, market demand, and improvements. While equity grows both through mortgage repayments and appreciation, appreciation strictly measures the property's rising value independent of outstanding debts.

Strategies to Maximize Home Equity

Building home equity strategically involves prioritizing regular mortgage payments and choosing properties in appreciating neighborhoods with strong market demand. Renovations that enhance key home features such as kitchens and bathrooms can significantly boost property value while minimizing short-term costs. Monitoring local market trends enables homeowners to refinance at optimal times, reducing interest expenses and increasing overall equity growth.

Best Practices for Increasing Property Appreciation

Maximizing property appreciation involves strategic improvements such as renovating kitchens and bathrooms, enhancing curb appeal, and modernizing fixtures to attract higher market value. Investing in energy-efficient upgrades and smart home technology can also boost long-term equity by reducing operating costs and appealing to eco-conscious buyers. Regular market analysis and understanding local development trends ensure timely decisions that capitalize on neighborhood growth and infrastructure improvements.

Measuring Return: Equity Growth vs Appreciation Rates

Equity growth measures the increase in an owner's actual stake in a property, factoring in mortgage principal payments alongside market price changes. Appreciation rates represent the percentage increase in the property's market value over time, reflecting demand, location, and economic factors. Comparing these metrics helps investors understand overall return by balancing property value gains against reductions in loan principal.

Risks and Rewards: Equity and Appreciation Compared

Equity represents the homeowner's current ownership stake in a property, offering tangible collateral and potential borrowing power, but it can diminish if property values fall or mortgage balances rise. Appreciation reflects the increase in property value over time, providing significant wealth-building potential, yet it's subject to market volatility and economic fluctuations that can lead to depreciation. Balancing equity and appreciation involves managing risks such as market downturns and leveraging rewards like long-term asset growth and financial security.

Which Matters More: Equity or Appreciation for Investors?

Equity represents the actual ownership stake a real estate investor holds in a property, while appreciation refers to the increase in the property's market value over time. For investors, building equity through consistent mortgage payments and property improvements often provides more tangible financial security than relying solely on market-driven appreciation, which can be unpredictable. Focusing on equity allows investors to leverage their asset for additional investments, making it a crucial factor in long-term wealth accumulation.

equity vs appreciation Infographic

difterm.com

difterm.com