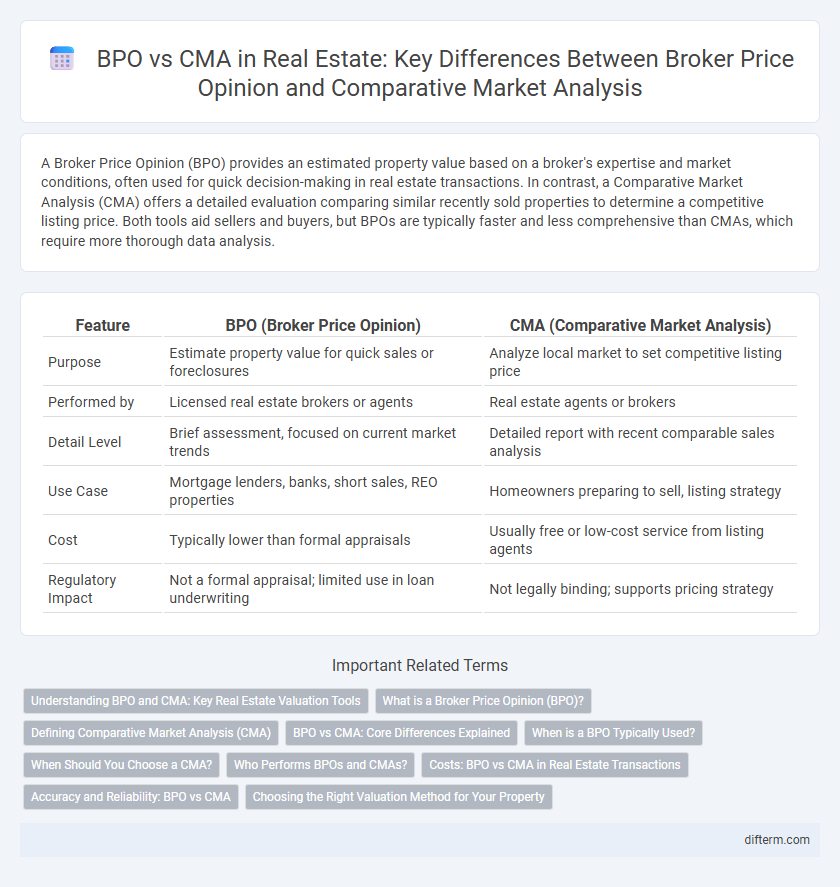

A Broker Price Opinion (BPO) provides an estimated property value based on a broker's expertise and market conditions, often used for quick decision-making in real estate transactions. In contrast, a Comparative Market Analysis (CMA) offers a detailed evaluation comparing similar recently sold properties to determine a competitive listing price. Both tools aid sellers and buyers, but BPOs are typically faster and less comprehensive than CMAs, which require more thorough data analysis.

Table of Comparison

| Feature | BPO (Broker Price Opinion) | CMA (Comparative Market Analysis) |

|---|---|---|

| Purpose | Estimate property value for quick sales or foreclosures | Analyze local market to set competitive listing price |

| Performed by | Licensed real estate brokers or agents | Real estate agents or brokers |

| Detail Level | Brief assessment, focused on current market trends | Detailed report with recent comparable sales analysis |

| Use Case | Mortgage lenders, banks, short sales, REO properties | Homeowners preparing to sell, listing strategy |

| Cost | Typically lower than formal appraisals | Usually free or low-cost service from listing agents |

| Regulatory Impact | Not a formal appraisal; limited use in loan underwriting | Not legally binding; supports pricing strategy |

Understanding BPO and CMA: Key Real Estate Valuation Tools

BPO (Broker Price Opinion) offers a quick, cost-effective property valuation often used by lenders and asset managers, relying on an agent's market expertise and comparable sales data. CMA (Comparative Market Analysis) provides a more comprehensive and detailed approach by analyzing similar properties' recent sales, active listings, and market trends to assist sellers and buyers in making informed decisions. Both tools play a crucial role in real estate valuation, with BPOs catering to efficiency and CMAs focusing on accuracy and depth of market insight.

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion (BPO) is a real estate professional's estimate of a property's value based on current market trends, comparable sales, and property condition, primarily used by lenders, banks, and asset managers for quick valuation purposes. Unlike a Comparative Market Analysis (CMA), which is typically prepared by agents for marketing or listing strategies, a BPO offers a more concise, cost-effective alternative to appraisals in scenarios like foreclosure, refinancing, or short sales. BPOs provide actionable insights for decision-making in real estate transactions where a full appraisal is not necessary or feasible.

Defining Comparative Market Analysis (CMA)

A Comparative Market Analysis (CMA) provides a detailed evaluation of a property's value by analyzing recent sales data, active listings, and expired listings within a specific market area. Real estate agents use CMAs to help sellers set competitive asking prices and assist buyers in making informed offers. Unlike a Broker Price Opinion (BPO), which is often requested by lenders for quick valuation, a CMA offers a comprehensive market-based assessment tailored for client decision-making.

BPO vs CMA: Core Differences Explained

BPO (Broker Price Opinion) and CMA (Comparative Market Analysis) differ primarily in scope and purpose; BPOs are often used by lenders and banks to estimate property value for loan decisions, while CMAs are tailored by real estate agents to help sellers price homes competitively. BPOs typically involve less detailed property inspections and are faster to produce, whereas CMAs require comprehensive analysis of recent sales, market trends, and property conditions. Understanding these core differences enables sellers and lenders to select the appropriate valuation tool based on accuracy needs and transaction context.

When is a BPO Typically Used?

A Broker Price Opinion (BPO) is typically used when a quick and cost-effective property valuation is needed, often for distressed sales, refinancing, or portfolio assessments by lenders and asset managers. Unlike a Comparative Market Analysis (CMA), which is detailed and designed to help sellers set listing prices, a BPO offers a professional estimate without the expense of a full appraisal. BPOs are commonly utilized in foreclosure scenarios, short sales, and by financial institutions requiring timely market value insights.

When Should You Choose a CMA?

A Comparative Market Analysis (CMA) is ideal when sellers need a detailed and accurate market value estimate based on recent comparable sales and active listings in their neighborhood. Real estate agents use CMAs to provide personalized pricing strategies reflecting current market trends, property condition, and unique features. Opt for a CMA when preparing to list a home, negotiating offers, or setting a competitive price for sale.

Who Performs BPOs and CMAs?

Real estate agents or brokers typically perform Comparative Market Analyses (CMAs) to help sellers set competitive listing prices by analyzing recent sales of similar properties. Broker Price Opinions (BPOs) are often conducted by licensed real estate professionals, including brokers and agents, but are frequently ordered by lenders, banks, or financial institutions during loan approval or foreclosure processes. Both BPOs and CMAs rely on market data and property evaluations, but BPOs tend to be more detailed and serve financial or risk assessment purposes.

Costs: BPO vs CMA in Real Estate Transactions

BPOs (Broker Price Opinions) usually cost less than CMAs (Comparative Market Analyses) because they require less detailed market research and are often completed faster. While BPOs typically range from $50 to $150, CMAs can cost between $200 and $500 due to their comprehensive analysis and data-driven approach. Choosing between BPO and CMA depends on budget constraints and the depth of pricing accuracy needed in real estate transactions.

Accuracy and Reliability: BPO vs CMA

BPO (Broker Price Opinion) provides a fast, cost-effective estimate of property value primarily used by lenders, but its accuracy can vary based on the broker's expertise and limited property inspection. CMA (Comparative Market Analysis) offers a more detailed and reliable valuation by analyzing multiple comparable properties, recent sales data, and local market trends, often prepared by licensed real estate agents for seller pricing strategies. CMA typically yields higher accuracy and reliability than BPO, making it the preferred tool for informed decision-making in real estate transactions.

Choosing the Right Valuation Method for Your Property

Selecting the appropriate valuation method between BPO (Broker Price Opinion) and CMA (Comparative Market Analysis) depends on the property's purpose and required accuracy. BPOs, conducted by licensed brokers, provide a quick, cost-effective estimate often used by lenders or banks for distressed properties. CMAs, prepared by real estate agents, offer a detailed analysis of comparable sales, market trends, and neighborhood data, making them ideal for sellers aiming for precise pricing strategies.

BPO (Broker Price Opinion) vs CMA (Comparative Market Analysis) Infographic

difterm.com

difterm.com