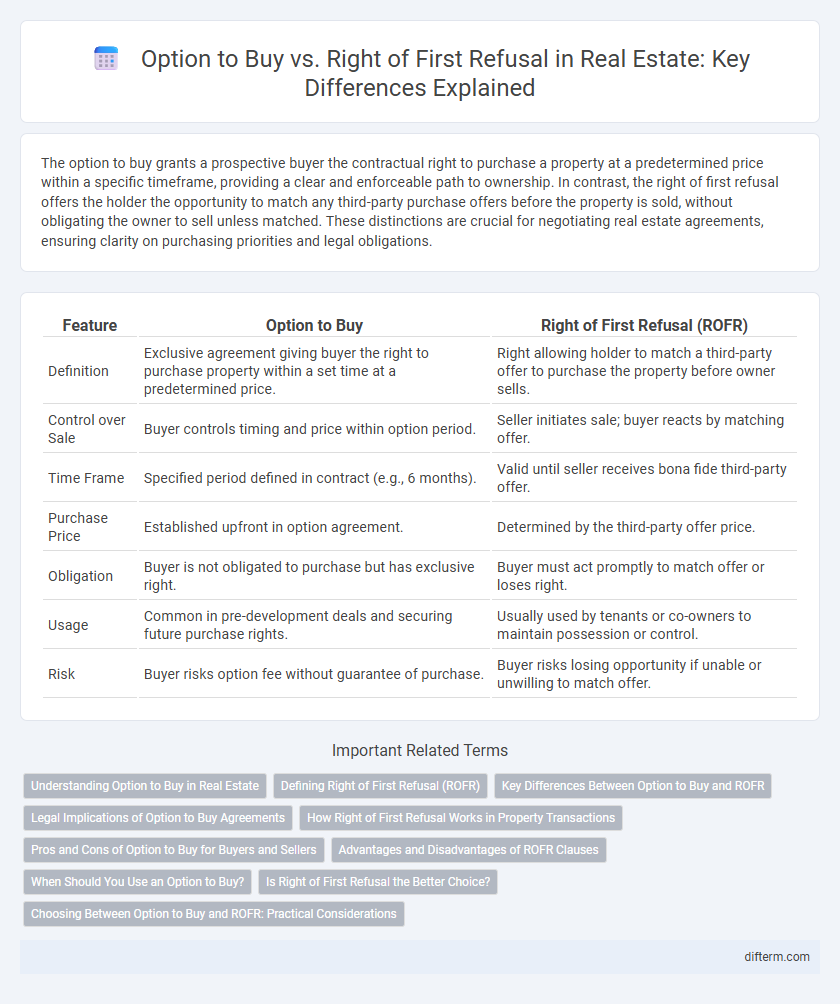

The option to buy grants a prospective buyer the contractual right to purchase a property at a predetermined price within a specific timeframe, providing a clear and enforceable path to ownership. In contrast, the right of first refusal offers the holder the opportunity to match any third-party purchase offers before the property is sold, without obligating the owner to sell unless matched. These distinctions are crucial for negotiating real estate agreements, ensuring clarity on purchasing priorities and legal obligations.

Table of Comparison

| Feature | Option to Buy | Right of First Refusal (ROFR) |

|---|---|---|

| Definition | Exclusive agreement giving buyer the right to purchase property within a set time at a predetermined price. | Right allowing holder to match a third-party offer to purchase the property before owner sells. |

| Control over Sale | Buyer controls timing and price within option period. | Seller initiates sale; buyer reacts by matching offer. |

| Time Frame | Specified period defined in contract (e.g., 6 months). | Valid until seller receives bona fide third-party offer. |

| Purchase Price | Established upfront in option agreement. | Determined by the third-party offer price. |

| Obligation | Buyer is not obligated to purchase but has exclusive right. | Buyer must act promptly to match offer or loses right. |

| Usage | Common in pre-development deals and securing future purchase rights. | Usually used by tenants or co-owners to maintain possession or control. |

| Risk | Buyer risks option fee without guarantee of purchase. | Buyer risks losing opportunity if unable or unwilling to match offer. |

Understanding Option to Buy in Real Estate

An Option to Buy in real estate is a contractual agreement giving a potential buyer the exclusive right to purchase a property at a predetermined price within a specified time frame. This option secures the buyer's opportunity to buy without obligation, providing control over the property while assessing its value or market conditions. Sellers benefit from receiving option fees, which can be credited to the purchase price, ensuring commitment while retaining ownership until the option is exercised.

Defining Right of First Refusal (ROFR)

The Right of First Refusal (ROFR) in real estate grants a preemptive opportunity to a specified party to purchase a property before the owner can sell it to third parties. This contractual right obliges the property owner to present the exact terms of any third-party offer to the ROFR holder, who then has the option to match those terms and acquire the property. Unlike an Option to Buy, ROFR does not guarantee a fixed purchase price or terms in advance, making it highly contingent on external offers.

Key Differences Between Option to Buy and ROFR

The Option to Buy grants the holder a contractual right to purchase a property at a predetermined price within a specific period, ensuring exclusivity and price certainty. In contrast, the Right of First Refusal (ROFR) allows the holder to match any third-party offer before the property owner can sell, without guaranteeing a fixed price or timeframe. Key differences include the Option's price control and exclusivity versus ROFR's reactive matching right and uncertainty in transaction timing.

Legal Implications of Option to Buy Agreements

Option to buy agreements legally bind the property owner to sell at a predetermined price within a specified time, creating an enforceable contract that limits the owner's ability to sell to others during the option period. These agreements often require clear terms on duration, consideration, and purchase price to avoid disputes and ensure enforceability in court. Failure to comply with option terms can lead to breach of contract claims, highlighting the importance of precise drafting to protect both parties' interests.

How Right of First Refusal Works in Property Transactions

The Right of First Refusal (ROFR) in property transactions grants a party the opportunity to match any third-party offer before the seller can finalize a sale, effectively acting as a preemptive purchase option. This mechanism ensures the holder can acquire the property on identical terms to those proposed by external buyers, maintaining control over ownership transfer. Unlike an Option to Buy, which involves a direct agreement between purchaser and seller with fixed terms, ROFR only activates upon receipt of a bona fide offer from another party.

Pros and Cons of Option to Buy for Buyers and Sellers

The Option to Buy grants buyers a secured opportunity to purchase property at a preset price within a defined period, providing price certainty and exclusive negotiation rights. Sellers benefit from non-refundable option fees and committed potential sales but face the risk of limiting market exposure and potentially accepting lower offers due to the locked-in terms. Buyers may lose the option fee if they decide not to purchase, while sellers must honor the option agreement, reducing flexibility to sell to other interested parties during the option term.

Advantages and Disadvantages of ROFR Clauses

Right of First Refusal (ROFR) clauses in real estate grant holders priority to match third-party offers before the seller accepts a sale, offering strategic control over property transactions. Advantages include protecting buyers from losing desired properties and potentially securing favorable purchase terms without competitive bidding. However, disadvantages arise as ROFR can deter other buyers, delay transactions, and decrease property marketability due to added contractual complexity.

When Should You Use an Option to Buy?

An Option to Buy is ideal when a buyer wants to secure the exclusive right to purchase a property within a specific period at a predetermined price, providing certainty in competitive markets. This instrument is particularly useful when the buyer needs time to arrange financing or conduct inspections without risking losing the property. Unlike the Right of First Refusal, the Option to Buy guarantees the buyer the ability to execute the purchase without facing competing offers during the option term.

Is Right of First Refusal the Better Choice?

Right of First Refusal (ROFR) grants a potential buyer the opportunity to match any third-party offer before a property sale, providing flexibility without immediate commitment, unlike the Option to Buy which requires upfront consideration and sets a fixed price and timeframe. ROFR often benefits sellers by maintaining competitive bidding environments, while buyers gain the chance to secure property on market terms rather than predetermined conditions. For investors prioritizing market-driven pricing and decision-making flexibility, ROFR generally represents the better strategic choice in real estate transactions.

Choosing Between Option to Buy and ROFR: Practical Considerations

Choosing between an Option to Buy and a Right of First Refusal (ROFR) depends on the level of control and timing desired in real estate transactions. An Option to Buy provides a buyer with a secured period to purchase property at predetermined terms, ideal for investors seeking certainty and exclusive negotiation rights. In contrast, a ROFR offers the holder the opportunity to match a third-party offer before the seller can finalize the sale, best suited for parties prioritizing flexibility and market-based pricing.

Option to Buy vs Right of First Refusal Infographic

difterm.com

difterm.com