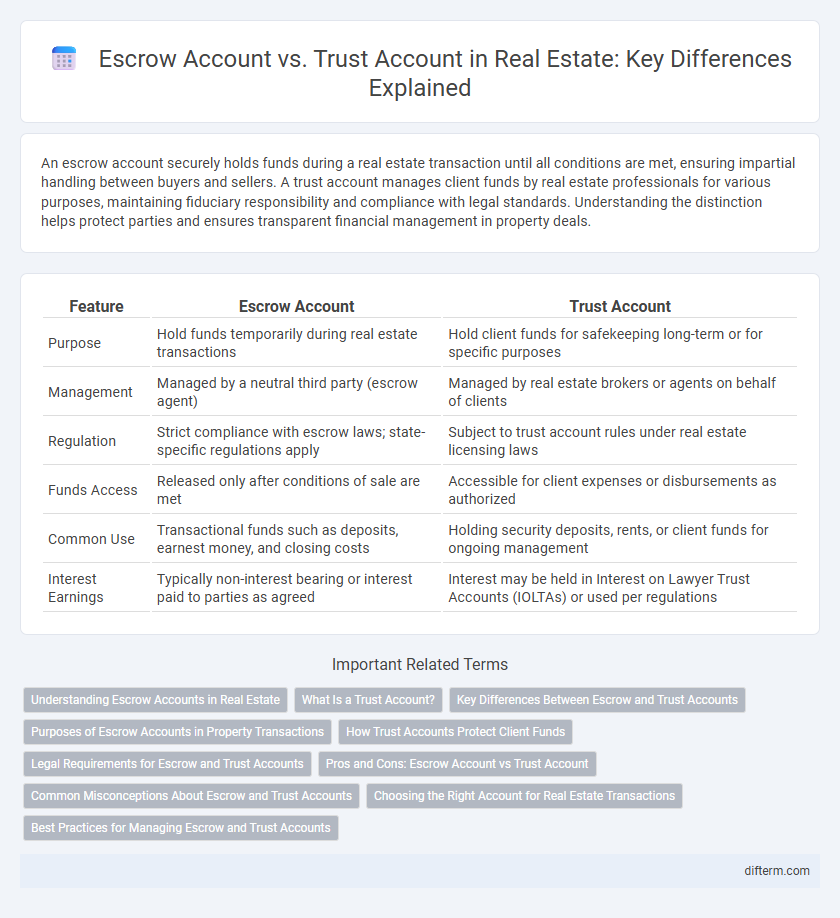

An escrow account securely holds funds during a real estate transaction until all conditions are met, ensuring impartial handling between buyers and sellers. A trust account manages client funds by real estate professionals for various purposes, maintaining fiduciary responsibility and compliance with legal standards. Understanding the distinction helps protect parties and ensures transparent financial management in property deals.

Table of Comparison

| Feature | Escrow Account | Trust Account |

|---|---|---|

| Purpose | Hold funds temporarily during real estate transactions | Hold client funds for safekeeping long-term or for specific purposes |

| Management | Managed by a neutral third party (escrow agent) | Managed by real estate brokers or agents on behalf of clients |

| Regulation | Strict compliance with escrow laws; state-specific regulations apply | Subject to trust account rules under real estate licensing laws |

| Funds Access | Released only after conditions of sale are met | Accessible for client expenses or disbursements as authorized |

| Common Use | Transactional funds such as deposits, earnest money, and closing costs | Holding security deposits, rents, or client funds for ongoing management |

| Interest Earnings | Typically non-interest bearing or interest paid to parties as agreed | Interest may be held in Interest on Lawyer Trust Accounts (IOLTAs) or used per regulations |

Understanding Escrow Accounts in Real Estate

Escrow accounts in real estate serve as secure holding accounts managed by a neutral third party during property transactions, ensuring funds like earnest money or closing costs are safely maintained until contract conditions are met. These accounts provide protection for both buyers and sellers by preventing premature disbursal of funds, reducing the risk of fraud or disputes. Trust accounts, while also used in real estate, typically handle client funds for ongoing management and differ from escrow accounts by not being specifically tied to transaction milestones.

What Is a Trust Account?

A trust account in real estate is a specialized bank account used to hold funds on behalf of clients, such as earnest money deposits or rental payments, ensuring these funds are kept separate from the agent's personal or business accounts. Managed under strict regulations, trust accounts protect clients by providing transparency and reducing the risk of misappropriation or commingling of funds. Real estate brokers and agents are required to maintain trust accounts to comply with legal and ethical standards during property transactions.

Key Differences Between Escrow and Trust Accounts

Escrow accounts in real estate securely hold funds during a transaction until all contractual conditions are met, ensuring buyer and seller obligations are fulfilled, while trust accounts manage client funds for broader use, such as property management or real estate agent commissions. Escrow accounts are typically managed by a neutral third party to ensure impartiality, whereas trust accounts are maintained by brokers or agents with fiduciary responsibility. Key differences include the purpose of fund holding, regulatory oversight, and the timing of fund disbursement in property transactions.

Purposes of Escrow Accounts in Property Transactions

Escrow accounts in property transactions serve to securely hold funds such as earnest money deposits, down payments, and closing costs until all contractual conditions are fulfilled, ensuring the interests of both buyers and sellers are protected. These accounts prevent premature release of funds, reducing risks of fraud and disputes during the transfer of real estate ownership. Real estate escrow accounts provide a neutral financial intermediary, maintaining transparency and trust throughout the transaction process.

How Trust Accounts Protect Client Funds

Trust accounts protect client funds by segregating money from the real estate agent's operational funds, ensuring that client deposits are held securely and only used for authorized transactions. These accounts are governed by strict legal regulations requiring detailed record-keeping and regular audits to prevent misappropriation or fraud. By maintaining client funds in trust accounts, real estate professionals provide transparency and assurance that the money is safeguarded throughout the transaction process.

Legal Requirements for Escrow and Trust Accounts

Escrow accounts and trust accounts serve distinct legal purposes in real estate transactions, with strict regulatory frameworks governing their use to protect client funds. Escrow accounts must comply with state-specific statutes that mandate fiduciary responsibilities, requiring licensed escrow agents to hold funds securely until contract conditions are met. Trust accounts are governed by trust laws, requiring real estate brokers to maintain separate accounts for client money, ensuring transparency and preventing commingling, with periodic audits mandated by regulatory authorities.

Pros and Cons: Escrow Account vs Trust Account

Escrow accounts offer secure, third-party holding of funds during property transactions, ensuring impartial management but often involve higher fees and strict regulatory oversight. Trust accounts provide more flexibility for real estate agents to manage multiple clients' funds simultaneously but require meticulous record-keeping to avoid legal complications. Choosing between escrow and trust accounts depends on the need for security versus operational convenience in real estate transactions.

Common Misconceptions About Escrow and Trust Accounts

Many people mistakenly believe escrow accounts and trust accounts serve the same purpose in real estate transactions, but escrow accounts specifically hold funds during the closing process, while trust accounts manage client funds on behalf of agents or brokers. Another common misconception is that escrow accounts are controlled by the buyer or seller; in reality, a neutral third party administers them to ensure impartial handling. Confusion also arises regarding the regulation and security of these accounts, with escrow accounts typically governed by state laws ensuring strict compliance and trust accounts subject to fiduciary responsibilities under real estate licensing regulations.

Choosing the Right Account for Real Estate Transactions

Selecting the appropriate account for real estate transactions hinges on understanding the distinctions between escrow accounts and trust accounts. Escrow accounts securely hold funds on behalf of all parties until contract conditions are met, ensuring impartial management of deposits, while trust accounts are managed by brokers or agents to safeguard client funds separately from operational finances. Properly choosing between these accounts helps maintain regulatory compliance and protects buyer and seller interests throughout the transaction process.

Best Practices for Managing Escrow and Trust Accounts

Best practices for managing escrow and trust accounts in real estate include maintaining separate, clearly labeled accounts to prevent commingling of client funds and regularly reconciling accounts to ensure accuracy and compliance with state regulations. Implementing detailed record-keeping systems and conducting routine internal audits can safeguard against errors and fraud, enhancing transparency and accountability. Utilizing secure banking institutions with robust online access features supports efficient monitoring and timely transaction processing, reinforcing trust between agents, clients, and regulatory bodies.

Escrow Account vs Trust Account Infographic

difterm.com

difterm.com