Construction loans provide short-term financing specifically for building or renovating properties, featuring higher interest rates and flexible draw schedules based on project progress. Permanent loans, also known as mortgage loans, are long-term financing options secured after construction completion, offering stable interest rates and fixed repayment terms. Understanding the differences helps real estate investors optimize cash flow and project timelines effectively.

Table of Comparison

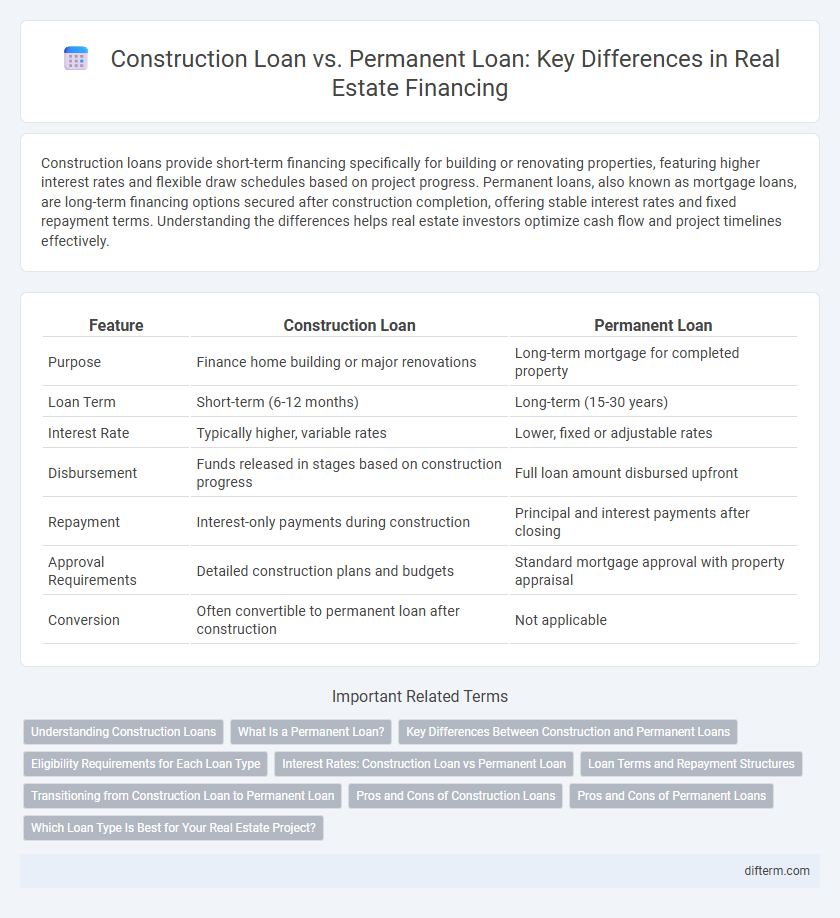

| Feature | Construction Loan | Permanent Loan |

|---|---|---|

| Purpose | Finance home building or major renovations | Long-term mortgage for completed property |

| Loan Term | Short-term (6-12 months) | Long-term (15-30 years) |

| Interest Rate | Typically higher, variable rates | Lower, fixed or adjustable rates |

| Disbursement | Funds released in stages based on construction progress | Full loan amount disbursed upfront |

| Repayment | Interest-only payments during construction | Principal and interest payments after closing |

| Approval Requirements | Detailed construction plans and budgets | Standard mortgage approval with property appraisal |

| Conversion | Often convertible to permanent loan after construction | Not applicable |

Understanding Construction Loans

Construction loans are short-term, high-interest loans designed to finance the building phase of real estate projects, typically disbursed in stages as construction progresses; they require detailed project plans, budgets, and timelines for approval. Unlike permanent loans, which provide long-term financing used after construction completion, construction loans often convert into permanent mortgages or require refinancing. Understanding loan-to-cost ratios, draw schedules, and lender requirements is crucial for successfully managing construction loans.

What Is a Permanent Loan?

A permanent loan in real estate financing refers to a long-term mortgage used to replace a construction loan once a property is completed. Unlike construction loans, which are short-term and designed to cover building costs, permanent loans provide stable, fixed or variable interest rates and longer repayment terms, typically ranging from 15 to 30 years. This loan type helps homeowners or investors secure long-term financing, ensuring manageable monthly payments and establishing equity in the property.

Key Differences Between Construction and Permanent Loans

Construction loans provide short-term financing specifically for building or renovating properties, with funds disbursed in stages based on construction progress. Permanent loans, also known as mortgage loans, offer long-term financing for completed properties and feature fixed or adjustable interest rates with regular payment schedules. Key differences include loan duration, disbursement methods, and risk assessment, as construction loans often have higher interest rates due to their temporary nature and increased risk during the building phase.

Eligibility Requirements for Each Loan Type

Construction loans require borrowers to demonstrate strong credit scores, detailed project plans, and sufficient income to cover fluctuating disbursements during the building phase. Permanent loans demand stable income verification, typically lower debt-to-income ratios, and proof of home appraisal to secure long-term financing after construction. Each loan type mandates specific eligibility criteria aligned with the loan's purpose and risk profile in real estate financing.

Interest Rates: Construction Loan vs Permanent Loan

Construction loans typically feature higher interest rates than permanent loans due to increased lender risk during the building phase. Permanent loans offer lower, fixed or variable interest rates, providing long-term financial stability for homeowners. Understanding the interest rate disparity is crucial for borrowers to optimize financing costs in real estate development and home purchase.

Loan Terms and Repayment Structures

Construction loans typically feature short-term, interest-only payments during the building phase, with terms lasting 6 to 12 months, while permanent loans have longer terms, often 15 to 30 years, with fixed or adjustable interest rates and fully amortizing repayments. Construction loans require disbursements in stages based on project milestones and convert to permanent loans upon project completion or require refinancing. Permanent loan repayment structures are designed for long-term stability, often including principal and interest payments, whereas construction loans focus on short-term financing needs with higher interest rates and variable disbursement schedules.

Transitioning from Construction Loan to Permanent Loan

Transitioning from a construction loan to a permanent loan involves refinancing short-term, interest-only debt used for building into a long-term mortgage with fixed or adjustable rates. Lenders typically require a certificate of occupancy and property appraisal to approve the permanent loan, ensuring the home's market value meets or exceeds the loan amount. This seamless conversion reduces financing costs and simplifies monthly payments, enabling homeowners to stabilize their financial obligations post-construction.

Pros and Cons of Construction Loans

Construction loans offer flexible disbursement tied to project milestones, enabling borrowers to pay interest only on funds used, which reduces upfront costs. These loans, however, typically have higher interest rates and shorter terms compared to permanent loans, increasing financial risk if construction delays occur. Approval processes for construction loans can be more rigorous, requiring detailed project plans, budgets, and contractor qualifications.

Pros and Cons of Permanent Loans

Permanent loans provide long-term financing with fixed or variable interest rates, offering predictable monthly payments and stability for homeowners or investors. These loans often have lower interest rates compared to construction loans, reducing overall borrowing costs, but require full approval and often involve stricter credit and income qualifications. However, permanent loans lack the flexibility of construction loans, as they cannot be drawn upon for ongoing construction expenses and usually have less favorable terms for properties not yet completed.

Which Loan Type Is Best for Your Real Estate Project?

Construction loans offer short-term financing tailored for building or renovating properties, featuring interest-only payments during the construction phase and often higher rates due to increased risk. Permanent loans, also known as take-out loans, provide long-term financing with fixed or variable rates, ideal once construction is complete and the property is ready for occupancy or lease. Choosing the best loan depends on project timelines, risk tolerance, and cash flow needs, with construction loans suited for active building phases and permanent loans for stable, long-term financing.

Construction Loan vs Permanent Loan Infographic

difterm.com

difterm.com