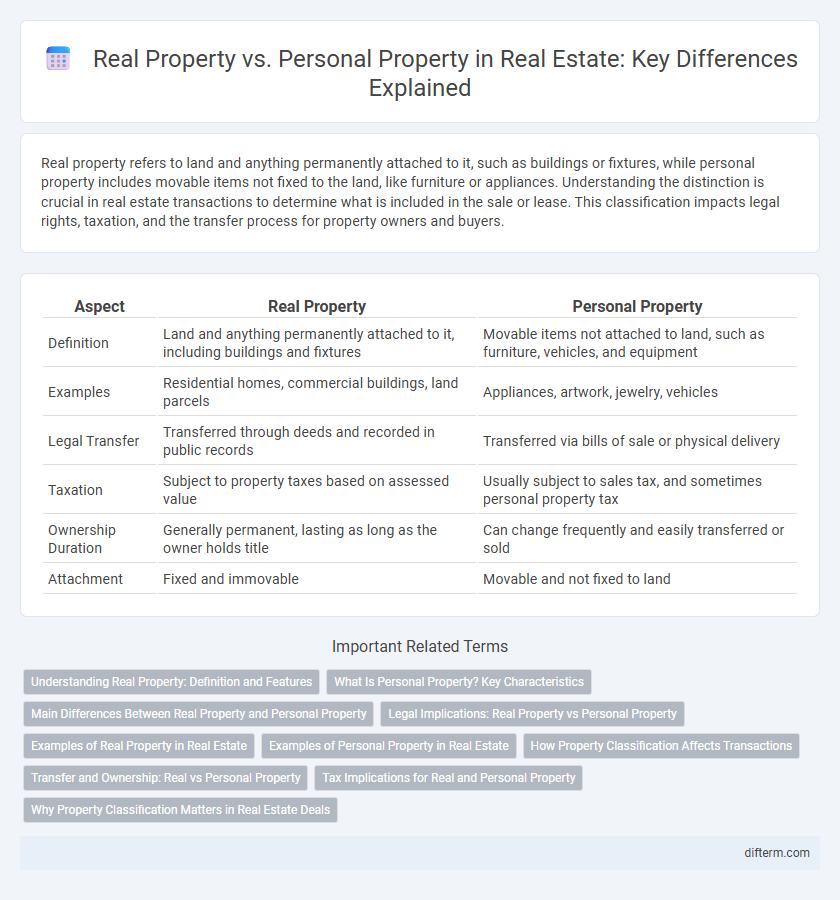

Real property refers to land and anything permanently attached to it, such as buildings or fixtures, while personal property includes movable items not fixed to the land, like furniture or appliances. Understanding the distinction is crucial in real estate transactions to determine what is included in the sale or lease. This classification impacts legal rights, taxation, and the transfer process for property owners and buyers.

Table of Comparison

| Aspect | Real Property | Personal Property |

|---|---|---|

| Definition | Land and anything permanently attached to it, including buildings and fixtures | Movable items not attached to land, such as furniture, vehicles, and equipment |

| Examples | Residential homes, commercial buildings, land parcels | Appliances, artwork, jewelry, vehicles |

| Legal Transfer | Transferred through deeds and recorded in public records | Transferred via bills of sale or physical delivery |

| Taxation | Subject to property taxes based on assessed value | Usually subject to sales tax, and sometimes personal property tax |

| Ownership Duration | Generally permanent, lasting as long as the owner holds title | Can change frequently and easily transferred or sold |

| Attachment | Fixed and immovable | Movable and not fixed to land |

Understanding Real Property: Definition and Features

Real property refers to land and anything permanently attached to it, such as buildings, structures, and natural resources like trees and minerals. It is characterized by immobility, permanence, and legal rights including possession, control, exclusion, and disposition. Unlike personal property, real property is subject to property taxes and can be conveyed through deeds or real estate transactions.

What Is Personal Property? Key Characteristics

Personal property refers to movable assets that are not permanently attached to real estate, including items such as furniture, vehicles, and appliances. Key characteristics include portability, ease of transfer, and lack of immovability compared to real property like land or buildings. Personal property is also subject to different legal treatments in sales, taxation, and ownership rights than real estate.

Main Differences Between Real Property and Personal Property

Real property consists of land and anything permanently attached to it, such as buildings, trees, and minerals, while personal property includes movable items like furniture, vehicles, and equipment. Real property rights encompass ownership interests, usage, and control over the land and fixtures, whereas personal property rights pertain to possession and use of tangible, transferable assets. Understanding these distinctions is crucial for transactions, taxation, and legal ownership in real estate.

Legal Implications: Real Property vs Personal Property

Legal implications distinguish real property as land and permanently attached structures, subject to specific regulations such as zoning laws, property taxes, and transfer procedures. Personal property encompasses movable items not fixed to land, with ownership transfer typically governed by sales contracts or bailment agreements. Understanding these distinctions is crucial for determining liability, taxation, and rights during real estate transactions and estate planning.

Examples of Real Property in Real Estate

Examples of real property in real estate include land, buildings, and permanent structures such as houses, commercial buildings, and fences. Fixtures attached to the land, like plumbing, lighting, and built-in cabinetry, also qualify as real property. These assets are immovable and legally tied to the property, distinguishing them from personal property like furniture or vehicles.

Examples of Personal Property in Real Estate

Examples of personal property in real estate include movable items such as furniture, appliances, and decorative objects that are not permanently attached to the property. Personal property also encompasses items like curtains, artwork, and portable electronics, which can be removed without damaging the real estate. Understanding the distinction between real property and personal property is crucial during real estate transactions to determine what stays with the property and what can be taken by the seller.

How Property Classification Affects Transactions

Property classification directly influences real estate transactions by determining what assets are included in the sale and how they are taxed. Real property, such as land and buildings, typically transfers through deeds and may involve property taxes, while personal property like furniture or appliances often requires separate bill of sale and may be subject to different tax rules. Understanding these distinctions is crucial for accurate contract drafting, valuation, and legal compliance during property transfers.

Transfer and Ownership: Real vs Personal Property

Real property transfer requires formal documentation such as deeds and typically involves a public recording process to establish ownership, while personal property can be transferred through bills of sale or delivery without public registration. Ownership of real property includes not just the physical land but also fixtures and interests in rights like easements, whereas personal property covers movable items that are not permanently attached. Legal protections differ as real property transfers are governed by real estate law and require strict compliance, whereas personal property ownership is generally simpler and more flexible.

Tax Implications for Real and Personal Property

Real property, including land and buildings, is subject to property taxes assessed by local governments based on assessed value, which can affect annual tax liabilities significantly. Personal property, such as vehicles, equipment, and business assets, may be subject to personal property tax depending on jurisdiction, but often faces different depreciation rules for tax deductions. Understanding the distinctions between real and personal property ensures accurate tax reporting and maximizes potential tax benefits and compliance.

Why Property Classification Matters in Real Estate Deals

Understanding the distinction between real property and personal property is crucial in real estate transactions because it directly affects ownership rights, transfer processes, and tax implications. Real property includes land and anything permanently attached to it, while personal property encompasses movable items not fixed to the land. Accurate classification ensures proper contract drafting, financing terms, and compliance with local real estate laws, ultimately safeguarding both buyer and seller interests.

real property vs personal property Infographic

difterm.com

difterm.com