Option contracts in real estate pet transactions grant buyers the exclusive right to purchase a property within a specified period, providing flexibility without immediate obligation. Purchase agreements, however, are binding contracts that finalize the sale terms, requiring both parties to complete the transaction under agreed conditions. Understanding the distinctions between these contracts helps buyers and sellers manage risks and commitments effectively in pet-friendly property deals.

Table of Comparison

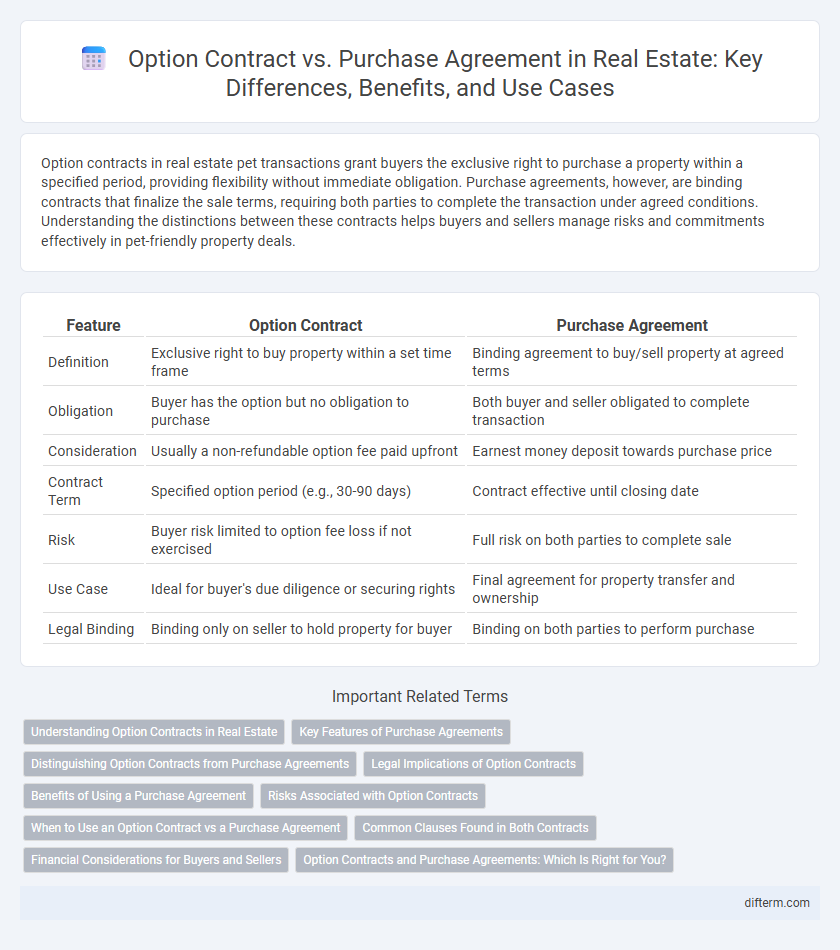

| Feature | Option Contract | Purchase Agreement |

|---|---|---|

| Definition | Exclusive right to buy property within a set time frame | Binding agreement to buy/sell property at agreed terms |

| Obligation | Buyer has the option but no obligation to purchase | Both buyer and seller obligated to complete transaction |

| Consideration | Usually a non-refundable option fee paid upfront | Earnest money deposit towards purchase price |

| Contract Term | Specified option period (e.g., 30-90 days) | Contract effective until closing date |

| Risk | Buyer risk limited to option fee loss if not exercised | Full risk on both parties to complete sale |

| Use Case | Ideal for buyer's due diligence or securing rights | Final agreement for property transfer and ownership |

| Legal Binding | Binding only on seller to hold property for buyer | Binding on both parties to perform purchase |

Understanding Option Contracts in Real Estate

Option contracts in real estate grant the buyer exclusive rights to purchase a property within a specified period without an obligation to buy, providing flexibility and control over the decision. These contracts typically require a nonrefundable option fee paid to the seller, which can sometimes be applied towards the purchase price if the option is exercised. Unlike purchase agreements, option contracts allow buyers to secure property interest while exploring financing or market conditions before committing to a full sale.

Key Features of Purchase Agreements

Purchase agreements are legally binding contracts outlining the terms and conditions of a real estate transaction, including purchase price, closing date, and contingencies such as inspections and financing. They provide clear obligations for both buyers and sellers, ensuring a structured timeline and protection against breaches through remedies like earnest money deposits and cancellation clauses. Detailed specifications on property condition, disclosures, and title conveyance further secure both parties' interests in the transfer of ownership.

Distinguishing Option Contracts from Purchase Agreements

Option contracts grant the buyer the exclusive right to purchase a property within a specified timeframe without the obligation to buy, while purchase agreements legally bind both parties to complete the transaction under agreed terms. Option contracts require an option fee, which may be credited toward the purchase price if exercised, whereas purchase agreements typically involve earnest money deposits demonstrating commitment. Understanding the non-binding nature of option contracts compared to the enforceable obligations in purchase agreements is crucial for investors and homebuyers navigating real estate transactions.

Legal Implications of Option Contracts

Option contracts in real estate grant the buyer the exclusive right to purchase a property within a specified period without an immediate obligation, creating a binding agreement that protects the buyer's interest. Unlike standard purchase agreements, option contracts may involve non-refundable option fees, which the seller retains if the buyer decides not to exercise the option, emphasizing the financial risk and enforceability aspects. Legal implications include strict adherence to contract terms, potential challenges in transferring rights, and the necessity for clear clauses to avoid disputes over property control and timing.

Benefits of Using a Purchase Agreement

A purchase agreement provides legally binding commitments that clearly outline the terms and conditions of a real estate transaction, reducing the risk of misunderstandings or disputes. It offers protection for both buyer and seller by specifying payment schedules, contingencies, and closing dates, ensuring a smoother transaction process. Using a purchase agreement establishes transparency and enforces accountability, which increases confidence and facilitates faster property transfers.

Risks Associated with Option Contracts

Option contracts in real estate carry risks such as potential loss of option fees if the buyer decides not to proceed with the purchase. Sellers face uncertainty and limited ability to market the property during the option period, which can delay or complicate resale opportunities. Buyers may also risk forfeiting their option rights if contract terms are not strictly adhered to, leading to possible financial loss.

When to Use an Option Contract vs a Purchase Agreement

Option contracts are ideal when a buyer needs exclusive time to decide on a property without committing to purchase immediately, providing the right but not the obligation to buy within a specified period. Purchase agreements are used when both parties are ready to finalize the terms and proceed with the sale, outlining binding obligations and conditions for transferring property ownership. Choosing between these contracts depends on the buyer's readiness and the need for flexibility versus commitment in real estate transactions.

Common Clauses Found in Both Contracts

Common clauses found in both Option Contracts and Purchase Agreements include the identification of parties involved, detailed property description, and the specified purchase price or option fee. Both contract types typically outline contingencies such as financing approval, property inspections, and deadlines for acceptance or execution. Additionally, clauses addressing default, remedies, and the transfer of title rights ensure legal protection and clear obligations for buyers and sellers.

Financial Considerations for Buyers and Sellers

Option contracts require buyers to pay a non-refundable premium for the right to purchase the property within a specified period, providing flexibility without immediate full financial commitment. Purchase agreements involve a binding commitment, typically necessitating earnest money deposits and full financing arrangements, resulting in a stronger obligation for both parties. Sellers benefit from option contract premiums as immediate income, while purchase agreements offer more definitive cash flow through scheduled payments and closing proceeds.

Option Contracts and Purchase Agreements: Which Is Right for You?

Option contracts in real estate provide the buyer exclusive rights to purchase a property within a specified timeframe, offering flexibility to assess the investment without immediate obligation. Purchase agreements, by contrast, are binding contracts that commit both parties to the transaction under agreed terms, ensuring certainty and clarity in property transfer. Choosing between an option contract and a purchase agreement depends on your need for flexibility versus commitment during the buying process and your investment strategy.

Option Contract vs Purchase Agreement Infographic

difterm.com

difterm.com