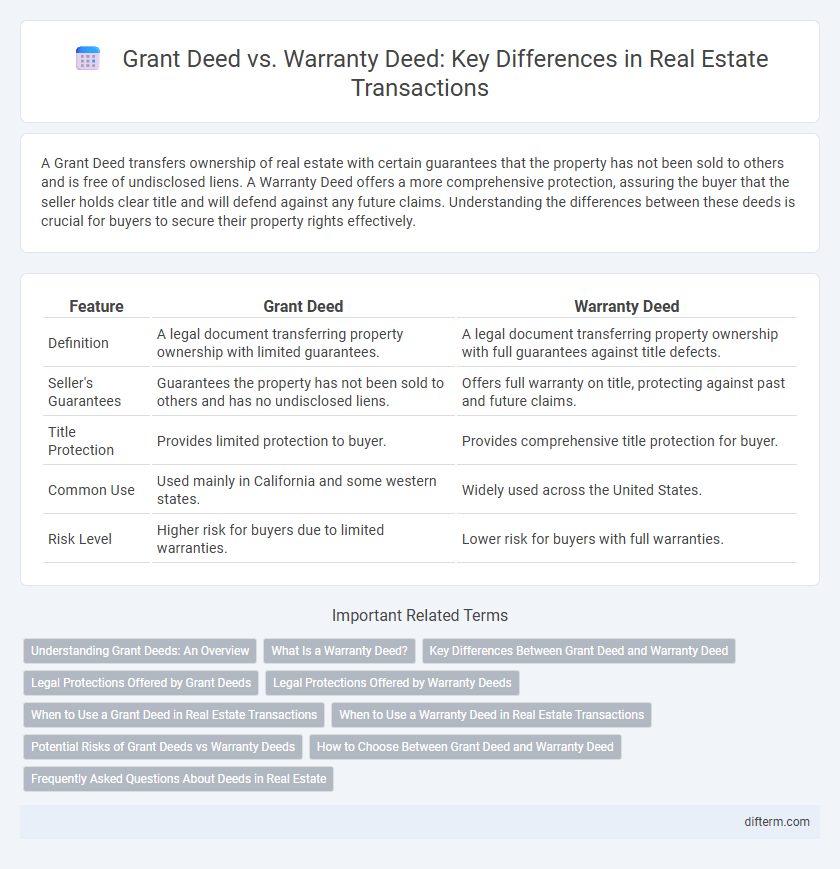

A Grant Deed transfers ownership of real estate with certain guarantees that the property has not been sold to others and is free of undisclosed liens. A Warranty Deed offers a more comprehensive protection, assuring the buyer that the seller holds clear title and will defend against any future claims. Understanding the differences between these deeds is crucial for buyers to secure their property rights effectively.

Table of Comparison

| Feature | Grant Deed | Warranty Deed |

|---|---|---|

| Definition | A legal document transferring property ownership with limited guarantees. | A legal document transferring property ownership with full guarantees against title defects. |

| Seller's Guarantees | Guarantees the property has not been sold to others and has no undisclosed liens. | Offers full warranty on title, protecting against past and future claims. |

| Title Protection | Provides limited protection to buyer. | Provides comprehensive title protection for buyer. |

| Common Use | Used mainly in California and some western states. | Widely used across the United States. |

| Risk Level | Higher risk for buyers due to limited warranties. | Lower risk for buyers with full warranties. |

Understanding Grant Deeds: An Overview

Grant deeds transfer ownership with implied warranties that the property has not been sold to another party and is free of undisclosed encumbrances. They provide limited protection by guaranteeing the grantor's right to convey the title and assurance against any title defects incurred during their ownership. Understanding these key features of grant deeds is essential for buyers seeking basic title security in real estate transactions.

What Is a Warranty Deed?

A Warranty Deed is a legal document that guarantees the seller holds clear ownership of a property and has the right to sell it, providing the buyer with full protection against any future claims or encumbrances. It includes covenants such as the covenant of seisin, guaranteeing ownership, and the covenant against encumbrances, ensuring the property is free from undisclosed liens or restrictions. This deed is commonly used in real estate transactions to offer the highest level of buyer security and assurance of a clean title.

Key Differences Between Grant Deed and Warranty Deed

A Grant Deed guarantees the property has not been sold to anyone else and that the title is clear up to the time of transfer, while a Warranty Deed offers broader protection by assuring the grantee against all title defects, including those arising before and during the grantor's ownership. Warranty Deeds provide a legal promise to defend the title against claims from third parties, whereas Grant Deeds only imply limited warranties against title issues during the grantor's actual period of ownership. Understanding these distinctions is critical for buyers seeking comprehensive title security in real estate transactions.

Legal Protections Offered by Grant Deeds

Grant deeds provide legal protections by guaranteeing the property has not been sold to anyone else and that the title is free from undisclosed encumbrances during the grantor's ownership. They assure buyers that the grantor has not placed any liens or claims on the property beyond those already disclosed. While not as comprehensive as warranty deeds, grant deeds still offer essential safeguards against title defects arising during the grantor's tenure.

Legal Protections Offered by Warranty Deeds

Warranty deeds provide comprehensive legal protections by guaranteeing that the grantor holds clear title to the property and has the authority to sell it, ensuring the buyer against future claims or title defects. They include covenants such as the covenant of seisin, which affirms ownership, and the covenant against encumbrances, ensuring the property is free of undisclosed liens. This form of deed is essential in real estate transactions for safeguarding buyers from legal disputes over ownership and undisclosed liens after closing.

When to Use a Grant Deed in Real Estate Transactions

Use a Grant Deed in real estate transactions when the seller guarantees that the property has not been sold to anyone else and that the title is free of undisclosed encumbrances. It is ideal for most residential property transfers and ensures a basic level of protection for the buyer without the extensive warranties found in a Warranty Deed. This type of deed is commonly used in private sales, foreclosures, and property transfers between family members or trusts.

When to Use a Warranty Deed in Real Estate Transactions

A Warranty Deed is essential in real estate transactions when the buyer requires guaranteed protection against any title defects, ensuring the seller fully warrants clear ownership and the right to sell the property. It is typically used in traditional home sales, refinancing, and when transferring property between family members to provide the highest level of legal assurance. This deed type helps prevent future disputes by legally holding the seller accountable for any title issues arising after the transaction.

Potential Risks of Grant Deeds vs Warranty Deeds

Grant deeds carry potential risks such as limited protection against undisclosed liens or claims that may surface after the sale, as they only guarantee the grantor has not transferred property to another party and that the property is free of encumbrances during the grantor's ownership. Warranty deeds provide stronger protection by guaranteeing clear title and covering the entire ownership history, reducing the risk of future legal disputes or financial loss due to title defects. Buyers choosing grant deeds should consider title insurance to mitigate these risks, whereas warranty deeds inherently offer more robust safeguards.

How to Choose Between Grant Deed and Warranty Deed

Choosing between a Grant Deed and a Warranty Deed depends on the level of protection required by the buyer in a real estate transaction. A Warranty Deed offers a more comprehensive guarantee, ensuring the property is free of liens or encumbrances and providing legal recourse if title defects arise. Opt for a Grant Deed for simpler transactions where the seller only guarantees that they have not transferred the property to others and that the title is unencumbered during their ownership.

Frequently Asked Questions About Deeds in Real Estate

A Grant Deed transfers ownership of real estate while guaranteeing the property has not been sold to someone else and is free of undisclosed liens, but it offers limited protection compared to a Warranty Deed. A Warranty Deed provides broader guarantees, including protection against any claims or defects in the title that may arise before or after the sale, making it the preferred choice for buyers seeking maximum security. Common questions include differences in legal obligations, the extent of title protection, and which deed is advisable under various transaction circumstances.

Grant Deed vs Warranty Deed Infographic

difterm.com

difterm.com