Real estate wholesaling involves securing a property under contract and quickly selling that contract to another buyer, requiring little to no capital investment and minimal risk. Flipping properties entails purchasing a home, renovating it to increase value, and then selling it for profit, demanding more capital, time, and expertise. Both strategies offer distinct advantages depending on the investor's resources, risk tolerance, and market knowledge.

Table of Comparison

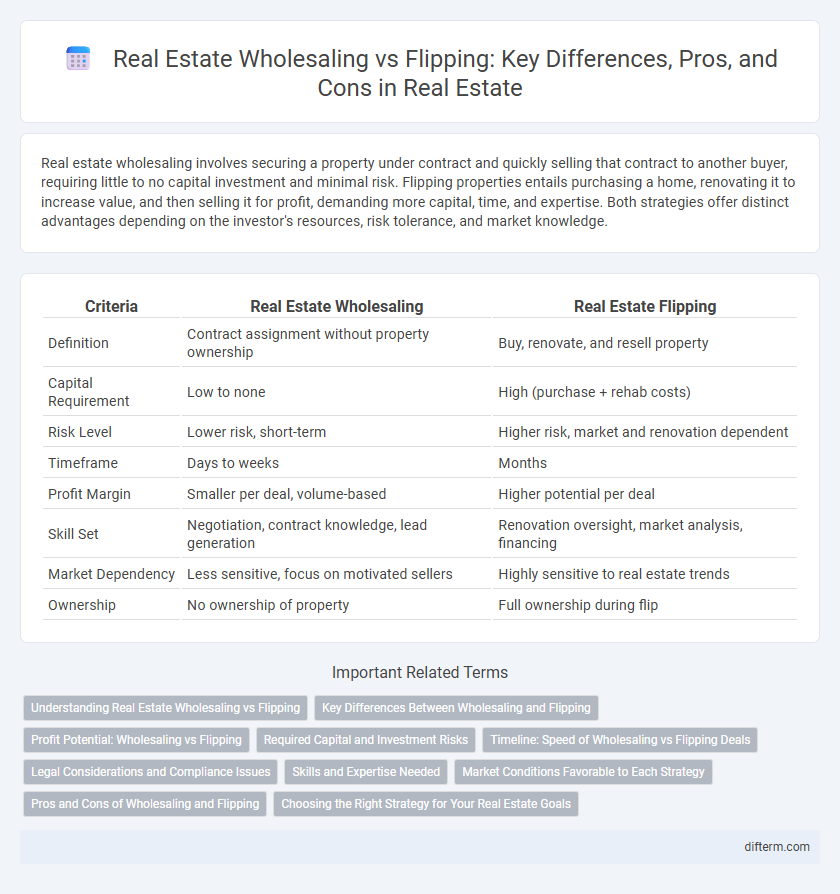

| Criteria | Real Estate Wholesaling | Real Estate Flipping |

|---|---|---|

| Definition | Contract assignment without property ownership | Buy, renovate, and resell property |

| Capital Requirement | Low to none | High (purchase + rehab costs) |

| Risk Level | Lower risk, short-term | Higher risk, market and renovation dependent |

| Timeframe | Days to weeks | Months |

| Profit Margin | Smaller per deal, volume-based | Higher potential per deal |

| Skill Set | Negotiation, contract knowledge, lead generation | Renovation oversight, market analysis, financing |

| Market Dependency | Less sensitive, focus on motivated sellers | Highly sensitive to real estate trends |

| Ownership | No ownership of property | Full ownership during flip |

Understanding Real Estate Wholesaling vs Flipping

Real estate wholesaling involves securing properties under contract and assigning those contracts to buyers for a fee, requiring minimal capital and avoiding direct property ownership. Flipping entails purchasing properties, renovating them, and selling for profit, demanding significant investment and experience in project management. Understanding the distinction helps investors choose strategies aligned with their risk tolerance, capital availability, and market knowledge.

Key Differences Between Wholesaling and Flipping

Real estate wholesaling involves securing a property under contract and selling that contract to another buyer without renovating or owning the property, typically requiring less capital and lower risk. Flipping requires purchasing a property, investing in renovations to increase its value, and then reselling at a profit, which demands more upfront investment and management of renovation projects. Key differences include the level of financial investment, ownership duration, and involvement in property improvements.

Profit Potential: Wholesaling vs Flipping

Wholesaling in real estate generates profit through quick assignment fees, often ranging from $5,000 to $20,000 per deal, with minimal capital investment and lower risk, making it attractive for beginners. Flipping properties can yield significantly higher returns, typically between 10% and 30% of the property's after-repair value (ARV), but requires substantial upfront capital, renovation costs, and market knowledge. Profit potential in flipping depends heavily on accurate property valuation and renovation budgeting, while wholesaling profits rely on effective networking and rapid deal closure.

Required Capital and Investment Risks

Real estate wholesaling requires significantly lower capital since investors primarily contract properties rather than purchase them outright, minimizing upfront financial commitments. Flipping demands substantial capital to acquire, renovate, and market the property, increasing exposure to market fluctuations and renovation cost overruns. Investment risks in wholesaling are generally lower due to the short holding period and limited capital risk, while flipping involves greater risk due to potential market downturns and unforeseen repair expenses.

Timeline: Speed of Wholesaling vs Flipping Deals

Wholesaling in real estate typically involves a rapid transaction timeline, often closing deals within 7 to 30 days due to minimal repair requirements and quick assignment contracts. Flipping extends the timeline significantly, ranging from several weeks to months as investors purchase, renovate, and resell properties to maximize profit. Speed in wholesaling offers quick capital turnover, whereas flipping demands more time investment for renovation and market appreciation.

Legal Considerations and Compliance Issues

Real estate wholesaling requires strict adherence to contract assignment laws and disclosure regulations to avoid accusations of unlicensed brokering, while flipping mandates compliance with property renovation permits and local zoning codes. Both strategies must ensure transparent transactions to prevent legal disputes and protect buyer rights under state real estate statutes. Failure to meet these legal considerations can result in fines, litigation, or license revocation, emphasizing the need for thorough due diligence and compliance monitoring.

Skills and Expertise Needed

Real estate wholesaling requires strong negotiation skills, quick decision-making, and a deep understanding of contract law to effectively assign contracts to buyers without significant upfront capital. Flipping properties demands expertise in property valuation, renovation management, and knowledge of market trends to ensure profitable resale after improvements. Both strategies benefit from robust networking abilities and a solid grasp of local real estate regulations.

Market Conditions Favorable to Each Strategy

Real estate wholesaling thrives in rapidly changing markets with abundant distressed properties and motivated sellers, allowing quick contract assignments for profit. Flipping is more favorable in stable or appreciating markets where renovation can add significant value and recoup repair costs with a higher resale price. Understanding local demand, inventory levels, and price trends is crucial to choosing the right strategy for maximum returns.

Pros and Cons of Wholesaling and Flipping

Wholesaling in real estate offers the advantage of low capital investment and faster turnover by assigning contracts rather than purchasing properties, but it requires strong negotiation skills and a solid buyer network to be successful. Flipping involves purchasing, renovating, and reselling properties, which can yield higher profits but demands significant capital, time, and market knowledge, along with risks of renovation delays and market fluctuations. Investors must weigh the lower risk and quicker cash flow potential of wholesaling against the higher profit margins and increased complexity of flipping to choose the best strategy for their resources and goals.

Choosing the Right Strategy for Your Real Estate Goals

Real estate wholesaling offers quick returns with minimal capital investment by assigning contracts to buyers, making it ideal for investors seeking fast cash flow and low risk. Flipping requires a larger capital outlay and renovation skills but can yield higher profits through property appreciation in rehabilitated homes. Selecting the right strategy depends on your financial capacity, time commitment, and long-term objectives in the real estate market.

real estate wholesaling vs flipping Infographic

difterm.com

difterm.com