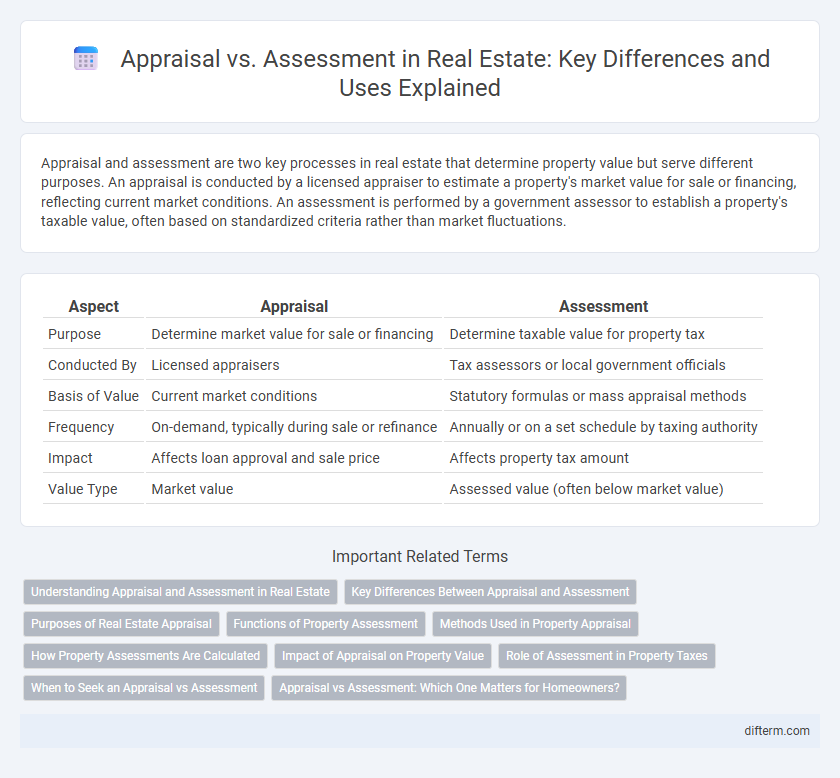

Appraisal and assessment are two key processes in real estate that determine property value but serve different purposes. An appraisal is conducted by a licensed appraiser to estimate a property's market value for sale or financing, reflecting current market conditions. An assessment is performed by a government assessor to establish a property's taxable value, often based on standardized criteria rather than market fluctuations.

Table of Comparison

| Aspect | Appraisal | Assessment |

|---|---|---|

| Purpose | Determine market value for sale or financing | Determine taxable value for property tax |

| Conducted By | Licensed appraisers | Tax assessors or local government officials |

| Basis of Value | Current market conditions | Statutory formulas or mass appraisal methods |

| Frequency | On-demand, typically during sale or refinance | Annually or on a set schedule by taxing authority |

| Impact | Affects loan approval and sale price | Affects property tax amount |

| Value Type | Market value | Assessed value (often below market value) |

Understanding Appraisal and Assessment in Real Estate

Appraisal in real estate is an expert's unbiased estimate of a property's market value based on factors like location, condition, and comparable sales. Assessment refers to the value assigned by a tax authority to determine property taxes, often calculated using a standardized formula rather than market trends. Understanding the distinction between appraisal and assessment is crucial for buyers and sellers to accurately gauge property worth and tax obligations.

Key Differences Between Appraisal and Assessment

Appraisal determines a property's market value based on current market conditions, typically conducted by licensed professionals for buying, selling, or financing purposes. Assessment assigns a value to property primarily for tax purposes, based on standardized formulas and local government criteria rather than market fluctuations. The key difference lies in appraisal being market-driven and specific to transactions, while assessment serves as a consistent valuation tool for property taxation.

Purposes of Real Estate Appraisal

Real estate appraisal primarily serves to determine the accurate market value of a property for buying, selling, financing, or insurance purposes. It provides a professional, unbiased opinion essential for securing loans, setting a sale price, or resolving disputes. Unlike assessments used mainly for tax evaluations, appraisals focus on current market conditions and property-specific factors to ensure fair valuation.

Functions of Property Assessment

Property assessment functions primarily determine the taxable value of real estate for local government revenue purposes. Assessors evaluate market conditions, property characteristics, and legal factors to establish uniform values used in tax calculations. This process ensures equitable tax distribution based on property worth rather than individual negotiations.

Methods Used in Property Appraisal

Property appraisal methods primarily include the sales comparison approach, which analyzes recent sales of comparable properties to estimate market value, the cost approach that calculates the current cost to replace the property minus depreciation, and the income approach, used mainly for rental or commercial properties, which evaluates potential income generation. These methods rely on detailed market data, property condition, location characteristics, and income potential to provide an accurate valuation. Appraisal differs from assessment in that it uses more specific, market-driven data to determine the property's fair market value for buying or selling purposes.

How Property Assessments Are Calculated

Property assessments are calculated based on factors such as the property's location, size, age, condition, and comparable sales in the area. Assessors use standardized mass appraisal techniques and market data analysis to determine the assessed value, which influences local property tax rates. Unlike appraisals, assessments are primarily for taxation purposes and may not reflect current market value precisely.

Impact of Appraisal on Property Value

Appraisal directly influences property value by providing an expert, market-driven estimate of worth that lenders and buyers rely on during transactions. Unlike assessments used primarily for tax purposes, appraisals reflect current market conditions and property specifics, thus impacting sale price and financing options. Accurate appraisals ensure fair market value, affecting investment decisions and homeowner equity.

Role of Assessment in Property Taxes

Assessment determines the taxable value of a property, which directly influences the amount of property taxes owed by the owner. Unlike appraisals that estimate market value for buying or selling, assessments are set by local governments to establish fair tax distribution. Accurate assessments are essential for maintaining equitable property tax systems and funding public services.

When to Seek an Appraisal vs Assessment

Seek an appraisal when buying, selling, or refinancing a property to obtain an accurate market value conducted by a certified professional. Assessments are primarily used by local governments to determine property tax values and are updated periodically, so refer to an assessment for tax-related inquiries or disputes. Understanding the timing and purpose of each can optimize financial decisions and property-related negotiations.

Appraisal vs Assessment: Which One Matters for Homeowners?

Appraisal vs assessment plays a critical role in determining a home's market value and property taxes, with appraisals reflecting current market conditions used primarily during sales or refinancing, while assessments are conducted by local governments to calculate property tax obligations. Homeowners rely on appraisals for accurate sale prices and mortgage approvals, whereas assessments impact annual property tax bills and can differ significantly from market value. Understanding the distinction between appraisal and assessment helps homeowners anticipate financial commitments and negotiate effectively during property transactions.

Appraisal vs Assessment Infographic

difterm.com

difterm.com