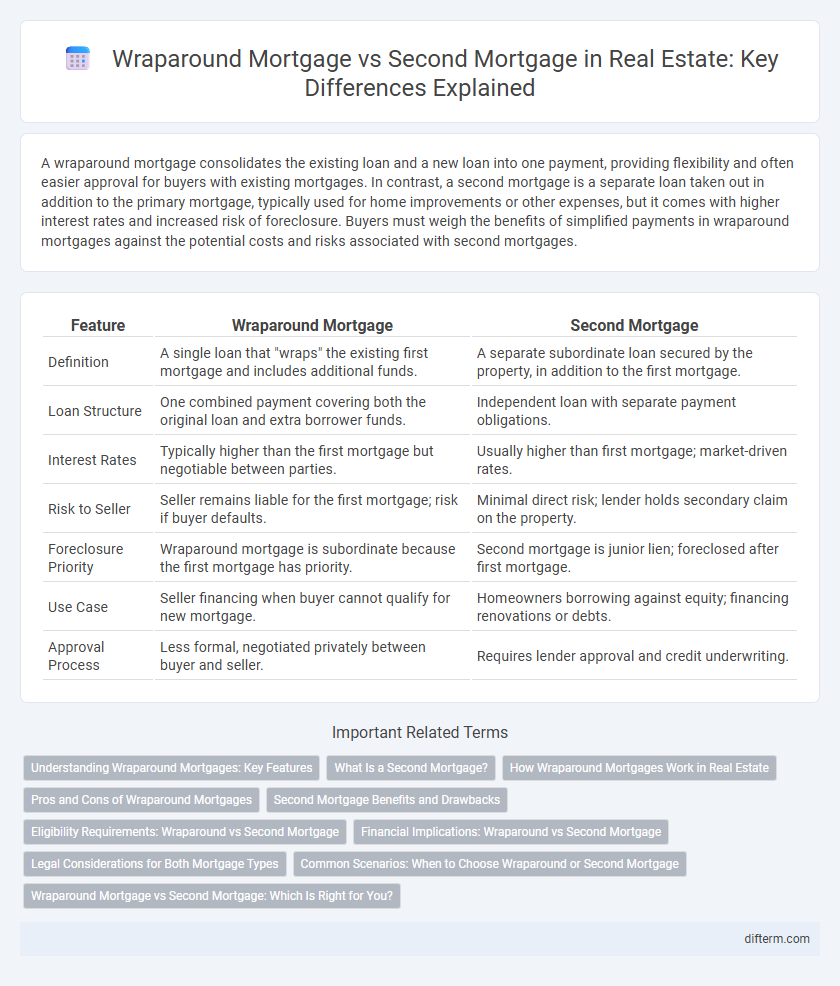

A wraparound mortgage consolidates the existing loan and a new loan into one payment, providing flexibility and often easier approval for buyers with existing mortgages. In contrast, a second mortgage is a separate loan taken out in addition to the primary mortgage, typically used for home improvements or other expenses, but it comes with higher interest rates and increased risk of foreclosure. Buyers must weigh the benefits of simplified payments in wraparound mortgages against the potential costs and risks associated with second mortgages.

Table of Comparison

| Feature | Wraparound Mortgage | Second Mortgage |

|---|---|---|

| Definition | A single loan that "wraps" the existing first mortgage and includes additional funds. | A separate subordinate loan secured by the property, in addition to the first mortgage. |

| Loan Structure | One combined payment covering both the original loan and extra borrower funds. | Independent loan with separate payment obligations. |

| Interest Rates | Typically higher than the first mortgage but negotiable between parties. | Usually higher than first mortgage; market-driven rates. |

| Risk to Seller | Seller remains liable for the first mortgage; risk if buyer defaults. | Minimal direct risk; lender holds secondary claim on the property. |

| Foreclosure Priority | Wraparound mortgage is subordinate because the first mortgage has priority. | Second mortgage is junior lien; foreclosed after first mortgage. |

| Use Case | Seller financing when buyer cannot qualify for new mortgage. | Homeowners borrowing against equity; financing renovations or debts. |

| Approval Process | Less formal, negotiated privately between buyer and seller. | Requires lender approval and credit underwriting. |

Understanding Wraparound Mortgages: Key Features

A wraparound mortgage combines the existing mortgage with a new loan, creating a single payment that covers both, often used to facilitate seller financing and offer flexible terms. This type of mortgage allows the seller to maintain the original loan while providing financing to the buyer, typically at a higher interest rate, benefiting both parties. Unlike a second mortgage, which is a separate, subordinate loan requiring independent approval, a wraparound mortgage integrates debts, simplifying payment management and potentially accelerating purchase processes.

What Is a Second Mortgage?

A second mortgage is a loan taken out against a property that already has a primary mortgage, allowing homeowners to borrow additional funds while retaining their first mortgage. It typically has a higher interest rate than the primary loan due to increased risk for lenders and can be used for home improvements, debt consolidation, or other expenses. Unlike a wraparound mortgage, a second mortgage does not alter the terms of the original loan but exists as a separate lien on the property.

How Wraparound Mortgages Work in Real Estate

Wraparound mortgages function by combining an existing loan balance with an additional loan amount into a single new mortgage payment, allowing the buyer to make payments directly to the seller. This financing structure enables the seller to maintain the original mortgage while profiting from the interest rate difference between the wraparound loan and the underlying mortgage. Unlike second mortgages, wraparound mortgages streamline transactions by consolidating debts, reducing the buyer's need to qualify for multiple loans.

Pros and Cons of Wraparound Mortgages

Wraparound mortgages offer the advantage of simplifying financing by combining existing loans with new credit into a single payment, often benefiting buyers with less stringent qualification requirements and sellers who can attract a broader pool of buyers. However, risks include potential complications if the underlying loan is due on sale or requires immediate payoff, and the seller retaining liability for the original mortgage. These agreements can also pose challenges in foreclosure scenarios, making clear legal guidance essential to protect both parties.

Second Mortgage Benefits and Drawbacks

Second mortgages allow homeowners to access additional funds by borrowing against their home equity, often with lower interest rates compared to unsecured loans, making them a viable option for home improvements or debt consolidation. However, taking a second mortgage increases the total debt secured by the property, leading to higher monthly payments and risk of foreclosure if payments are missed. Unlike wraparound mortgages, second mortgages operate independently of the primary loan, which can simplify terms but may limit refinancing flexibility.

Eligibility Requirements: Wraparound vs Second Mortgage

Wraparound mortgages typically require the borrower to have an existing underlying loan with lender consent, making eligibility dependent on the original loan terms and the seller's willingness to finance. Second mortgages usually demand a strong credit score, stable income, and a low debt-to-income ratio since they involve a separate lien on the property behind the primary mortgage. Lenders for second mortgages often require a clear appraisal and equity of at least 20%, while wraparound mortgages hinge more on negotiation and agreement between buyer and seller.

Financial Implications: Wraparound vs Second Mortgage

Wraparound mortgages consolidate existing debt into a single loan, potentially offering lower overall interest rates and simplified payments, which can improve cash flow and reduce closing costs. Second mortgages typically have higher interest rates and require separate payments, increasing the borrower's financial obligations and risking stricter lender terms. Evaluating tax benefits, interest deductions, and repayment flexibility is crucial when choosing between wraparound and second mortgage structures for optimal financial management.

Legal Considerations for Both Mortgage Types

Legal considerations for wraparound mortgages include ensuring compliance with the original loan terms and obtaining lender consent to avoid acceleration clauses. Second mortgages require clear lien priority and thorough title searches to prevent conflicts with the primary loan. Both mortgage types demand precise contract drafting to protect lender and borrower rights while minimizing the risk of foreclosure or litigation.

Common Scenarios: When to Choose Wraparound or Second Mortgage

Wraparound mortgages are ideal in scenarios where a buyer wants to assume an existing low-interest loan balance while obtaining additional financing, often used in seller-financed transactions or when refinancing is costly. Second mortgages are commonly chosen for home improvements, debt consolidation, or accessing equity without disturbing the primary loan terms, typically when the borrower seeks faster access to funds or lower interest rates. Selecting between wraparound and second mortgages depends on factors like interest rate environment, lender approval, and the borrower's financial strategy.

Wraparound Mortgage vs Second Mortgage: Which Is Right for You?

Wraparound mortgages consolidate existing loans into a single new loan with a lower interest rate, simplifying payments while giving sellers flexibility in negotiating terms. Second mortgages provide additional financing without altering the primary loan but often come with higher interest rates and increased risk for borrowers. Choosing between a wraparound mortgage and a second mortgage depends on your financial goals, credit profile, and the terms offered by both lenders.

wraparound mortgage vs second mortgage Infographic

difterm.com

difterm.com