Net operating income (NOI) represents the total revenue from a property minus operating expenses, excluding taxes and financing costs, providing a clear picture of profitability. Gross operating income (GOI) includes all income generated by the property before deducting any expenses, such as vacancies or operating costs. Understanding the difference between NOI and GOI is essential for investors to accurately assess a property's financial performance and investment potential.

Table of Comparison

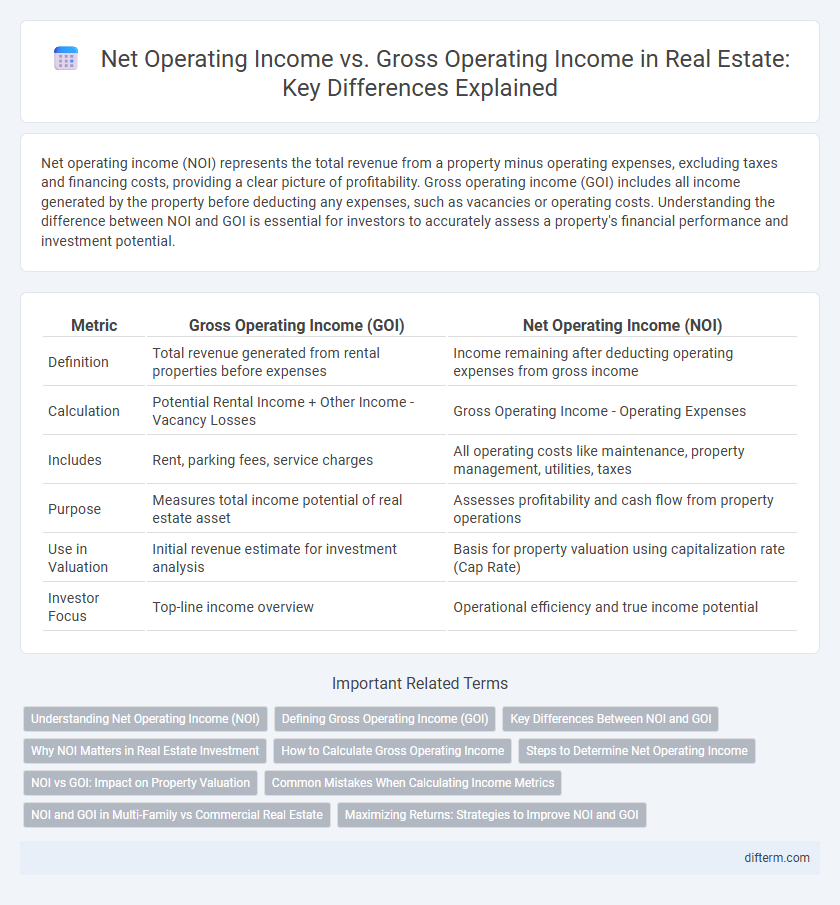

| Metric | Gross Operating Income (GOI) | Net Operating Income (NOI) |

|---|---|---|

| Definition | Total revenue generated from rental properties before expenses | Income remaining after deducting operating expenses from gross income |

| Calculation | Potential Rental Income + Other Income - Vacancy Losses | Gross Operating Income - Operating Expenses |

| Includes | Rent, parking fees, service charges | All operating costs like maintenance, property management, utilities, taxes |

| Purpose | Measures total income potential of real estate asset | Assesses profitability and cash flow from property operations |

| Use in Valuation | Initial revenue estimate for investment analysis | Basis for property valuation using capitalization rate (Cap Rate) |

| Investor Focus | Top-line income overview | Operational efficiency and true income potential |

Understanding Net Operating Income (NOI)

Net Operating Income (NOI) represents the total revenue generated from a real estate property after deducting all operating expenses, excluding taxes, financing costs, and depreciation. NOI is a critical metric for evaluating a property's profitability, calculated by subtracting expenses such as maintenance, property management, insurance, and utilities from Gross Operating Income (GOI). Understanding NOI helps investors make informed decisions by providing a clear picture of the income available from operations before financing impacts.

Defining Gross Operating Income (GOI)

Gross Operating Income (GOI) represents the total revenue generated from a property before deducting operating expenses, including rental income, parking fees, and other service charges. It serves as a key indicator of a property's income potential by capturing the total inflows from all income sources. Understanding GOI is essential for accurately assessing a real estate investment's profitability and comparing it with Net Operating Income (NOI), which accounts for operating expenses.

Key Differences Between NOI and GOI

Net Operating Income (NOI) represents the total revenue from a property minus operating expenses, excluding financing costs and taxes, reflecting actual profitability. Gross Operating Income (GOI) includes total potential rental income plus other income sources before deducting vacancies and operating expenses. The key differences lie in NOI accounting for operational efficiency and cash flow, whereas GOI provides an initial snapshot of income potential prior to expenses.

Why NOI Matters in Real Estate Investment

Net operating income (NOI) represents the revenue generated from a real estate property after deducting operating expenses but before taxes and financing costs, providing a clearer picture of true profitability than gross operating income (GOI), which includes total potential income without expenses accounted for. NOI is crucial for investors because it directly influences property valuation, cash flow analysis, and the calculation of key metrics like capitalization rate and debt service coverage ratio. Understanding NOI enables more accurate assessments of investment performance, risk, and return potential in real estate portfolios.

How to Calculate Gross Operating Income

Gross Operating Income (GOI) is calculated by adding all potential rental income and other income generated by a property before accounting for vacancies and operating expenses. To determine GOI, start with the total potential rental income, then include any additional sources such as parking fees, laundry, and service charges. This figure provides a comprehensive view of a property's total income potential before deductions.

Steps to Determine Net Operating Income

Net operating income (NOI) is calculated by subtracting operating expenses such as property management fees, maintenance costs, and property taxes from the gross operating income (GOI), which includes total rental income and other income sources. To determine NOI, begin by accurately assessing all potential income streams from the property, then comprehensively list and sum all allowable operating expenses. This precise evaluation ensures a clear understanding of the property's profitability before financing and tax considerations.

NOI vs GOI: Impact on Property Valuation

Net Operating Income (NOI) represents the revenue from a property after deducting operating expenses, excluding financing and tax costs, while Gross Operating Income (GOI) reflects the total rental income before expenses. NOI provides a more accurate measure of a property's profitability and cash flow potential, directly influencing capitalization rates and market value assessments. Investors prioritize NOI over GOI to evaluate property valuation because it captures operational efficiency and sustainable income generation.

Common Mistakes When Calculating Income Metrics

Common mistakes when calculating net operating income (NOI) versus gross operating income (GOI) include failing to accurately separate operating expenses from gross income, leading to inflated NOI figures. Overlooking vacancy rates and tenant turnover reduces the reliability of GOI estimations, causing financial miscalculations. Confusing non-operating income with operational revenue further distorts both metrics, impacting investment analysis and property valuation.

NOI and GOI in Multi-Family vs Commercial Real Estate

Net Operating Income (NOI) in multi-family real estate is a critical metric that subtracts operating expenses from Gross Operating Income (GOI), which includes rental income and other revenue streams before expenses. In commercial real estate, GOI often accounts for a wider range of income sources such as tenant reimbursements and percentage rents, making the calculation of NOI vital for assessing true profitability by excluding these operating expenses. Understanding the distinction between NOI and GOI is essential for investors comparing multi-family properties, where stable rental income dominates, versus commercial properties with more complex income structures and variable operating costs.

Maximizing Returns: Strategies to Improve NOI and GOI

Maximizing returns in real estate investment requires a focused strategy to boost both Net Operating Income (NOI) and Gross Operating Income (GOI). Enhancing GOI involves optimizing rental income through competitive market analysis, effective lease management, and minimizing vacancy rates. Improving NOI demands strict control over operating expenses, including utilities, maintenance, and property management costs, while implementing energy-efficient upgrades and leveraging tax benefits to amplify profitability.

net operating income vs gross operating income Infographic

difterm.com

difterm.com