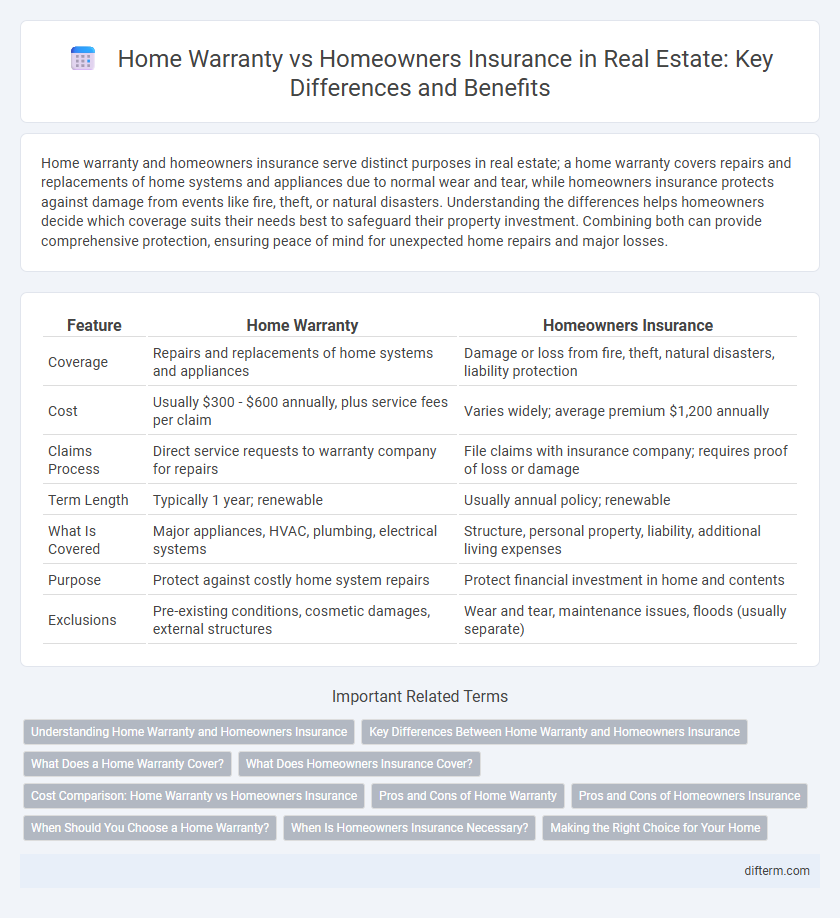

Home warranty and homeowners insurance serve distinct purposes in real estate; a home warranty covers repairs and replacements of home systems and appliances due to normal wear and tear, while homeowners insurance protects against damage from events like fire, theft, or natural disasters. Understanding the differences helps homeowners decide which coverage suits their needs best to safeguard their property investment. Combining both can provide comprehensive protection, ensuring peace of mind for unexpected home repairs and major losses.

Table of Comparison

| Feature | Home Warranty | Homeowners Insurance |

|---|---|---|

| Coverage | Repairs and replacements of home systems and appliances | Damage or loss from fire, theft, natural disasters, liability protection |

| Cost | Usually $300 - $600 annually, plus service fees per claim | Varies widely; average premium $1,200 annually |

| Claims Process | Direct service requests to warranty company for repairs | File claims with insurance company; requires proof of loss or damage |

| Term Length | Typically 1 year; renewable | Usually annual policy; renewable |

| What Is Covered | Major appliances, HVAC, plumbing, electrical systems | Structure, personal property, liability, additional living expenses |

| Purpose | Protect against costly home system repairs | Protect financial investment in home and contents |

| Exclusions | Pre-existing conditions, cosmetic damages, external structures | Wear and tear, maintenance issues, floods (usually separate) |

Understanding Home Warranty and Homeowners Insurance

Home warranty provides coverage for repair or replacement of home systems and appliances due to normal wear and tear, while homeowners insurance protects against damage or loss caused by events like fire, theft, or natural disasters. Home warranty plans typically cover HVAC systems, plumbing, and electrical components, whereas homeowners insurance includes liability protection and coverage for the structure and personal belongings. Understanding these distinctions helps homeowners decide how to safeguard their investment and manage unexpected expenses efficiently.

Key Differences Between Home Warranty and Homeowners Insurance

Home warranty covers repairs and replacements of home systems and appliances due to normal wear and tear, while homeowners insurance protects against damage from disasters like fire, theft, or natural calamities. Homeowners insurance also includes liability coverage for injuries occurring on the property, which home warranty does not provide. Understanding these key differences helps homeowners determine the best protection for their property and investments.

What Does a Home Warranty Cover?

A home warranty covers the repair or replacement of major home systems and appliances, such as HVAC units, plumbing, electrical systems, kitchen appliances, and water heaters. It protects homeowners from unexpected repair costs for items that naturally wear out over time, unlike homeowners insurance which covers damage from perils like fire or theft. Coverage details vary by provider and plan, often including maintenance services and offering peace of mind for aging homes.

What Does Homeowners Insurance Cover?

Homeowners insurance primarily covers structural damage to the home caused by perils like fire, windstorms, theft, and vandalism, as well as liability protection against accidents occurring on the property. It typically includes coverage for personal belongings and additional living expenses if the home becomes uninhabitable due to a covered event. Unlike home warranties, homeowners insurance does not cover repairs or replacements of appliances or systems due to wear and tear.

Cost Comparison: Home Warranty vs Homeowners Insurance

Home warranty costs typically range between $300 and $600 annually, covering repair and replacement of appliances and systems, while homeowners insurance averages $1,200 to $1,500 per year, providing protection against property damage and liability. Home warranties offer predictable budgeting for specific home repairs, whereas homeowners insurance premiums vary based on property value, location, and coverage limits. Choosing between the two depends on the homeowner's need for appliance coverage versus broader protection against disasters and liability claims.

Pros and Cons of Home Warranty

Home warranties offer protection for major home systems and appliances, covering repairs and replacements that homeowners insurance typically excludes, such as HVAC, plumbing, and electrical components. They provide peace of mind with predictable costs through service fees but may have limitations like coverage caps, service provider restrictions, and potential delays in repairs. While homeowners insurance safeguards against risks like theft, fire, and natural disasters, home warranties focus on maintenance issues, making them a complementary, not replacement, option.

Pros and Cons of Homeowners Insurance

Homeowners insurance provides broad protection against property damage, theft, and liability, making it essential for financial security in unexpected events like fire, storms, or accidents. However, its policies often exclude normal wear and tear or mechanical failures, which can lead to out-of-pocket expenses for repairs. While it covers structural damage and personal liability, it typically requires deductibles and premium payments that can fluctuate based on location, home value, and coverage levels.

When Should You Choose a Home Warranty?

A home warranty is ideal for buyers of older homes or properties with aging systems and appliances, providing protection against costly repairs and replacements not covered by homeowners insurance. Home warranties cover mechanical failures due to normal wear and tear, while homeowners insurance protects against damages from accidents, theft, or natural disasters. Choosing a home warranty offers peace of mind for unexpected repair expenses and can enhance marketability when selling a home.

When Is Homeowners Insurance Necessary?

Homeowners insurance is necessary when protecting against financial loss from damage or liability related to the property, such as fire, theft, or accidents on the premises. Unlike home warranties that cover repair or replacement of home systems and appliances, homeowners insurance provides comprehensive coverage required by mortgage lenders and essential for safeguarding property investment. Ensuring proper homeowners insurance can prevent costly out-of-pocket expenses from unforeseen events impacting the home's structure and personal belongings.

Making the Right Choice for Your Home

Home warranty plans cover repairs and replacements of major home systems and appliances, providing peace of mind for unexpected breakdowns, while homeowners insurance protects against property damage and liability from events like fire, theft, or natural disasters. Evaluating the condition of your home's key systems, budget for potential repairs, and local risk factors helps determine whether a home warranty, homeowners insurance, or both best fit your protection needs. Choosing the right coverage ensures financial security and maintains your investment in your real estate property.

home warranty vs homeowners insurance Infographic

difterm.com

difterm.com