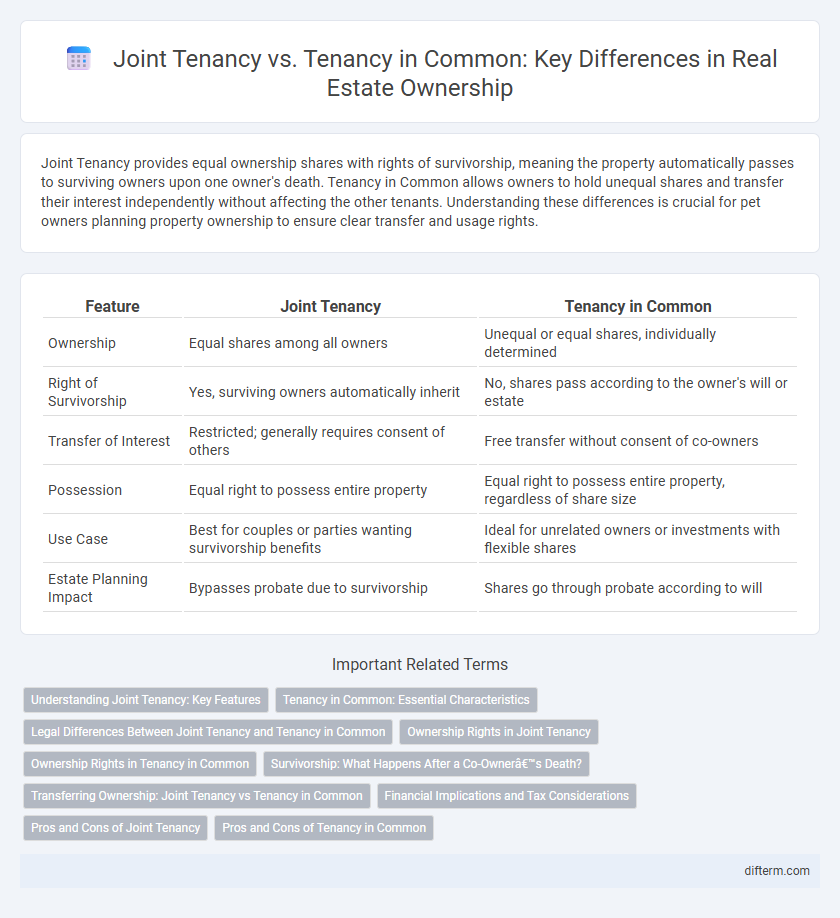

Joint Tenancy provides equal ownership shares with rights of survivorship, meaning the property automatically passes to surviving owners upon one owner's death. Tenancy in Common allows owners to hold unequal shares and transfer their interest independently without affecting the other tenants. Understanding these differences is crucial for pet owners planning property ownership to ensure clear transfer and usage rights.

Table of Comparison

| Feature | Joint Tenancy | Tenancy in Common |

|---|---|---|

| Ownership | Equal shares among all owners | Unequal or equal shares, individually determined |

| Right of Survivorship | Yes, surviving owners automatically inherit | No, shares pass according to the owner's will or estate |

| Transfer of Interest | Restricted; generally requires consent of others | Free transfer without consent of co-owners |

| Possession | Equal right to possess entire property | Equal right to possess entire property, regardless of share size |

| Use Case | Best for couples or parties wanting survivorship benefits | Ideal for unrelated owners or investments with flexible shares |

| Estate Planning Impact | Bypasses probate due to survivorship | Shares go through probate according to will |

Understanding Joint Tenancy: Key Features

Joint tenancy is a form of property ownership where two or more individuals hold equal shares with rights of survivorship, meaning the interest of a deceased tenant automatically passes to the surviving tenants. Key features include unity of time, title, interest, and possession, ensuring all co-owners acquire the property simultaneously under the same deed and hold equal rights. This arrangement is often used to avoid probate and provide seamless transfer of ownership upon death.

Tenancy in Common: Essential Characteristics

Tenancy in Common allows multiple owners to hold unequal shares of a property, with each having a distinct, divisible interest that can be sold or bequeathed independently. Unlike Joint Tenancy, Tenancy in Common does not include the right of survivorship, meaning ownership passes according to the owner's will or state law upon death. This form of co-ownership provides flexibility in investment and estate planning, making it popular for unrelated investors or family members.

Legal Differences Between Joint Tenancy and Tenancy in Common

Joint tenancy includes the right of survivorship, ensuring that ownership automatically transfers to surviving co-owners upon death, whereas tenancy in common allows each owner to bequeath their share independently through a will. In joint tenancy, all owners hold equal shares with unified ownership interests, while tenancy in common permits unequal ownership percentages and separate title interests. Legal implications also differ in terms of title transfer and creditor claims, making the choice between joint tenancy and tenancy in common critical for estate and asset protection strategies.

Ownership Rights in Joint Tenancy

In joint tenancy, ownership rights include the right of survivorship, meaning when one owner dies, their share automatically transfers to the surviving owners, not heirs. Each joint tenant holds an equal, undivided interest in the property, maintaining unity of possession, interest, title, and time. This arrangement provides a seamless transfer of ownership and prevents property from being subject to probate.

Ownership Rights in Tenancy in Common

In tenancy in common, each owner holds an individual, undivided interest in the property, which can vary in size and be transferred independently without the consent of others. Unlike joint tenancy, there is no right of survivorship, so each owner's share passes according to their will or state inheritance laws upon death. This structure provides flexibility in ownership rights, allowing for unequal shares and distinct heirs.

Survivorship: What Happens After a Co-Owner’s Death?

In joint tenancy, the right of survivorship ensures that the deceased co-owner's share automatically passes to the surviving co-owners, bypassing probate. Tenancy in common lacks survivorship rights, so a deceased owner's share is distributed according to their will or state intestacy laws, potentially involving probate. Understanding these distinctions is crucial when choosing an ownership structure to control asset transfer after death.

Transferring Ownership: Joint Tenancy vs Tenancy in Common

Transferring ownership in joint tenancy allows the surviving co-owners to automatically inherit the deceased owner's share through the right of survivorship, bypassing probate. In tenancy in common, each owner holds a distinct percentage of the property that can be sold, transferred, or bequeathed independently without affecting other owners' shares. This distinction significantly impacts estate planning and the ease of ownership transfer in real estate holdings.

Financial Implications and Tax Considerations

Joint tenancy offers right of survivorship, which can simplify estate transfer and potentially reduce probate costs, but all owners share equal financial responsibility and income reporting. Tenancy in common allows owners to hold unequal shares and transfer them independently, impacting capital gains taxes differently upon sale or inheritance. Both ownership types require careful consideration of property taxes, mortgage liabilities, and potential estate tax consequences to optimize financial outcomes.

Pros and Cons of Joint Tenancy

Joint Tenancy offers the advantage of survivorship rights, allowing property ownership to automatically transfer to remaining co-owners upon a tenant's death, which simplifies estate planning and avoids probate. However, this structure requires all tenants to hold equal shares, limiting flexibility in ownership percentages and potentially complicating financial arrangements. Joint Tenancy also exposes the property to the risk that one owner's creditors can place a lien on the entire property, affecting all co-owners.

Pros and Cons of Tenancy in Common

Tenancy in Common offers flexible ownership shares, allowing each co-owner to hold an unequal interest and freely transfer their portion without the others' consent. However, this arrangement lacks the right of survivorship, meaning upon a co-owner's death, their share passes according to their will or estate plan, potentially complicating ownership continuity. Disputes may arise from differing intentions among co-owners, and partition actions could force a sale of the property, creating uncertainty for all parties involved.

Joint Tenancy vs Tenancy in Common Infographic

difterm.com

difterm.com