A Broker Price Opinion (BPO) provides a quick estimate of a property's value, often used by banks and lenders, while a Comparative Market Analysis (CMA) offers a detailed evaluation based on recent sales data of similar homes in the area, typically prepared by real estate agents. Both tools aid in determining market value but differ in depth and purpose, with BPOs being more cost-effective and CMAs delivering more comprehensive insights. Understanding the distinction helps buyers, sellers, and real estate professionals make informed decisions in the property market.

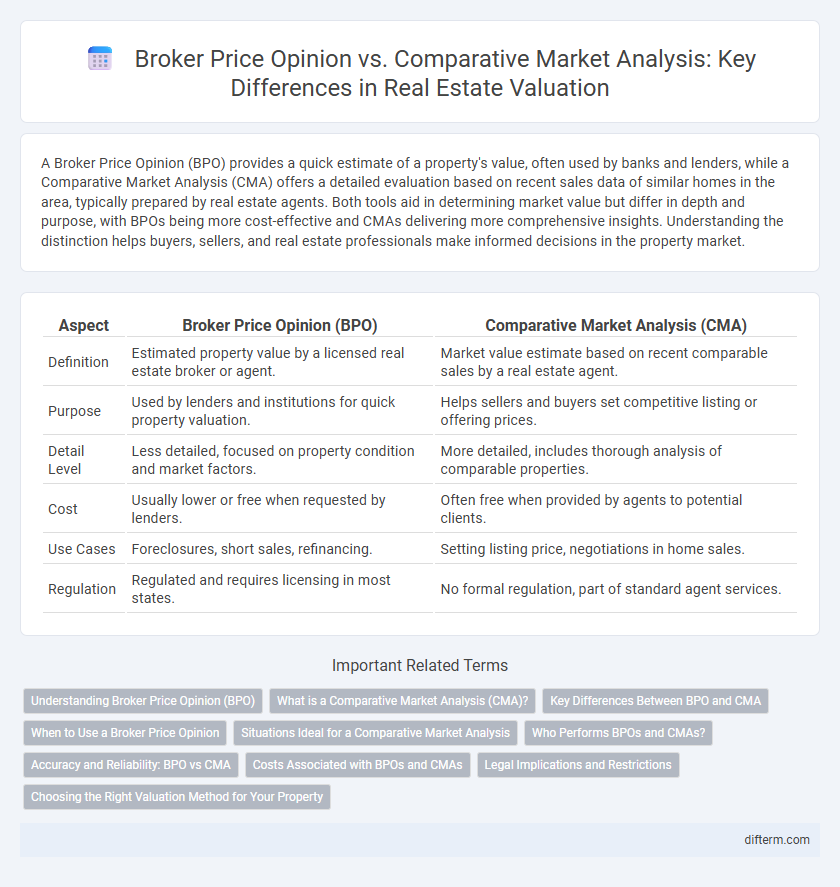

Table of Comparison

| Aspect | Broker Price Opinion (BPO) | Comparative Market Analysis (CMA) |

|---|---|---|

| Definition | Estimated property value by a licensed real estate broker or agent. | Market value estimate based on recent comparable sales by a real estate agent. |

| Purpose | Used by lenders and institutions for quick property valuation. | Helps sellers and buyers set competitive listing or offering prices. |

| Detail Level | Less detailed, focused on property condition and market factors. | More detailed, includes thorough analysis of comparable properties. |

| Cost | Usually lower or free when requested by lenders. | Often free when provided by agents to potential clients. |

| Use Cases | Foreclosures, short sales, refinancing. | Setting listing price, negotiations in home sales. |

| Regulation | Regulated and requires licensing in most states. | No formal regulation, part of standard agent services. |

Understanding Broker Price Opinion (BPO)

A Broker Price Opinion (BPO) provides a detailed estimate of a property's value based on current market conditions, recent comparable sales, and property condition. BPOs are commonly used by lenders, real estate agents, and financial institutions to assess collateral value or determine listing prices without the expense of a formal appraisal. Unlike Comparative Market Analysis (CMA), which is primarily designed for helping sellers set listing prices, BPOs offer a more comprehensive valuation often used in short sales, foreclosures, and portfolio evaluations.

What is a Comparative Market Analysis (CMA)?

A Comparative Market Analysis (CMA) is a detailed report used by real estate agents to estimate a property's value based on recently sold, active, and expired listings in the same area. CMAs analyze factors such as location, size, condition, and features to provide a market-driven price range for sellers and buyers. This tool helps clients make informed decisions by reflecting current market trends and comparable property sales.

Key Differences Between BPO and CMA

A Broker Price Opinion (BPO) provides a professional estimate of a property's value based on limited market data and the broker's expertise, often used by lenders for quick evaluations in distressed sales. Comparative Market Analysis (CMA) involves a detailed assessment of recently sold properties, active listings, and market trends to determine a more precise home value, primarily used by real estate agents during buyer or seller consultations. While BPOs rely on fewer data points for expedited decisions, CMAs incorporate comprehensive market comparisons for accuracy in pricing strategies.

When to Use a Broker Price Opinion

A Broker Price Opinion (BPO) is most effective when a quick, cost-efficient property valuation is needed, such as during short sales, foreclosures, or refinancing decisions. Unlike a Comparative Market Analysis (CMA), which is typically used by sellers and agents to set listing prices, BPOs are frequently utilized by lenders and real estate investors to assess property value without the expense of a full appraisal. Employing a BPO provides timely insights on market trends and property conditions, streamlining decision-making in fast-paced real estate transactions.

Situations Ideal for a Comparative Market Analysis

A Comparative Market Analysis (CMA) is ideal for situations where sellers need accurate pricing guidance based on recent sales of similar properties in the same neighborhood. Real estate agents use CMAs to help homeowners set competitive listing prices and to support negotiation strategies with data-driven market insights. Unlike Broker Price Opinions, CMAs provide detailed, neighborhood-specific comparisons essential for pricing decisions in balanced or seller's markets.

Who Performs BPOs and CMAs?

Real estate brokers or licensed agents typically perform Broker Price Opinions (BPOs) to estimate property values for lenders or buyers when a full appraisal is unnecessary. Comparative Market Analyses (CMAs) are usually conducted by real estate agents to help sellers set competitive listing prices based on recent sales of similar properties in the same area. Both BPOs and CMAs rely on the expertise and market knowledge of professionals, but BPOs often serve financial institutions while CMAs primarily assist individual sellers and buyers.

Accuracy and Reliability: BPO vs CMA

Broker Price Opinions (BPOs) typically offer quicker, less detailed property valuations performed by licensed brokers, which may sacrifice some accuracy compared to Comparative Market Analyses (CMAs). CMAs provide more comprehensive evaluations by analyzing multiple comparable properties in detail, enhancing reliability in pricing decisions. Real estate professionals often consider CMAs more trustworthy for precise market value assessments, while BPOs serve as efficient estimates in fast-paced scenarios.

Costs Associated with BPOs and CMAs

Broker Price Opinions (BPOs) typically cost between $50 and $150, providing a cost-effective valuation method often used by lenders and real estate agents for quick property assessments. Comparative Market Analyses (CMAs) are generally free when provided by real estate agents as part of their marketing strategy but can incur indirect costs related to commission-based transactions. Understanding the cost differences is crucial for sellers and buyers seeking accurate yet budget-conscious property valuations in competitive markets.

Legal Implications and Restrictions

Broker Price Opinions (BPOs) and Comparative Market Analyses (CMAs) differ significantly in legal standing and regulatory restrictions within real estate transactions. BPOs, often performed by licensed brokers or agents, serve as estimated property value reports intended for lenders and financial institutions, but their use is restricted by state laws to prevent unlicensed appraisal practices. CMAs, on the other hand, are informal analyses prepared exclusively for clients by real estate agents to assist in pricing decisions, with fewer regulatory constraints but no formal legal weight as appraisals in contract or litigation contexts.

Choosing the Right Valuation Method for Your Property

Broker Price Opinion (BPO) provides a quick, cost-effective estimate of property value using current market data and professional expertise, ideal for lenders and investors seeking fast assessments. Comparative Market Analysis (CMA) offers a detailed evaluation based on recent sales of similar properties, tailored for sellers and buyers aiming for precise pricing strategies. Choosing between BPO and CMA depends on your need for speed versus accuracy, with CMA generally preferred for listing decisions and BPO favored for lending or portfolio management.

Broker Price Opinion vs Comparative Market Analysis Infographic

difterm.com

difterm.com