A lien waiver is a legal document that property owners, contractors, or suppliers sign to waive future lien rights on a property after receiving payment. A mechanics lien, on the other hand, is a claim filed by contractors or suppliers to secure payment for labor or materials provided during a construction or renovation project. Understanding the distinction between lien waivers and mechanics liens is crucial for homeowners and real estate investors to protect their property interests and avoid potential legal disputes.

Table of Comparison

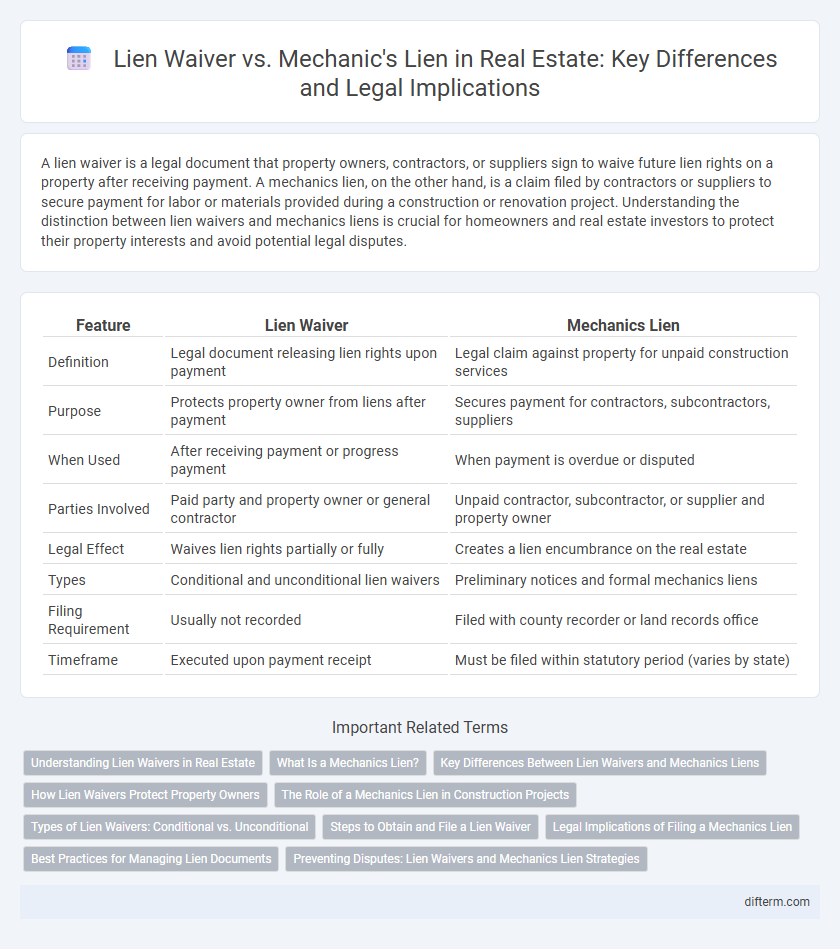

| Feature | Lien Waiver | Mechanics Lien |

|---|---|---|

| Definition | Legal document releasing lien rights upon payment | Legal claim against property for unpaid construction services |

| Purpose | Protects property owner from liens after payment | Secures payment for contractors, subcontractors, suppliers |

| When Used | After receiving payment or progress payment | When payment is overdue or disputed |

| Parties Involved | Paid party and property owner or general contractor | Unpaid contractor, subcontractor, or supplier and property owner |

| Legal Effect | Waives lien rights partially or fully | Creates a lien encumbrance on the real estate |

| Types | Conditional and unconditional lien waivers | Preliminary notices and formal mechanics liens |

| Filing Requirement | Usually not recorded | Filed with county recorder or land records office |

| Timeframe | Executed upon payment receipt | Must be filed within statutory period (varies by state) |

Understanding Lien Waivers in Real Estate

Lien waivers serve as legal documents in real estate transactions that protect property owners by relinquishing the right to file a mechanics lien after receiving payment. These waivers ensure that contractors, subcontractors, and suppliers cannot claim unpaid work or materials once they acknowledge payment, which streamlines the closing process. Understanding the distinct roles of lien waivers and mechanics liens is essential for mitigating risks and securing clear property titles during construction projects.

What Is a Mechanics Lien?

A mechanics lien is a legal claim filed by contractors, subcontractors, or suppliers who have provided labor or materials for a construction project and have not been paid. This lien ensures their right to seek payment by placing a hold on the property title, which can affect the owner's ability to sell or refinance. Understanding mechanics liens is crucial for property owners to avoid potential financial and legal complications during or after construction.

Key Differences Between Lien Waivers and Mechanics Liens

Lien waivers are legal documents signed by contractors or suppliers waiving their right to file a mechanics lien after receiving payment, ensuring clear title transfer in real estate transactions. Mechanics liens are claims filed against a property by contractors or suppliers who have not been paid for their work or materials, providing a security interest that can lead to foreclosure if debts remain unpaid. The key differences lie in their purpose and timing: lien waivers facilitate smooth payment closure, while mechanics liens serve as a protective remedy for unpaid parties.

How Lien Waivers Protect Property Owners

Lien waivers protect property owners by providing documented proof that contractors, subcontractors, or suppliers have been paid for their work or materials, preventing future claims on the property. These waivers eliminate the risk of mechanics liens, which can encumber the title and complicate property transactions or refinancing. Using lien waivers as a standard part of payment procedures ensures clear ownership and reduces legal disputes in real estate projects.

The Role of a Mechanics Lien in Construction Projects

A mechanics lien provides contractors, subcontractors, and suppliers a legal claim against a property when they have not been paid for work or materials supplied on a construction project. This lien ensures that property owners fulfill payment obligations by placing a hold on the property's title, protecting the financial interests of those who contributed labor or materials. Unlike lien waivers that release lien rights upon payment, mechanics liens serve as a critical enforcement tool to secure compensation in real estate transactions.

Types of Lien Waivers: Conditional vs. Unconditional

Conditional lien waivers are effective only after payment is verified, protecting contractors until funds are secured, while unconditional lien waivers relinquish lien rights immediately upon signing regardless of payment status. Choosing between conditional and unconditional lien waivers impacts risk management in construction projects and can affect cash flow and legal protections. Understanding these distinctions is crucial for contractors, subcontractors, and property owners to safeguard payments and avoid potential disputes.

Steps to Obtain and File a Lien Waiver

To obtain and file a lien waiver, start by verifying payment completion for services or materials provided on the property. Next, prepare the lien waiver form specifying the type--partial or final--clearly stating the amount paid and relinquishing lien rights accordingly. Finally, have the waiver signed by the party waiving the lien rights and file or exchange it with the property owner or relevant stakeholders to ensure proper record-keeping and prevent future claims.

Legal Implications of Filing a Mechanics Lien

Filing a mechanics lien secures payment by legally encumbering the property, potentially leading to foreclosure if debts remain unpaid. It creates a public record that alerts future buyers and lenders about outstanding claims, thereby affecting title clearance and property transfer processes. Legal challenges can arise from improper filing, requiring strict adherence to state-specific deadlines and documentation to maintain lien validity.

Best Practices for Managing Lien Documents

Effective management of lien documents involves understanding the key differences between lien waivers and mechanics liens, with lien waivers serving as legal releases of lien rights upon payment receipt, while mechanics liens secure payment by holding a claim on the property. Best practices include obtaining signed lien waivers promptly after each payment to prevent disputes and systematically tracking mechanics lien deadlines to safeguard property interests. Utilizing digital lien waiver platforms and maintaining organized records enhances compliance and minimizes risks associated with lien claims in real estate transactions.

Preventing Disputes: Lien Waivers and Mechanics Lien Strategies

Lien waivers serve as crucial documents that contractors and subcontractors sign to relinquish their right to file a mechanics lien after receiving payment, effectively preventing payment disputes in real estate projects. Mechanics liens provide a legal claim against a property when payments are overdue, ensuring contractors have leverage to secure outstanding funds but can lead to costly disputes if improperly managed. Employing a strategic combination of timely lien waivers and proactive mechanics lien filings safeguards all parties involved by promoting transparency and minimizing legal conflicts.

Lien Waiver vs Mechanics Lien Infographic

difterm.com

difterm.com