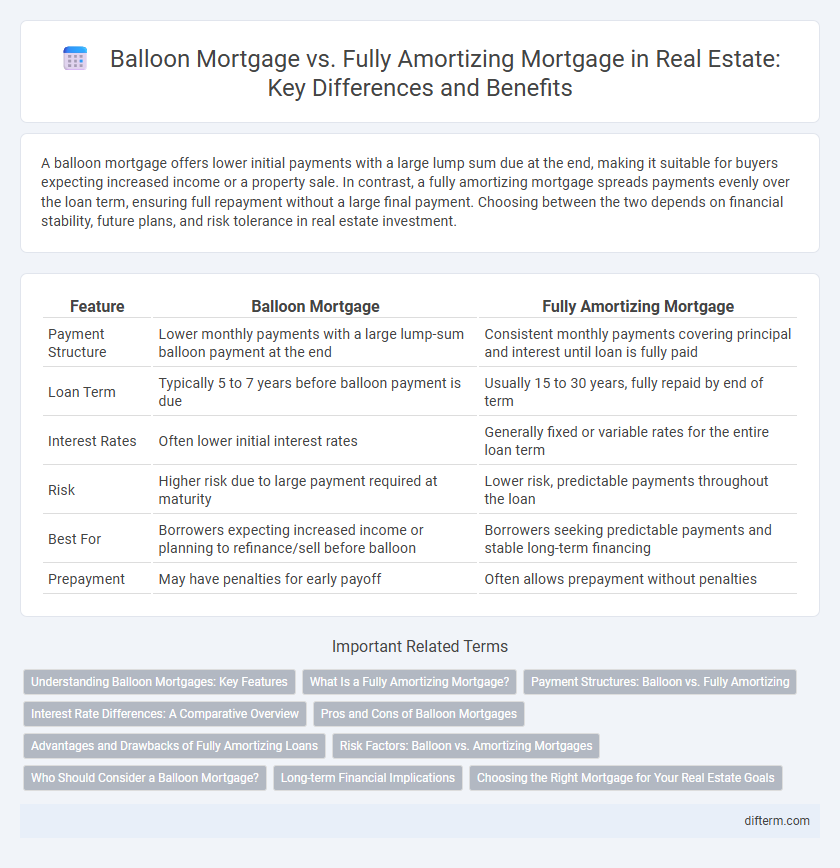

A balloon mortgage offers lower initial payments with a large lump sum due at the end, making it suitable for buyers expecting increased income or a property sale. In contrast, a fully amortizing mortgage spreads payments evenly over the loan term, ensuring full repayment without a large final payment. Choosing between the two depends on financial stability, future plans, and risk tolerance in real estate investment.

Table of Comparison

| Feature | Balloon Mortgage | Fully Amortizing Mortgage |

|---|---|---|

| Payment Structure | Lower monthly payments with a large lump-sum balloon payment at the end | Consistent monthly payments covering principal and interest until loan is fully paid |

| Loan Term | Typically 5 to 7 years before balloon payment is due | Usually 15 to 30 years, fully repaid by end of term |

| Interest Rates | Often lower initial interest rates | Generally fixed or variable rates for the entire loan term |

| Risk | Higher risk due to large payment required at maturity | Lower risk, predictable payments throughout the loan |

| Best For | Borrowers expecting increased income or planning to refinance/sell before balloon | Borrowers seeking predictable payments and stable long-term financing |

| Prepayment | May have penalties for early payoff | Often allows prepayment without penalties |

Understanding Balloon Mortgages: Key Features

Balloon mortgages feature lower initial monthly payments with a large lump-sum payment due at the loan's end, typically after 5 to 7 years, contrasting fully amortizing mortgages that spread payments evenly over the loan term. Borrowers benefit from reduced early costs but face the risk of refinancing or paying off the balloon payment in full once the term expires. Understanding the balloon structure is essential for real estate investors seeking short-term financing strategies or anticipating property sale before maturity.

What Is a Fully Amortizing Mortgage?

A fully amortizing mortgage is a loan with fixed monthly payments that cover both principal and interest, ensuring the entire loan balance is paid off by the end of the term, typically 15 or 30 years. This type of mortgage eliminates the risk of a large lump-sum payment, unlike a balloon mortgage where the borrower must pay a substantial remaining balance at the loan's maturity. Fully amortizing loans provide predictable budgeting and long-term financial stability for homeowners.

Payment Structures: Balloon vs. Fully Amortizing

Balloon mortgages feature lower initial monthly payments followed by a large lump-sum payment at the loan's end, requiring borrowers to prepare for substantial refinance or payoff amounts. Fully amortizing mortgages spread payments evenly over the loan term, ensuring the principal and interest are completely paid off by maturity without any large final balance. The choice between these payment structures hinges on cash flow preferences and the borrower's ability to manage potential refinancing risks.

Interest Rate Differences: A Comparative Overview

Balloon mortgages generally offer lower initial interest rates compared to fully amortizing mortgages, making them attractive for short-term financing or quick property turnover. Fully amortizing mortgages have higher rates but provide consistent payments that gradually reduce principal and interest over the loan term, reducing risk for both lenders and borrowers. The interest rate difference reflects the lender's risk exposure and the loan's repayment structure, influencing borrower choice based on financial goals and market conditions.

Pros and Cons of Balloon Mortgages

Balloon mortgages offer lower initial monthly payments compared to fully amortizing mortgages, making them attractive for borrowers expecting increased income or planning to refinance before the balloon payment due date. However, the risk of a large lump-sum payment at the end of the term creates potential financial strain if refinancing options are unavailable or if property values decline. Balloon mortgages can provide short-term cash flow advantages but carry greater uncertainty than fully amortizing loans, which evenly distribute principal and interest payments over the loan term.

Advantages and Drawbacks of Fully Amortizing Loans

Fully amortizing loans provide predictable monthly payments that cover both principal and interest, ensuring the loan is completely paid off by the end of the term. This type of mortgage reduces the risk of large unexpected payments, making budgeting easier and offering long-term financial stability. However, fully amortizing loans typically have higher monthly payments compared to balloon mortgages, which may limit cash flow flexibility for some borrowers.

Risk Factors: Balloon vs. Amortizing Mortgages

Balloon mortgages carry significant risk due to the large lump-sum payment required at the end of the term, which may be challenging to refinance or pay off, especially if market conditions deteriorate or property values decline. Fully amortizing mortgages mitigate this risk by spreading principal and interest payments evenly over the loan term, ensuring the loan is fully paid off without unexpected large payments. Borrowers with balloon mortgages face greater financial uncertainty and potential default risk compared to those with fully amortizing loans.

Who Should Consider a Balloon Mortgage?

Homebuyers with short-term financial plans or those expecting significant income growth often consider balloon mortgages as a strategic financing option. Real estate investors seeking lower initial monthly payments before refinancing or selling the property may benefit from the structure of a balloon mortgage. Borrowers confident in future refinancing opportunities or property appreciation find balloon mortgages advantageous compared to fully amortizing loans that require constant, gradual repayment.

Long-term Financial Implications

Balloon mortgages require a large lump-sum payment at the end of the loan term, creating potential refinancing risks and exposing borrowers to interest rate fluctuations, which can increase long-term costs. Fully amortizing mortgages spread payments evenly over the loan duration, resulting in predictable monthly expenses and gradual equity buildup, supporting stable financial planning. Choosing between these mortgage types significantly impacts long-term financial stability and cash flow management for real estate investors.

Choosing the Right Mortgage for Your Real Estate Goals

A balloon mortgage offers lower initial payments with a large lump-sum due at the end, ideal for short-term real estate investments or plans to refinance before the balloon payment. Fully amortizing mortgages provide consistent payments that cover both principal and interest, building equity steadily over the loan term and suiting long-term property ownership goals. Evaluating cash flow, investment horizon, and risk tolerance helps determine whether a balloon or fully amortizing mortgage aligns best with your real estate objectives.

balloon mortgage vs fully amortizing mortgage Infographic

difterm.com

difterm.com