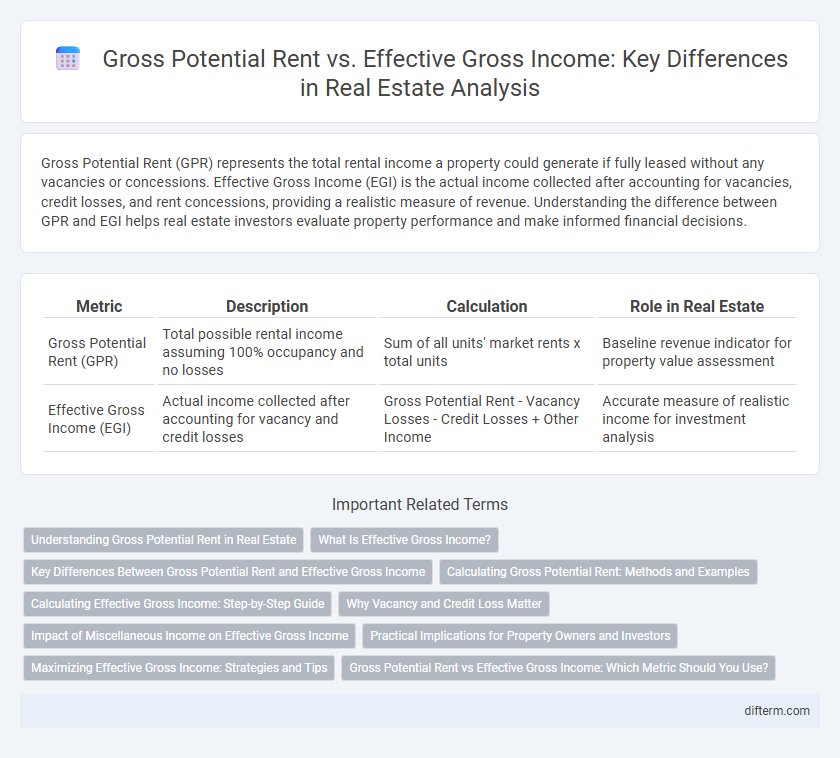

Gross Potential Rent (GPR) represents the total rental income a property could generate if fully leased without any vacancies or concessions. Effective Gross Income (EGI) is the actual income collected after accounting for vacancies, credit losses, and rent concessions, providing a realistic measure of revenue. Understanding the difference between GPR and EGI helps real estate investors evaluate property performance and make informed financial decisions.

Table of Comparison

| Metric | Description | Calculation | Role in Real Estate |

|---|---|---|---|

| Gross Potential Rent (GPR) | Total possible rental income assuming 100% occupancy and no losses | Sum of all units' market rents x total units | Baseline revenue indicator for property value assessment |

| Effective Gross Income (EGI) | Actual income collected after accounting for vacancy and credit losses | Gross Potential Rent - Vacancy Losses - Credit Losses + Other Income | Accurate measure of realistic income for investment analysis |

Understanding Gross Potential Rent in Real Estate

Gross Potential Rent (GPR) represents the total rental income a property can generate if fully leased at market rental rates, before any deductions or vacancies. It serves as a baseline metric for evaluating rental property performance and forecasting revenue potential. GPR differs from Effective Gross Income (EGI), which accounts for actual collections after vacancies, concessions, and credit losses, providing a more realistic income estimate.

What Is Effective Gross Income?

Effective Gross Income (EGI) represents the total income a property generates after accounting for vacancy losses and credit losses, offering a more accurate reflection of rental income than Gross Potential Rent (GPR). While Gross Potential Rent indicates the maximum possible income if the property is fully leased at market rates, EGI adjusts this figure to reflect actual collections and realistic occupancy levels. Investors use EGI to assess the property's true revenue potential and inform financial decisions such as valuation and cash flow analysis.

Key Differences Between Gross Potential Rent and Effective Gross Income

Gross Potential Rent (GPR) represents the total rental income a property can generate if fully leased at market rates without any deductions, reflecting the maximum revenue potential. Effective Gross Income (EGI) accounts for actual rental income received, subtracting losses from vacancies, tenant defaults, and adding other income streams such as fees or service charges, providing a more realistic measure of income. The key difference lies in GPR being a theoretical maximum, while EGI offers a practical, net figure essential for accurate property valuation and cash flow analysis.

Calculating Gross Potential Rent: Methods and Examples

Gross Potential Rent (GPR) is calculated by multiplying the total rentable square footage of a property by the market rental rate per square foot, assuming full occupancy without any deductions for vacancies or concessions. For example, a 10,000 square foot office building leased at $20 per square foot annually results in a GPR of $200,000. This provides the baseline revenue before accounting for vacancies and credit losses, which are deducted to determine Effective Gross Income (EGI).

Calculating Effective Gross Income: Step-by-Step Guide

Calculating Effective Gross Income (EGI) starts with determining the Gross Potential Rent (GPR), which represents the total rental income a property could generate if fully leased at market rates. Subtract vacancy and collection losses from the GPR to accurately reflect anticipated income loss due to unoccupied units or unpaid rent. Add any additional income from sources like parking fees or laundry facilities to complete the EGI calculation, providing a realistic estimate of a property's revenue potential.

Why Vacancy and Credit Loss Matter

Vacancy and credit loss are critical factors affecting the difference between Gross Potential Rent (GPR) and Effective Gross Income (EGI) in real estate. GPR represents the total rental income a property can generate at full occupancy, while EGI accounts for income loss due to vacancies and tenant defaults, directly impacting cash flow and property valuation. Accurate estimation of vacancy and credit loss rates is essential for investors to project realistic income streams and make informed investment decisions.

Impact of Miscellaneous Income on Effective Gross Income

Gross Potential Rent (GPR) represents the total rental income a property can generate at full occupancy and market rent without deductions. Effective Gross Income (EGI) includes GPR reduced by vacancies and collection losses, but importantly adds miscellaneous income from sources such as parking fees, laundry, and service charges. Miscellaneous income significantly boosts EGI, enhancing overall property revenue beyond the base rental income, which is crucial for accurate financial analysis and investment decisions in real estate.

Practical Implications for Property Owners and Investors

Gross Potential Rent (GPR) represents the total rental income a property could generate at full occupancy without deductions, serving as a benchmark for maximum revenue potential. Effective Gross Income (EGI) accounts for actual collected rent after vacancy losses and other income adjustments, providing a realistic measure of cash flow. Understanding the gap between GPR and EGI helps property owners and investors accurately assess property performance, optimize rent pricing strategies, and forecast investment returns.

Maximizing Effective Gross Income: Strategies and Tips

Maximizing effective gross income involves strategically reducing vacancies and minimizing concessions to close the gap between gross potential rent and actual collected rent. Implementing targeted marketing campaigns, optimizing lease renewal processes, and adjusting rental rates based on market trends enhance tenant retention and occupancy rates. Leveraging property management software for real-time rent tracking and proactive maintenance scheduling further ensures consistent cash flow and higher effective gross income.

Gross Potential Rent vs Effective Gross Income: Which Metric Should You Use?

Gross Potential Rent (GPR) represents the total possible rental income of a property assuming 100% occupancy and no collection losses, serving as a benchmark for maximum revenue potential. Effective Gross Income (EGI) accounts for actual rental income after vacancy and credit losses, providing a realistic view of income flow. Choosing between GPR and EGI depends on whether you prioritize forecasting maximum income potential or assessing current, accurate cash flow performance in real estate investments.

Gross Potential Rent vs Effective Gross Income Infographic

difterm.com

difterm.com