Choosing between a primary residence and an investment property impacts financing options, tax benefits, and long-term financial goals. Primary residences often qualify for lower interest rates and tax deductions like mortgage interest, while investment properties offer opportunities for rental income and property appreciation. Evaluating your lifestyle needs and financial objectives helps determine the best real estate strategy to maximize returns and personal satisfaction.

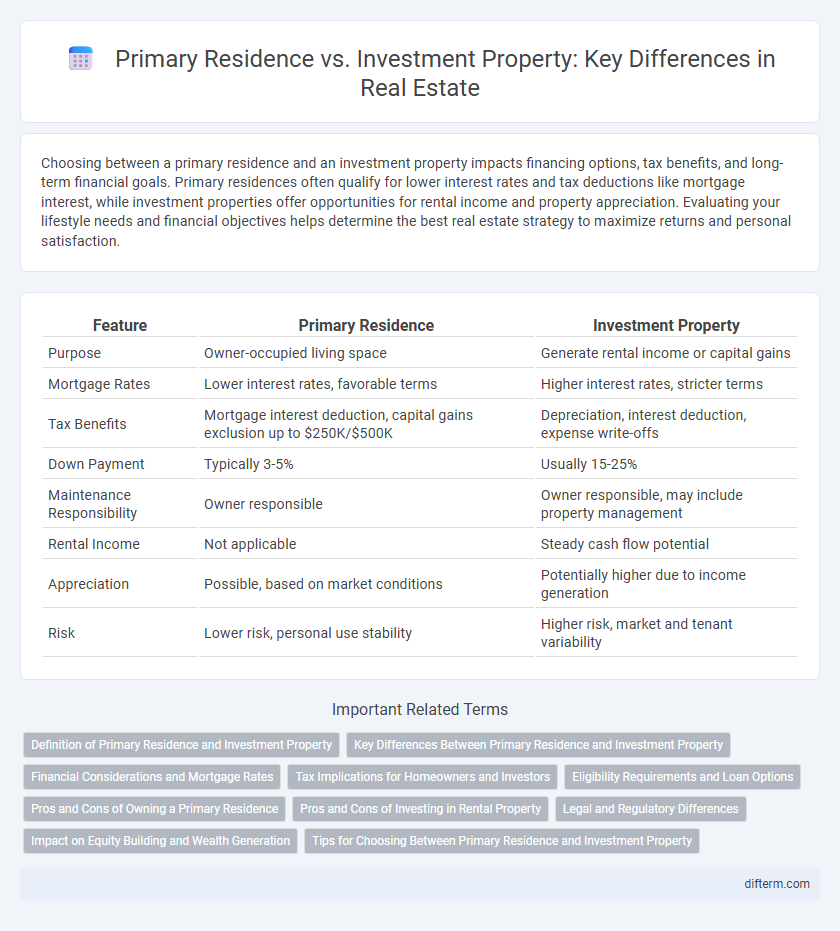

Table of Comparison

| Feature | Primary Residence | Investment Property |

|---|---|---|

| Purpose | Owner-occupied living space | Generate rental income or capital gains |

| Mortgage Rates | Lower interest rates, favorable terms | Higher interest rates, stricter terms |

| Tax Benefits | Mortgage interest deduction, capital gains exclusion up to $250K/$500K | Depreciation, interest deduction, expense write-offs |

| Down Payment | Typically 3-5% | Usually 15-25% |

| Maintenance Responsibility | Owner responsible | Owner responsible, may include property management |

| Rental Income | Not applicable | Steady cash flow potential |

| Appreciation | Possible, based on market conditions | Potentially higher due to income generation |

| Risk | Lower risk, personal use stability | Higher risk, market and tenant variability |

Definition of Primary Residence and Investment Property

A primary residence is a home where the owner lives most of the time, serving as their main dwelling and legal address for purposes like voting and tax filings. An investment property is real estate purchased primarily to generate rental income or to appreciate in value, not intended as the owner's main living space. Understanding these definitions is crucial for tax implications, mortgage rates, and eligibility for certain deductions or credits.

Key Differences Between Primary Residence and Investment Property

Primary residences offer tax benefits such as mortgage interest deductions and capital gains exclusions that investment properties do not provide. Investment properties typically generate rental income and appreciate in value, but they are subject to different tax rules, including depreciation and stricter loan requirements. Financing options vary significantly, with primary residences often qualifying for lower interest rates and down payment standards compared to investment properties.

Financial Considerations and Mortgage Rates

Primary residences often qualify for lower mortgage rates and offer tax benefits such as mortgage interest deductions, which reduce overall borrowing costs. Investment properties typically have higher interest rates, larger down payment requirements, and limited tax advantages, increasing financial risk and reducing cash flow. Understanding the impact of these factors on loan terms and monthly payments is essential for optimizing real estate investment strategies.

Tax Implications for Homeowners and Investors

Homeowners benefit from tax deductions on mortgage interest and property taxes for their primary residence, which can significantly reduce their taxable income. Investment properties offer opportunities to deduct expenses such as maintenance, depreciation, and loan interest, while rental income must be reported and taxed. Understanding the distinct tax treatments of primary residences versus investment properties is crucial for maximizing financial advantages and ensuring compliance with IRS regulations.

Eligibility Requirements and Loan Options

Primary residence loans typically require the borrower to occupy the property within a set timeframe and may offer lower interest rates with smaller down payment options, such as FHA or VA loans. Investment property financing demands stricter eligibility criteria, including higher credit scores and larger down payments--usually 15-25%--while offering fewer government-backed loan options and often resulting in higher interest rates. Understanding these distinctions helps buyers choose the optimal loan product tailored to their property use and financial goals.

Pros and Cons of Owning a Primary Residence

Owning a primary residence offers significant tax benefits, such as mortgage interest deductions and exclusions on capital gains after five years of ownership, enhancing long-term financial stability. However, it also requires ongoing maintenance costs and limits flexibility due to the emotional attachment and commitment to one location. Unlike investment properties, primary residences do not generate rental income, potentially reducing short-term cash flow opportunities.

Pros and Cons of Investing in Rental Property

Investing in rental property offers steady passive income and potential tax benefits through deductions on mortgage interest, property depreciation, and maintenance costs. However, it requires significant upfront capital, ongoing management efforts, and exposes investors to risks like tenant vacancies and fluctuating property values. Balancing cash flow potential with these challenges is crucial for maximizing returns in real estate investment portfolios.

Legal and Regulatory Differences

Primary residences are subject to stringent legal protections like homestead exemptions and zoning laws favoring owner-occupants, whereas investment properties face regulations targeting landlords, including tenant rights and property maintenance standards. Tax codes differ significantly, with primary residences often benefiting from capital gains exclusions and mortgage interest deductions not fully available for investment properties. Local regulations may impose stricter licensing, eviction procedures, and safety compliance on rental units compared to owner-occupied homes.

Impact on Equity Building and Wealth Generation

A primary residence often accelerates equity building through consistent mortgage payments and property appreciation, providing a stable wealth foundation. Investment properties generate wealth by producing rental income and potential tax benefits, though they require active management and carry higher risk. Balancing these factors is crucial for maximizing long-term financial growth in real estate portfolios.

Tips for Choosing Between Primary Residence and Investment Property

Evaluate your financial goals and risk tolerance before deciding between a primary residence and an investment property. Prioritize location analysis, market trends, and potential rental income to maximize investment returns. Consider tax benefits, maintenance costs, and long-term value appreciation to make an informed real estate decision.

Primary Residence vs Investment Property Infographic

difterm.com

difterm.com