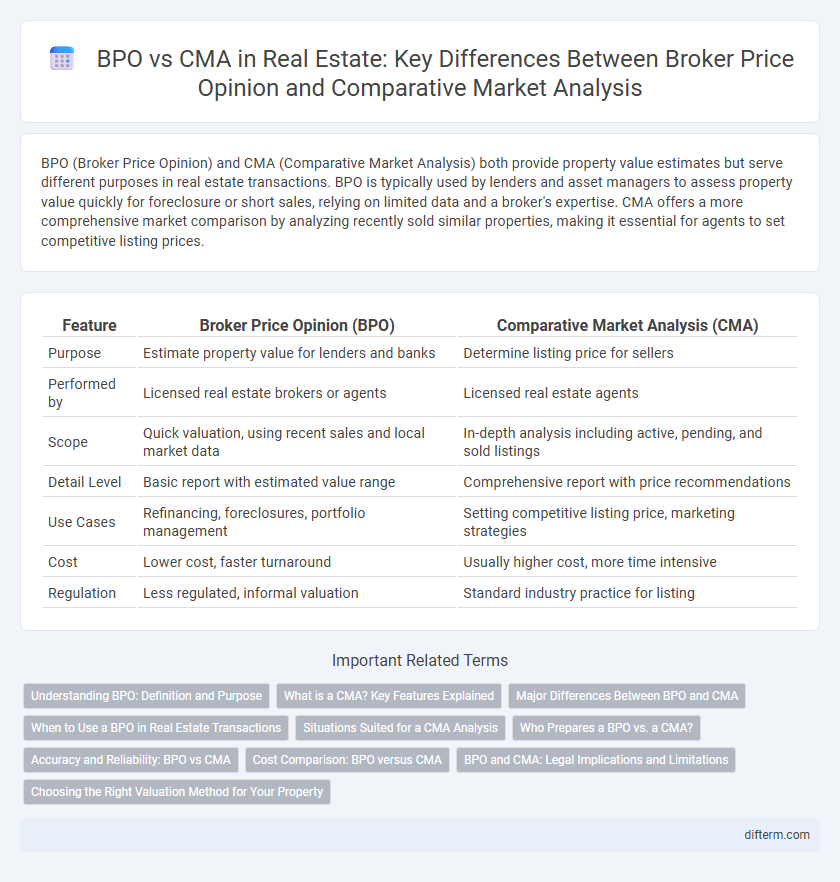

BPO (Broker Price Opinion) and CMA (Comparative Market Analysis) both provide property value estimates but serve different purposes in real estate transactions. BPO is typically used by lenders and asset managers to assess property value quickly for foreclosure or short sales, relying on limited data and a broker's expertise. CMA offers a more comprehensive market comparison by analyzing recently sold similar properties, making it essential for agents to set competitive listing prices.

Table of Comparison

| Feature | Broker Price Opinion (BPO) | Comparative Market Analysis (CMA) |

|---|---|---|

| Purpose | Estimate property value for lenders and banks | Determine listing price for sellers |

| Performed by | Licensed real estate brokers or agents | Licensed real estate agents |

| Scope | Quick valuation, using recent sales and local market data | In-depth analysis including active, pending, and sold listings |

| Detail Level | Basic report with estimated value range | Comprehensive report with price recommendations |

| Use Cases | Refinancing, foreclosures, portfolio management | Setting competitive listing price, marketing strategies |

| Cost | Lower cost, faster turnaround | Usually higher cost, more time intensive |

| Regulation | Less regulated, informal valuation | Standard industry practice for listing |

Understanding BPO: Definition and Purpose

A Broker Price Opinion (BPO) is a property valuation method used by real estate professionals to estimate a home's potential selling price based on market trends, property condition, and comparable sales. Unlike a Comparative Market Analysis (CMA), a BPO is often requested by lenders or banks for quick, cost-effective property assessments during foreclosure or short sale situations. BPOs provide valuable insights when full appraisals are not feasible, helping stakeholders make informed decisions in time-sensitive transactions.

What is a CMA? Key Features Explained

A Comparative Market Analysis (CMA) is a detailed report prepared by real estate professionals to estimate a property's market value based on recent sales of similar homes in the area. Key features include analysis of comparable properties' size, location, condition, and sale prices, providing a data-driven basis for pricing strategies. CMAs help sellers and buyers make informed decisions by reflecting current market trends and competitive pricing dynamics.

Major Differences Between BPO and CMA

Broker Price Opinion (BPO) offers a quick, approximate property valuation often used by lenders to assess collateral value, relying primarily on current market trends and recent sales data. Comparative Market Analysis (CMA) provides a detailed, customized property assessment created by real estate agents, focusing on comparable properties, property condition, and neighborhood specifics to guide pricing decisions. BPOs are generally less comprehensive and less expensive than CMAs, which are more thorough and used for setting competitive listing prices.

When to Use a BPO in Real Estate Transactions

A Broker Price Opinion (BPO) is typically used when a quick, cost-effective property valuation is needed, such as during short sales, foreclosures, or refinancing decisions. BPOs offer lenders and real estate agents a reliable estimate of market value without the expense of a full appraisal, making them ideal for portfolio management or assessing distressed properties. In high-volume markets or situations requiring expedited property assessments, BPOs provide actionable insights that support efficient transaction processes.

Situations Suited for a CMA Analysis

A Comparative Market Analysis (CMA) is best suited for real estate agents assisting home sellers in pricing their property competitively by evaluating recently sold, active, and expired listings within the same neighborhood. CMAs provide a detailed assessment tailored for residential properties, helping determine an optimal listing price that reflects current market trends and buyer demand. This method is ideal in traditional sales scenarios where agents aim to attract qualified buyers through strategic pricing grounded in local market data.

Who Prepares a BPO vs. a CMA?

BPOs (Broker Price Opinions) are typically prepared by licensed real estate brokers or agents who assess the property's value based on market data, condition, and comparable sales but with less detail than appraisals. CMAs (Comparative Market Analyses) are also conducted by real estate agents or brokers specifically to help sellers set competitive listing prices by analyzing similar properties recently sold in the area. Both BPOs and CMAs rely on professional expertise, but BPOs are often requested by financial institutions, while CMAs are primarily used in traditional buying and selling processes.

Accuracy and Reliability: BPO vs CMA

BPOs (Broker Price Opinions) often rely on limited property inspections and market data, which may affect their accuracy compared to CMAs (Comparative Market Analyses) prepared by licensed real estate agents using comprehensive multiple listing service (MLS) data and recent comparable sales. CMAs typically provide higher reliability for pricing decisions due to their detailed analysis of local market trends, property condition, and neighborhood factors. While BPOs are cost-effective and faster, CMAs are preferred for precision in valuation and informed negotiation strategies within residential real estate transactions.

Cost Comparison: BPO versus CMA

BPOs generally cost less than CMAs due to their streamlined process and reliance on limited property data, often provided by real estate brokers or agents. CMAs, conducted by licensed appraisers or realtors, involve comprehensive market research and detailed property analysis, leading to higher fees. For sellers and buyers, choosing between a BPO and CMA depends on budget constraints and the desired accuracy in valuation.

BPO and CMA: Legal Implications and Limitations

Broker Price Opinions (BPOs) and Comparative Market Analyses (CMAs) serve distinct roles in real estate valuations, with BPOs often used in foreclosure and short sale scenarios, while CMAs support pricing strategies for home sales. BPOs typically have stricter legal regulations and limitations, as they require licensure in many states and must comply with lender guidelines, making unauthorized use potentially riskier. CMAs, performed by real estate agents for marketing purposes, generally bear fewer legal liabilities but may lack the formal recognition of BPOs in judicial or financial contexts.

Choosing the Right Valuation Method for Your Property

Selecting the appropriate valuation method depends on your property's purpose, as BPOs offer a quick, cost-effective estimate typically used by lenders and agents for refinancing or short sales, while CMAs provide a detailed market-driven analysis tailored by real estate agents for accurate pricing in active selling scenarios. BPOs rely on fewer data points and less in-depth inspection, resulting in a ballpark figure, whereas CMAs incorporate comprehensive comparable sales, market trends, and property specifics to determine competitive listing prices. Understanding the strengths and limitations of both helps homeowners and investors make informed decisions aligned with their transaction goals and timelines.

BPO vs CMA (Broker Price Opinion vs Comparative Market Analysis) Infographic

difterm.com

difterm.com