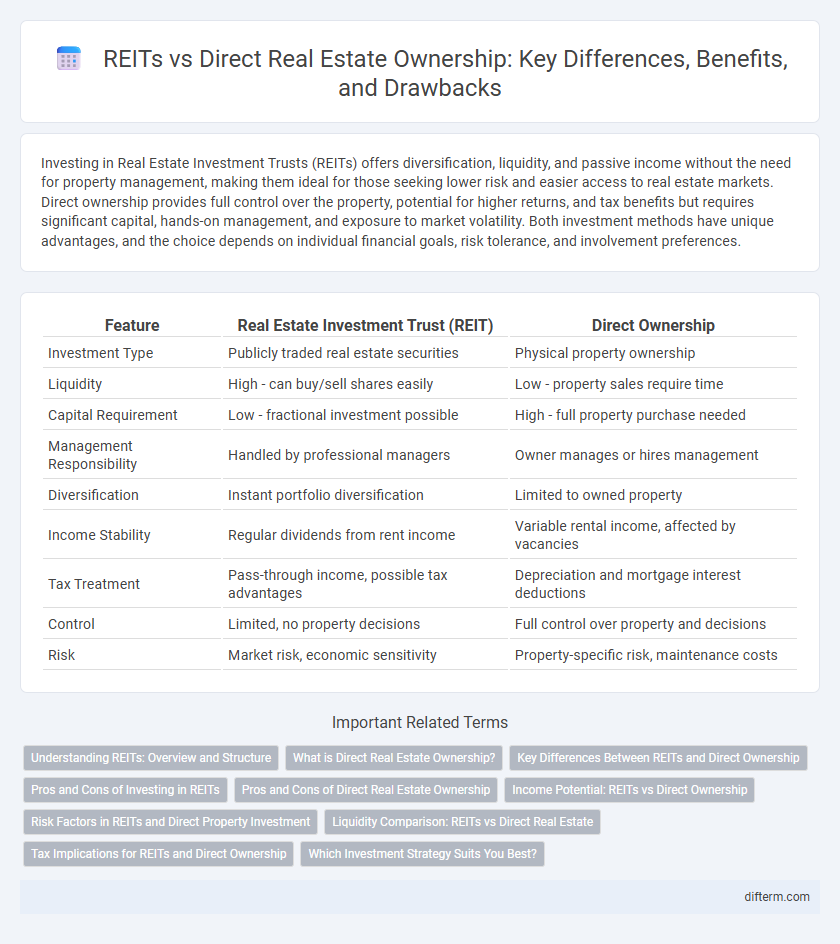

Investing in Real Estate Investment Trusts (REITs) offers diversification, liquidity, and passive income without the need for property management, making them ideal for those seeking lower risk and easier access to real estate markets. Direct ownership provides full control over the property, potential for higher returns, and tax benefits but requires significant capital, hands-on management, and exposure to market volatility. Both investment methods have unique advantages, and the choice depends on individual financial goals, risk tolerance, and involvement preferences.

Table of Comparison

| Feature | Real Estate Investment Trust (REIT) | Direct Ownership |

|---|---|---|

| Investment Type | Publicly traded real estate securities | Physical property ownership |

| Liquidity | High - can buy/sell shares easily | Low - property sales require time |

| Capital Requirement | Low - fractional investment possible | High - full property purchase needed |

| Management Responsibility | Handled by professional managers | Owner manages or hires management |

| Diversification | Instant portfolio diversification | Limited to owned property |

| Income Stability | Regular dividends from rent income | Variable rental income, affected by vacancies |

| Tax Treatment | Pass-through income, possible tax advantages | Depreciation and mortgage interest deductions |

| Control | Limited, no property decisions | Full control over property and decisions |

| Risk | Market risk, economic sensitivity | Property-specific risk, maintenance costs |

Understanding REITs: Overview and Structure

Real Estate Investment Trusts (REITs) provide investors with access to diversified portfolios of income-generating properties without the need for direct property management. Structured as publicly traded companies or private entities, REITs distribute at least 90% of taxable income as dividends, offering liquidity and passive income benefits. Understanding the legal framework, asset composition, and regulatory requirements of REITs is essential for evaluating their role compared to direct real estate ownership.

What is Direct Real Estate Ownership?

Direct real estate ownership involves purchasing and holding physical properties such as residential, commercial, or industrial real estate, allowing investors full control over management decisions, tenant relations, and property improvements. This approach provides potential tax benefits, leverage opportunities through mortgage financing, and the ability to generate rental income and capital appreciation. Unlike Real Estate Investment Trusts (REITs), direct ownership requires significant capital, hands-on management, and exposes investors to market-specific risks and liquidity constraints.

Key Differences Between REITs and Direct Ownership

Real Estate Investment Trusts (REITs) offer liquidity, diversification, and professional management, while direct ownership provides complete control and potential tax benefits like depreciation deductions. REIT investors gain exposure to a broad portfolio of properties without the responsibilities of property maintenance, whereas direct owners manage tenants, repairs, and property improvements directly. REITs trade on public markets with regular dividends, contrasting with the potential for long-term appreciation and income variability found in direct property investment.

Pros and Cons of Investing in REITs

Real Estate Investment Trusts (REITs) offer liquidity and diversification, allowing investors to access a broad portfolio of income-generating properties without large capital commitments. REITs provide steady dividends and professional management but typically lack control over property decisions and may be subject to market volatility. Direct ownership grants full control and potential tax benefits but requires significant capital, active management, and exposure to localized market risks.

Pros and Cons of Direct Real Estate Ownership

Direct real estate ownership offers full control over property management, customization, and decision-making, making it attractive for investors seeking hands-on involvement. It provides potential tax benefits like depreciation deductions and leverage opportunities through mortgage financing, but requires substantial capital and incurs higher liquidity risk compared to REITs. Property maintenance, tenant management, and market volatility pose operational challenges that require active management and expertise.

Income Potential: REITs vs Direct Ownership

Real Estate Investment Trusts (REITs) offer investors consistent dividend income derived from a diversified portfolio of commercial properties, often providing higher liquidity and lower entry costs compared to direct ownership. Direct ownership enables investors to capture rental income directly and benefit from property appreciation but requires active management, higher capital commitment, and potential vacancy risks. Income potential in REITs is typically more stable due to professional management and diversification, while direct ownership can yield greater returns but involves greater operational oversight and market exposure.

Risk Factors in REITs and Direct Property Investment

Real Estate Investment Trusts (REITs) expose investors to market volatility, interest rate fluctuations, and limited control over property management, increasing systemic risk. Direct property ownership involves risks like illiquidity, high capital requirements, tenant default, and maintenance expenses, which can lead to unpredictable cash flow. Understanding these risk factors is crucial for aligning investment strategies with financial goals and risk tolerance.

Liquidity Comparison: REITs vs Direct Real Estate

Real Estate Investment Trusts (REITs) offer significantly higher liquidity compared to direct real estate ownership due to their publicly traded nature, enabling investors to buy and sell shares quickly on stock exchanges. Direct real estate investment involves lengthy transaction processes, legal complexities, and greater time to convert assets into cash. The ability to liquidate REIT shares rapidly provides investors with flexibility and ease in managing their real estate exposure.

Tax Implications for REITs and Direct Ownership

Real Estate Investment Trusts (REITs) offer tax advantages such as avoiding corporate income tax by distributing at least 90% of taxable income to shareholders, who then pay taxes on dividends at their individual rates. Direct ownership allows for depreciation deductions and mortgage interest deductions, reducing taxable income but subjects investors to property taxes and potential capital gains taxes upon sale. Understanding these distinctions helps investors optimize tax liabilities and maximize after-tax returns in real estate portfolios.

Which Investment Strategy Suits You Best?

Real Estate Investment Trusts (REITs) provide investors with diversified property exposure, liquidity, and lower entry costs compared to direct ownership, making them ideal for those seeking passive income and portfolio diversification. Direct ownership requires significant capital, management expertise, and time commitment but offers greater control, potential tax benefits, and long-term appreciation tailored to individual investment goals. Choosing between REITs and direct property investment depends on your risk tolerance, investment horizon, and desired involvement in property management.

Real Estate Investment Trust (REIT) vs Direct Ownership Infographic

difterm.com

difterm.com