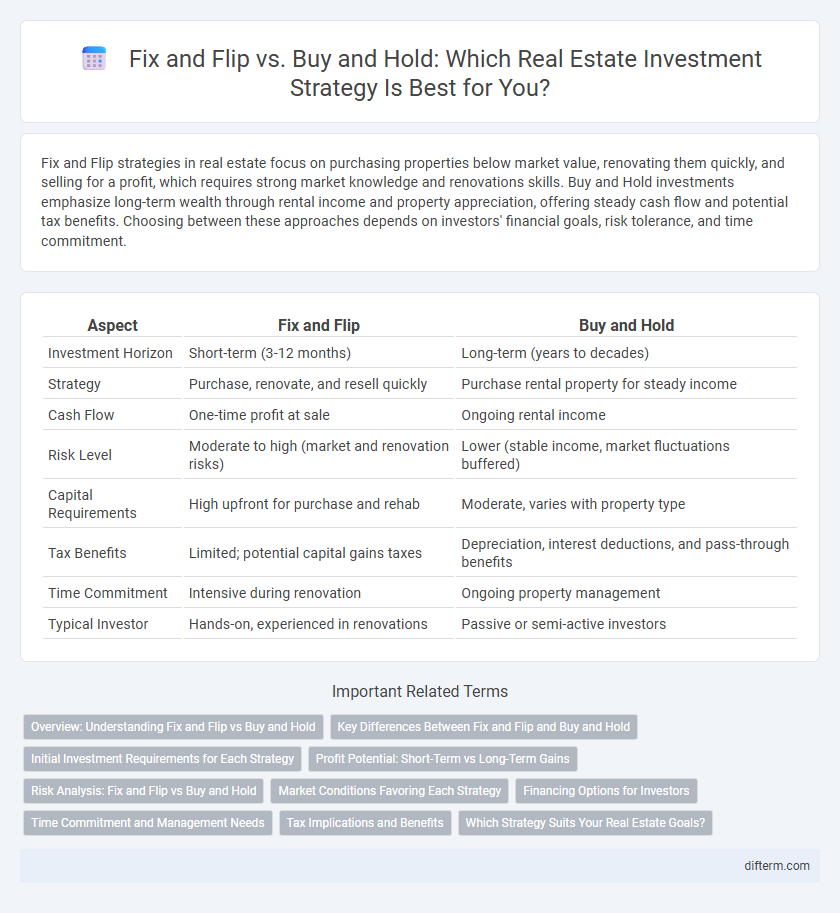

Fix and Flip strategies in real estate focus on purchasing properties below market value, renovating them quickly, and selling for a profit, which requires strong market knowledge and renovations skills. Buy and Hold investments emphasize long-term wealth through rental income and property appreciation, offering steady cash flow and potential tax benefits. Choosing between these approaches depends on investors' financial goals, risk tolerance, and time commitment.

Table of Comparison

| Aspect | Fix and Flip | Buy and Hold |

|---|---|---|

| Investment Horizon | Short-term (3-12 months) | Long-term (years to decades) |

| Strategy | Purchase, renovate, and resell quickly | Purchase rental property for steady income |

| Cash Flow | One-time profit at sale | Ongoing rental income |

| Risk Level | Moderate to high (market and renovation risks) | Lower (stable income, market fluctuations buffered) |

| Capital Requirements | High upfront for purchase and rehab | Moderate, varies with property type |

| Tax Benefits | Limited; potential capital gains taxes | Depreciation, interest deductions, and pass-through benefits |

| Time Commitment | Intensive during renovation | Ongoing property management |

| Typical Investor | Hands-on, experienced in renovations | Passive or semi-active investors |

Overview: Understanding Fix and Flip vs Buy and Hold

Fix and Flip involves purchasing properties at a lower price, renovating them quickly, and selling for immediate profit, appealing to investors seeking short-term returns. Buy and Hold focuses on acquiring properties to generate steady rental income and long-term appreciation, benefiting from market growth and tax advantages. Both strategies require careful market analysis, but Fix and Flip demands faster execution, while Buy and Hold emphasizes long-term property management and financial stability.

Key Differences Between Fix and Flip and Buy and Hold

Fix and flip involves purchasing properties in need of renovation, making improvements quickly, and selling for a profit within a short timeframe, whereas buy and hold focuses on acquiring rental properties to generate long-term passive income and equity growth. Fix and flip typically requires significant upfront capital, extensive market knowledge, and active project management, while buy and hold demands ongoing property management and tenant relations to maintain cash flow. The key financial difference lies in fix and flip delivering one-time profits from property appreciation and renovations, compared to buy and hold's steady, recurring rental income combined with amortization and potential tax benefits.

Initial Investment Requirements for Each Strategy

Fix and flip strategies typically require a substantial initial investment covering property acquisition, renovation costs, and holding expenses, often demanding access to liquid capital or hard money loans. Buy and hold approaches involve purchasing properties with sufficient down payments, closing costs, and reserves for maintenance and vacancy, generally requiring lower upfront cash but longer-term financial commitment. Understanding these distinct capital needs is crucial for investors to align their funding strategies with their investment goals.

Profit Potential: Short-Term vs Long-Term Gains

Fix and flip properties offer rapid profit potential by purchasing undervalued homes, renovating them, and selling quickly for immediate returns, typically within months. Buy and hold strategies generate long-term gains through property appreciation and steady rental income, benefiting from compound growth and tax advantages over years or decades. Investors seeking quick capital prefer fix and flip, while those targeting sustained wealth accumulation favor buy and hold approaches.

Risk Analysis: Fix and Flip vs Buy and Hold

Fix and Flip properties often carry higher short-term risk due to market volatility and unforeseen renovation costs, requiring precise timing and strong project management skills. Buy and Hold strategies generally present lower immediate risk by generating steady rental income and benefiting from long-term property appreciation, but they require ongoing maintenance and tenant management. Investors must weigh the liquidity challenges and market exposure of Fix and Flip against the steady cash flow and potential tax advantages associated with Buy and Hold real estate investments.

Market Conditions Favoring Each Strategy

Fix and flip strategies thrive in rapidly appreciating markets where property values increase quickly, allowing investors to capitalize on short-term gains through renovations and resale. Buy and hold approaches perform best in stable or growing rental markets with steady demand, providing consistent cash flow and long-term appreciation. Understanding local economic indicators, housing supply dynamics, and interest rate trends helps determine which strategy aligns with current market conditions.

Financing Options for Investors

Fix and flip investors often utilize short-term financing options such as hard money loans, bridge loans, or private money lenders to quickly acquire and renovate properties for resale. Buy and hold investors typically rely on long-term financing solutions like conventional mortgages, FHA loans, or portfolio loans to secure properties for rental income and long-term appreciation. Understanding the differences in loan terms, interest rates, and cash flow requirements is crucial for choosing the optimal financing strategy in real estate investment.

Time Commitment and Management Needs

Fix and flip properties require intense, short-term time commitment and hands-on project management to renovate the home quickly and resell for profit. Buy and hold investments demand ongoing management, including tenant relations, maintenance, and long-term financial planning, making it suitable for investors seeking passive income with steady oversight. Investors should consider their availability and management skills when choosing between these two real estate strategies.

Tax Implications and Benefits

Fix and flip properties are typically taxed as ordinary income due to their short-term nature, leading to higher tax rates compared to buy and hold investments, which benefit from long-term capital gains tax advantages. Buy and hold investors gain additional tax benefits such as depreciation deductions and the ability to defer taxes through 1031 exchanges, enhancing overall profitability. Understanding these tax implications is crucial for real estate investors to optimize returns and align strategies with their financial goals.

Which Strategy Suits Your Real Estate Goals?

Fix and Flip offers quick returns by renovating properties and selling them within months, ideal for investors seeking fast profits and active involvement. Buy and Hold emphasizes long-term wealth through rental income and property appreciation, suited for those aiming for steady cash flow and passive income. Evaluating your financial goals, risk tolerance, and market conditions determines which strategy aligns best with your real estate investment objectives.

Fix and Flip vs Buy and Hold Infographic

difterm.com

difterm.com