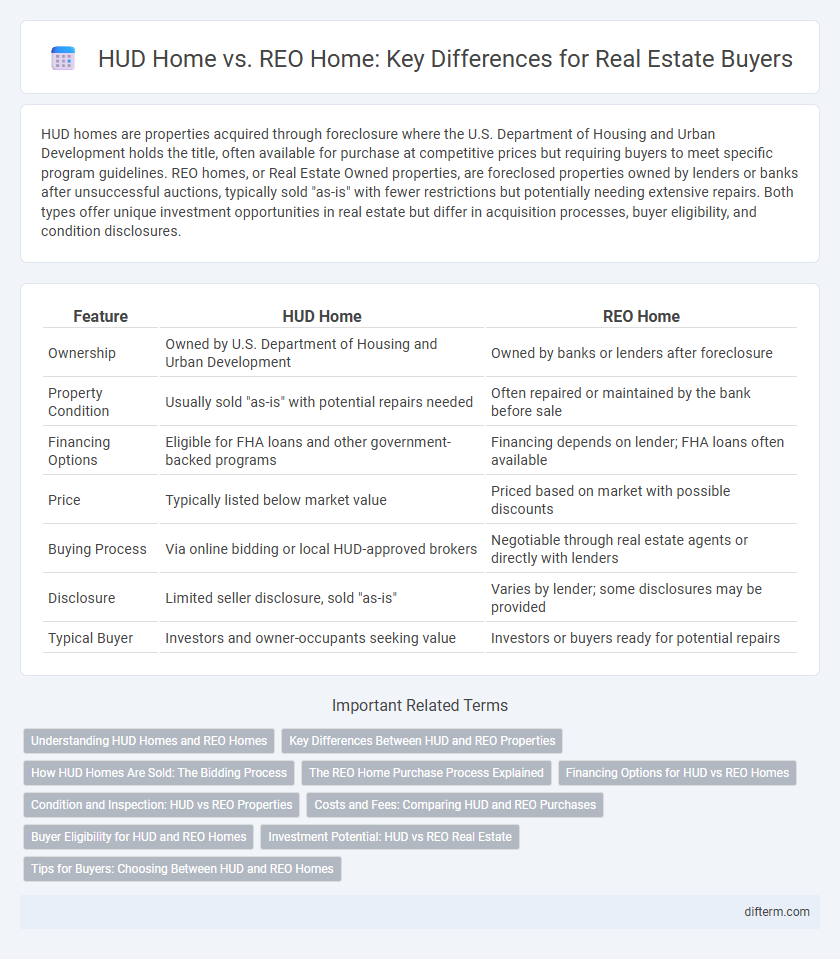

HUD homes are properties acquired through foreclosure where the U.S. Department of Housing and Urban Development holds the title, often available for purchase at competitive prices but requiring buyers to meet specific program guidelines. REO homes, or Real Estate Owned properties, are foreclosed properties owned by lenders or banks after unsuccessful auctions, typically sold "as-is" with fewer restrictions but potentially needing extensive repairs. Both types offer unique investment opportunities in real estate but differ in acquisition processes, buyer eligibility, and condition disclosures.

Table of Comparison

| Feature | HUD Home | REO Home |

|---|---|---|

| Ownership | Owned by U.S. Department of Housing and Urban Development | Owned by banks or lenders after foreclosure |

| Property Condition | Usually sold "as-is" with potential repairs needed | Often repaired or maintained by the bank before sale |

| Financing Options | Eligible for FHA loans and other government-backed programs | Financing depends on lender; FHA loans often available |

| Price | Typically listed below market value | Priced based on market with possible discounts |

| Buying Process | Via online bidding or local HUD-approved brokers | Negotiable through real estate agents or directly with lenders |

| Disclosure | Limited seller disclosure, sold "as-is" | Varies by lender; some disclosures may be provided |

| Typical Buyer | Investors and owner-occupants seeking value | Investors or buyers ready for potential repairs |

Understanding HUD Homes and REO Homes

HUD homes are properties owned by the U.S. Department of Housing and Urban Development, typically acquired after a foreclosure on FHA-insured mortgages. REO homes, or Real Estate Owned properties, are bank-owned foreclosures that failed to sell at auction and are managed by lenders. Both HUD and REO homes are often sold below market value, presenting potential investment opportunities with differing purchase and bidding processes.

Key Differences Between HUD and REO Properties

HUD homes are properties owned by the U.S. Department of Housing and Urban Development, typically acquired through foreclosures on FHA-insured loans, while REO homes are bank-owned properties after unsuccessful foreclosure auctions. HUD homes require buyers to adhere to specific bidding processes and primary residence requirements, whereas REO homes are sold directly by lenders with fewer purchasing restrictions. Pricing strategies differ as HUD homes often have fixed starting bids, whereas REO properties' prices are set by banks aiming to recover loan balances swiftly.

How HUD Homes Are Sold: The Bidding Process

HUD homes are sold through an online bidding process exclusively available to approved real estate agents representing potential buyers. Bids are submitted electronically and the Department of Housing and Urban Development evaluates offers based on current market value and bid amount before selecting the winning offer. This competitive auction system ensures transparency and fair market pricing for HUD-owned properties.

The REO Home Purchase Process Explained

The REO home purchase process begins after a property fails to sell at a foreclosure auction and is owned by a lender, typically a bank. Buyers must submit an offer through the listing agent, often navigating multiple offers and potential bidding wars, with the lender prioritizing the highest and best offer. Closing involves a standard real estate transaction with inspections, appraisals, and financing, but buyers should be aware that REO properties are sold as-is, requiring careful due diligence.

Financing Options for HUD vs REO Homes

HUD homes often provide more flexible financing options, including FHA loans with low down payments and competitive interest rates, making them accessible to first-time buyers. REO homes, sold by banks after foreclosure, typically require conventional financing, which may involve stricter credit requirements and higher down payments. Buyers of REO properties might also encounter cash purchase preferences due to property condition and lender policies.

Condition and Inspection: HUD vs REO Properties

HUD homes typically require buyers to purchase properties "as-is," with limited opportunity for inspection or repairs, often reflecting more noticeable wear and potential maintenance issues. REO homes, managed directly by lenders, usually allow for pre-sale inspections and are often repaired or cleaned up to enhance marketability, resulting in generally better condition. Understanding these differences helps buyers assess risks associated with property condition and inspection contingencies in HUD versus REO transactions.

Costs and Fees: Comparing HUD and REO Purchases

HUD homes often come with fixed listing prices and require earnest money deposits that may be higher than traditional sales, while REO homes typically allow more negotiation on price but may involve additional bank fees. Both HUD and REO properties can entail costs such as inspection fees, closing costs, and potential repairs, but HUD homes frequently mandate a pre-approval process through approved lenders, affecting financing fees. Understanding these distinctions helps buyers anticipate varying upfront expenses and ongoing costs in purchasing government-owned versus bank-owned real estate.

Buyer Eligibility for HUD and REO Homes

Buyer eligibility for HUD homes requires individuals to be owner-occupants, meaning they must live in the property as their primary residence, with priority given to first-time homebuyers and low-to-moderate income families. REO homes, owned by lenders after foreclosure, are generally available to all buyers without occupancy requirements, making them accessible to investors and buyers seeking rental properties. Understanding these distinctions helps buyers target suitable properties aligned with their eligibility and investment goals.

Investment Potential: HUD vs REO Real Estate

HUD homes often present competitive investment potential due to their below-market pricing and FHA backing, attracting investors seeking stable financing options. REO homes, owned directly by lenders, typically require extensive repairs but offer greater negotiation leverage and quicker closing, appealing to experienced investors aiming for higher returns through rehabbing. Comparing HUD versus REO real estate, investors must weigh upfront costs, financing accessibility, and renovation demands to maximize long-term profitability.

Tips for Buyers: Choosing Between HUD and REO Homes

When choosing between HUD homes and REO homes, buyers should closely evaluate the property's condition and potential repair costs, as HUD homes are often sold as-is through online auctions, while REO homes may offer more negotiation flexibility with lenders. It's crucial to work with a real estate agent experienced in distressed property sales to navigate the bidding process and understand financing options specific to each type. Conducting thorough due diligence, including title searches and home inspections, ensures buyers avoid unexpected liabilities and select the best investment.

HUD Home vs REO Home Infographic

difterm.com

difterm.com