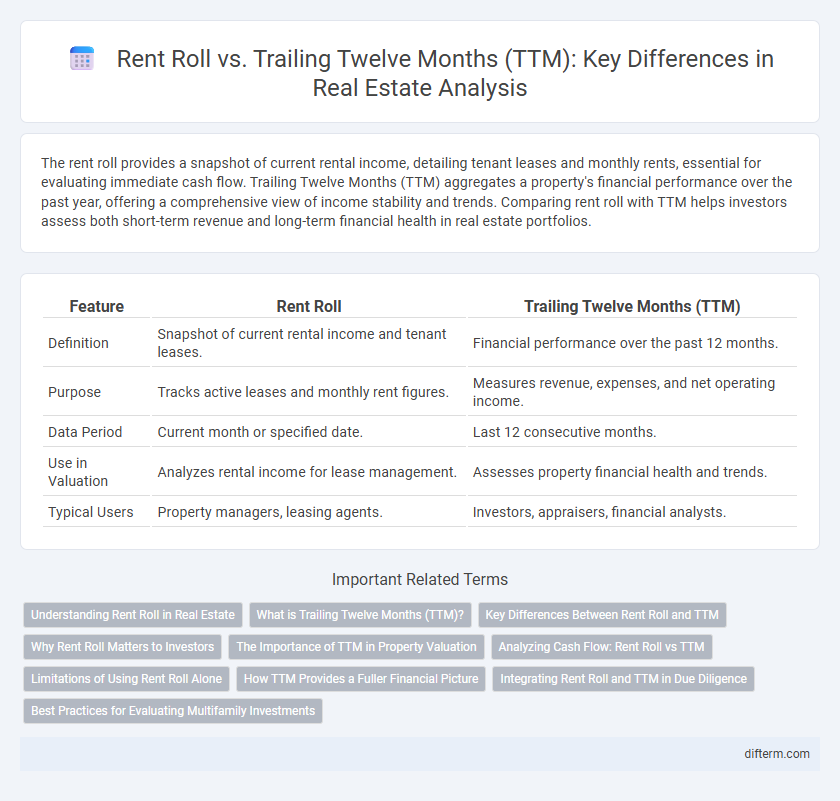

The rent roll provides a snapshot of current rental income, detailing tenant leases and monthly rents, essential for evaluating immediate cash flow. Trailing Twelve Months (TTM) aggregates a property's financial performance over the past year, offering a comprehensive view of income stability and trends. Comparing rent roll with TTM helps investors assess both short-term revenue and long-term financial health in real estate portfolios.

Table of Comparison

| Feature | Rent Roll | Trailing Twelve Months (TTM) |

|---|---|---|

| Definition | Snapshot of current rental income and tenant leases. | Financial performance over the past 12 months. |

| Purpose | Tracks active leases and monthly rent figures. | Measures revenue, expenses, and net operating income. |

| Data Period | Current month or specified date. | Last 12 consecutive months. |

| Use in Valuation | Analyzes rental income for lease management. | Assesses property financial health and trends. |

| Typical Users | Property managers, leasing agents. | Investors, appraisers, financial analysts. |

Understanding Rent Roll in Real Estate

Rent roll in real estate is a detailed report listing all rental income generated by a property, including tenant names, lease terms, rental rates, and payment status. It serves as a critical tool for investors and property managers to assess current cash flow, occupancy, and lease expirations. Understanding rent roll helps in evaluating the property's income stability and forecasting future revenue more accurately compared to Trailing Twelve Months (TTM) financials.

What is Trailing Twelve Months (TTM)?

Trailing Twelve Months (TTM) refers to the financial performance data of a property over the past 12 consecutive months, providing a comprehensive view of income, expenses, and net operating income. In real estate, TTM helps investors assess recent trends and the property's cash flow stability by evaluating actual operational results instead of projections. This metric is crucial for making informed investment decisions by reflecting the latest market conditions and property performance.

Key Differences Between Rent Roll and TTM

Rent Roll provides a detailed snapshot of current rental income by listing tenants, lease terms, and monthly rents, enabling precise cash flow analysis. Trailing Twelve Months (TTM) aggregates financial performance over the past year, reflecting trends in revenue, occupancy, and expenses for a broader operational perspective. Rent Roll focuses on contractual rental commitments, while TTM captures actual historical financial outcomes, essential for investment valuation and risk assessment.

Why Rent Roll Matters to Investors

Rent Roll provides detailed, up-to-date information on tenant leases, rental income, and occupancy rates, making it essential for investors to assess current cash flow stability. Unlike Trailing Twelve Months (TTM) financials that summarize past performance, Rent Roll offers granular visibility into future revenue through lease terms and rent escalations. This data helps investors evaluate risk, forecast income accurately, and make informed decisions on property valuation and investment potential.

The Importance of TTM in Property Valuation

Trailing Twelve Months (TTM) provides a comprehensive view of a property's financial performance by capturing revenue and expenses over the most recent 12-month period, offering a dynamic and up-to-date measure unlike the static Rent Roll. Rent Roll details tenant occupancy and lease terms at a specific point in time, but TTM incorporates fluctuations in rent collections, vacancy rates, and operational costs that directly influence investment valuations. Utilizing TTM ensures more accurate property valuation by reflecting real-time cash flow trends and identifying potential future income stability.

Analyzing Cash Flow: Rent Roll vs TTM

Rent Roll provides a detailed snapshot of current lease agreements, showing scheduled rents and tenant occupancy, essential for evaluating immediate cash flow stability. Trailing Twelve Months (TTM) financials aggregate historical income and expenses over the past year, offering a comprehensive view of actual cash flow performance and trends. Comparing Rent Roll to TTM helps investors identify variances between projected rental income and realized cash flow, improving accuracy in forecasting and property valuation.

Limitations of Using Rent Roll Alone

Rent roll provides a snapshot of current lease agreements and monthly rental income but fails to capture fluctuations in occupancy, lease renewals, or rent escalations over time. It overlooks expenses, capital expenditures, and cash flow variations, which are crucial for assessing a property's true financial performance. Relying solely on rent roll can lead to an incomplete valuation, whereas Trailing Twelve Months (TTM) financials offer a comprehensive view by incorporating actual income and expense data across a full year.

How TTM Provides a Fuller Financial Picture

Trailing Twelve Months (TTM) offers a comprehensive view of a property's financial performance by aggregating income and expenses over the past 12 months, unlike a rent roll that typically captures only current lease income. TTM includes rent fluctuations, vacancies, operating costs, and seasonal variations, enabling investors to assess true cash flow and profitability. This broader financial picture assists in accurate property valuation and informed investment decisions.

Integrating Rent Roll and TTM in Due Diligence

Integrating rent roll and trailing twelve months (TTM) metrics provides a comprehensive view of a property's income stability and historical cash flow trends during real estate due diligence. Rent roll details current lease agreements, tenant information, and scheduled rents, while TTM financials capture actual income received over the past year, highlighting occupancy rates and rent collection consistency. Combining these datasets allows investors to validate projected revenues, identify lease expiration risks, and assess the accuracy of seller representations for more informed investment decisions.

Best Practices for Evaluating Multifamily Investments

Rent roll provides a detailed snapshot of current rental income by listing each unit's rent, lease terms, and tenant status, essential for assessing immediate cash flow stability. Trailing Twelve Months (TTM) financials aggregate income and expenses over the past year, revealing trends and operational performance crucial for forecasting long-term profitability. Best practices for evaluating multifamily investments include analyzing rent roll accuracy alongside TTM data to validate revenue consistency, identify lease renewal risks, and detect potential vacancy impacts on investment returns.

Rent Roll vs Trailing Twelve Months (TTM) Infographic

difterm.com

difterm.com