Net Operating Income (NOI) represents the actual income generated from a real estate property after deducting operating expenses from the Gross Scheduled Income (GSI), which is the total potential rental income assuming full occupancy. Understanding the difference between NOI and GSI is crucial for investors to accurately assess a property's profitability and cash flow potential. While GSI indicates the maximum revenue, NOI provides a realistic measure of financial performance by accounting for vacancies, maintenance, and operational costs.

Table of Comparison

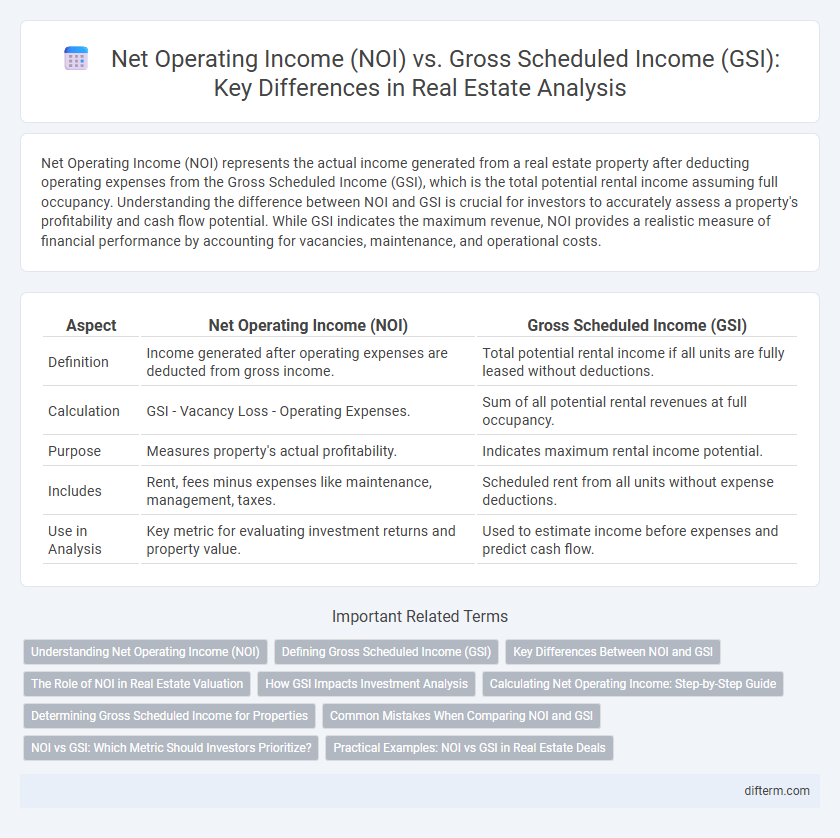

| Aspect | Net Operating Income (NOI) | Gross Scheduled Income (GSI) |

|---|---|---|

| Definition | Income generated after operating expenses are deducted from gross income. | Total potential rental income if all units are fully leased without deductions. |

| Calculation | GSI - Vacancy Loss - Operating Expenses. | Sum of all potential rental revenues at full occupancy. |

| Purpose | Measures property's actual profitability. | Indicates maximum rental income potential. |

| Includes | Rent, fees minus expenses like maintenance, management, taxes. | Scheduled rent from all units without expense deductions. |

| Use in Analysis | Key metric for evaluating investment returns and property value. | Used to estimate income before expenses and predict cash flow. |

Understanding Net Operating Income (NOI)

Net Operating Income (NOI) represents the total revenue generated from a property after subtracting operating expenses but before deducting taxes and financing costs, providing a clear measure of a property's profitability. Unlike Gross Scheduled Income (GSI), which reflects the potential rental income assuming full occupancy, NOI accounts for vacancy rates, maintenance, management fees, and other operational costs. This makes NOI a critical metric for investors to evaluate the true income-producing capacity and financial health of real estate assets.

Defining Gross Scheduled Income (GSI)

Gross Scheduled Income (GSI) is the total potential revenue generated from rental properties assuming 100% occupancy without accounting for vacancies or collection losses. It reflects all contractually agreed rents, including rent from tenants and any additional fees such as parking or service charges. GSI serves as a baseline metric in real estate to evaluate a property's income-generating potential before operating expenses and deductions.

Key Differences Between NOI and GSI

Net Operating Income (NOI) represents the revenue remaining after deducting operating expenses from Gross Scheduled Income (GSI), which is the total potential rental income assuming full occupancy. GSI reflects the maximum earnings from rental properties without accounting for vacancies, credit losses, or expenses, while NOI provides a more accurate measure of a property's profitability by incorporating these deductions. Understanding the distinction between NOI and GSI is essential for real estate investors to evaluate cash flow, property performance, and investment yields effectively.

The Role of NOI in Real Estate Valuation

Net Operating Income (NOI) is a critical metric in real estate valuation as it represents the property's profitability after operating expenses but before financing and taxes, providing a clear picture of income-generating potential. Unlike Gross Scheduled Income (GSI), which reflects the total potential income from rents without deductions, NOI accounts for vacancy rates, maintenance costs, and management fees, offering a realistic measure of cash flow. Investors and appraisers rely on NOI to calculate capitalization rates, assess investment quality, and determine market value, making it essential for informed decision-making in real estate transactions.

How GSI Impacts Investment Analysis

Gross Scheduled Income (GSI) represents the total potential revenue from rental properties before any deductions, serving as a foundational metric in real estate investment analysis. High GSI indicates strong rental income potential, directly influencing the Net Operating Income (NOI) when operating expenses are subtracted, which ultimately determines property profitability. Accurate assessment of GSI allows investors to forecast cash flow, evaluate investment performance, and compare properties effectively within competitive markets.

Calculating Net Operating Income: Step-by-Step Guide

Calculating Net Operating Income (NOI) begins with determining the Gross Scheduled Income (GSI), which represents the total potential rental income if the property is fully leased without vacancies. Next, subtract vacancy allowances and credit loss from the GSI to find the Effective Gross Income (EGI). Finally, deduct operating expenses such as property management, maintenance, insurance, and taxes from the EGI to arrive at the Net Operating Income, a key metric for evaluating real estate investment performance.

Determining Gross Scheduled Income for Properties

Gross Scheduled Income (GSI) represents the total potential rental income of a property before accounting for vacancies or expenses, serving as a foundational metric in real estate analysis. Determining GSI involves calculating the sum of all rental units' market rents multiplied by the number of rentable units, including any additional income from fees or services. Accurate estimation of GSI is critical for investors to assess property performance and project cash flow prior to deductions reflected in Net Operating Income (NOI).

Common Mistakes When Comparing NOI and GSI

Common mistakes when comparing Net Operating Income (NOI) and Gross Scheduled Income (GSI) include overlooking vacancy losses and operating expenses that differentiate NOI from GSI. Many investors misinterpret GSI as the actual cash flow, ignoring deductions for maintenance, property management, and taxes that impact NOI accuracy. Accurate evaluation requires understanding that NOI reflects true property profitability after expenses, unlike GSI which represents potential income before costs.

NOI vs GSI: Which Metric Should Investors Prioritize?

Net Operating Income (NOI) reflects a property's profitability by subtracting operating expenses from Gross Scheduled Income (GSI), which represents total potential rental income before expenses. Investors should prioritize NOI over GSI because it provides a clearer picture of actual earning potential, accounting for costs like maintenance, taxes, and management fees. Focusing on NOI enables more accurate property valuation and better investment decision-making.

Practical Examples: NOI vs GSI in Real Estate Deals

Net Operating Income (NOI) represents the revenue from a property after deducting operating expenses but before debt service and taxes, providing a clearer picture of profitability. Gross Scheduled Income (GSI) indicates the total potential income assuming 100% occupancy and no vacancies or collection losses. In practical real estate deals, a property with a GSI of $500,000 may yield an NOI of $350,000 after $150,000 in operating expenses, highlighting the importance of expense management for accurate investment analysis.

Net Operating Income (NOI) vs Gross Scheduled Income (GSI) Infographic

difterm.com

difterm.com