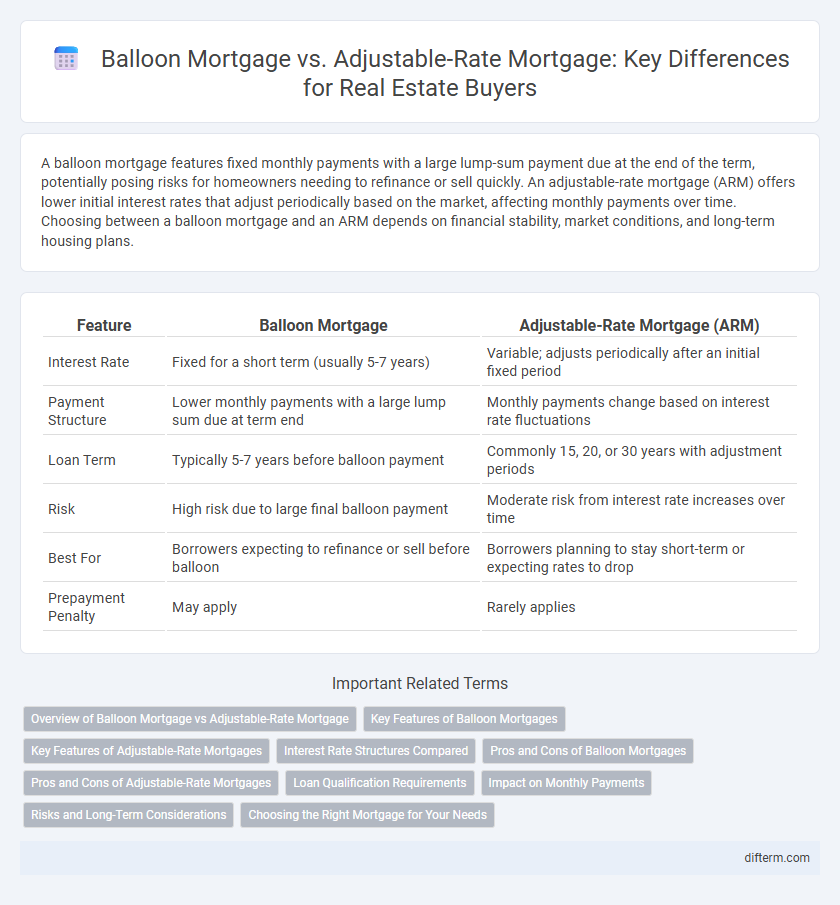

A balloon mortgage features fixed monthly payments with a large lump-sum payment due at the end of the term, potentially posing risks for homeowners needing to refinance or sell quickly. An adjustable-rate mortgage (ARM) offers lower initial interest rates that adjust periodically based on the market, affecting monthly payments over time. Choosing between a balloon mortgage and an ARM depends on financial stability, market conditions, and long-term housing plans.

Table of Comparison

| Feature | Balloon Mortgage | Adjustable-Rate Mortgage (ARM) |

|---|---|---|

| Interest Rate | Fixed for a short term (usually 5-7 years) | Variable; adjusts periodically after an initial fixed period |

| Payment Structure | Lower monthly payments with a large lump sum due at term end | Monthly payments change based on interest rate fluctuations |

| Loan Term | Typically 5-7 years before balloon payment | Commonly 15, 20, or 30 years with adjustment periods |

| Risk | High risk due to large final balloon payment | Moderate risk from interest rate increases over time |

| Best For | Borrowers expecting to refinance or sell before balloon | Borrowers planning to stay short-term or expecting rates to drop |

| Prepayment Penalty | May apply | Rarely applies |

Overview of Balloon Mortgage vs Adjustable-Rate Mortgage

Balloon mortgages require a large lump-sum payment at the end of a fixed term, typically 5 to 7 years, making them suitable for buyers expecting to refinance or sell before the balloon payment. Adjustable-rate mortgages (ARMs) feature interest rates that fluctuate periodically based on market indexes, offering lower initial rates but potential payment increases over time. Understanding the differences in payment structure and risk exposure between balloon mortgages and ARMs helps borrowers choose the right option based on financial goals and market conditions.

Key Features of Balloon Mortgages

Balloon mortgages feature a fixed interest rate with lower initial monthly payments and a large lump-sum payment due at the loan term's end, typically 5 to 7 years. Unlike adjustable-rate mortgages (ARMs), balloon loans do not adjust periodically but require refinancing or repayment of the remaining balance once the balloon payment is due. These loans are often used by borrowers expecting increased income or planning to sell the property before the balloon period expires.

Key Features of Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) offer interest rates that fluctuate based on a specific benchmark or index, resulting in potentially lower initial payments compared to fixed-rate loans. These mortgages typically include an initial fixed-rate period followed by periodic adjustments, which can affect monthly payment amounts depending on market conditions. Key features include rate caps to limit how much the interest rate can increase at each adjustment and over the life of the loan, providing some protection against extreme payment hikes.

Interest Rate Structures Compared

Balloon mortgages have fixed interest rates for a short term, typically 5 to 7 years, after which the remaining balance becomes due as a lump sum, making them suitable for borrowers expecting to refinance or sell quickly. Adjustable-rate mortgages (ARMs) start with a lower initial interest rate that adjusts periodically based on market indexes, causing payments to vary over time and potentially increase after the fixed-rate period expires. The key difference lies in the predictability of payments: balloon mortgages offer fixed short-term rates with a large final payment, while ARMs provide variable rates that fluctuate throughout the loan term.

Pros and Cons of Balloon Mortgages

Balloon mortgages offer lower initial interest rates and smaller monthly payments compared to adjustable-rate mortgages, appealing to borrowers planning to refinance or sell before the balloon payment is due. However, the large lump-sum payment at the end of the term presents significant refinancing risk, especially if market interest rates rise or property values decline. Unlike adjustable-rate mortgages with periodic rate adjustments, balloon loans carry higher default risk due to the payment spike, requiring careful financial planning.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) offer lower initial interest rates compared to fixed-rate loans, making them attractive for buyers planning to sell or refinance before rate adjustments occur. Interest rates on ARMs fluctuate based on benchmark indices, which can lead to unpredictable monthly payments and potential increases in overall loan costs. Borrowers should carefully evaluate their financial stability and market conditions to mitigate the risk of rising rates over the loan term.

Loan Qualification Requirements

Balloon mortgages often require higher credit scores and substantial income verification due to the large final lump-sum payment, making qualifying more stringent compared to adjustable-rate mortgages (ARMs). ARMs generally have more flexible income and credit requirements as their interest rates adjust periodically, reducing initial payment risk for lenders. Borrowers should also consider debt-to-income ratios closely, as balloon loans typically demand lower ratios to offset the risk of payment spikes.

Impact on Monthly Payments

Balloon mortgages typically feature lower initial monthly payments due to fixed interest rates but require a substantial lump-sum payment at the end of the term, causing potential payment shocks. Adjustable-rate mortgages (ARMs) have monthly payments that fluctuate based on index rates and margin changes, leading to variable payment amounts over time. Borrowers choosing ARMs should anticipate possible increases in monthly payments, while balloon mortgages demand careful planning for the final large payment.

Risks and Long-Term Considerations

Balloon mortgages carry the risk of a large lump-sum payment at the end of the term, which can lead to refinancing challenges or potential foreclosure if the borrower cannot secure adequate funds. Adjustable-rate mortgages (ARMs) expose borrowers to fluctuating interest rates over time, potentially increasing monthly payments and overall loan costs. Long-term considerations for both include market interest rate trends, borrower financial stability, and the risk tolerance for payment variability versus a significant end-of-term debt obligation.

Choosing the Right Mortgage for Your Needs

Balloon mortgages feature lower initial payments with a large lump-sum due at the end, suitable for borrowers expecting increased income or refinancing opportunities. Adjustable-rate mortgages (ARMs) offer variable interest rates that adjust periodically, aligning with market trends and potentially lowering early payments. Evaluating your financial stability, risk tolerance, and long-term plans is crucial when selecting between a balloon mortgage and an ARM to ensure alignment with your homeownership goals.

Balloon Mortgage vs Adjustable-Rate Mortgage Infographic

difterm.com

difterm.com